All in the mix

Article published in Bunkerspot

The prospect of new fuel blends entering the bunker pool as a result of the upcoming IMO 2020 regulations has sparked a heady mixture of expectancy and concern among shipowners. Steve Bee of VPS argues that preparation and careful fuel management will be crucial in coping with the transition.

It is hard to believe it has been one year since ARACON 2018 and the highly entertaining presentation given by renowned maritime lawyer, Steve Simms of Simms Showers LLP, where he delivered an almost Monty Python-like ‘spoof’ sketch, likening marine fuel production and blending, to the ‘Three Witches cauldron scene’ from Shakespeare’s Macbeth.

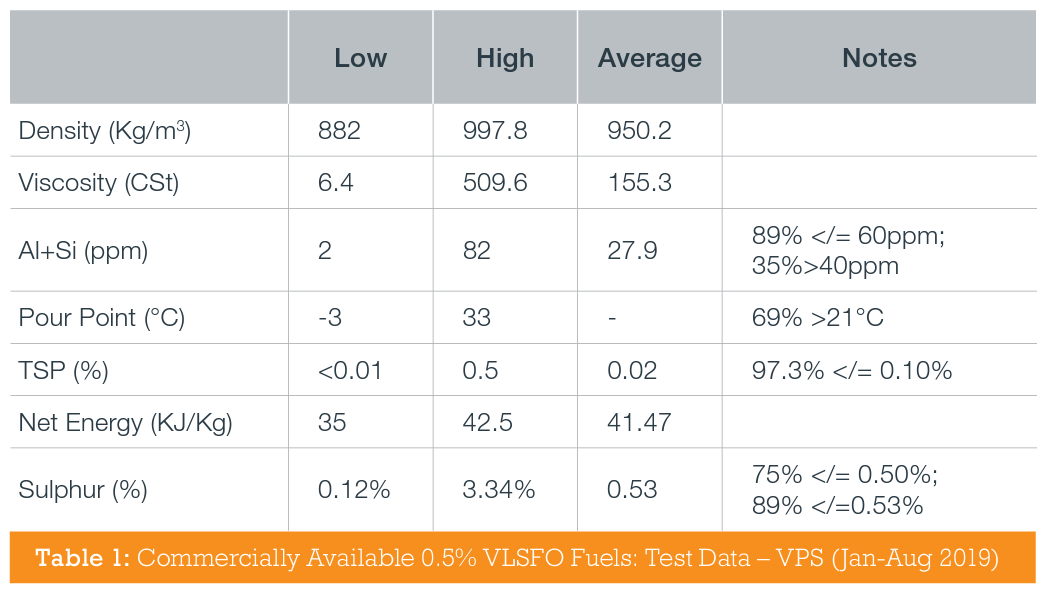

Since then, whilst we can be fairly confident no new 0.50%S-VLSFO contains ‘eye-of-newt and toe-of-frog’, it’s fair to say samples of these new fuels received and tested by Veritas Petroleum Services (VPS) so far in 2019, have shown certain characteristics which are markedly different from the traditional residual and distillate fuel-grades the industry has historically encountered. There has also been a number of new entrants to the fuel-supply market, in terms of additives, cutter stocks and ‘Compound-X’ suppliers. All of who are offering product to achieve the ‘holy grail’ of compliant fuel. As we race into and through the final quarter towards 2020, more new fuels offering compliance at <0.50%S, are coming to market. Many of these are blended products (ULS distillates + LS residues), utilising hydrotreated vacuum gas oils and hydrocracker fractionator bottoms as part of their make-up. The market’s expectations of such fuels are: increases in the number of stability issues due to heavy blending; and a greater number of compatibility issues due to the use of complex fuel blends. In addition, there are cold-flow concerns due to the presence of more wax-based components. With an expectation of larger differences between density and viscosity levels, there will be an impact on the calculated carbon aromaticity index( CCAI) and a question now over the validity of this calculation with respect to VLSFOs ignition quality? Added to this, the need for increased operational awareness due to expected elevated catfines (Al+Si) through the use of cat-cracker residues, plus lower flashpoints due to the use of inland market distillates and distillate blending. So, a significant number of expectations and concerns, but what have we actually witnessed in 2019 so far with respect to 0.50%S VLSFOs? (Table 1)

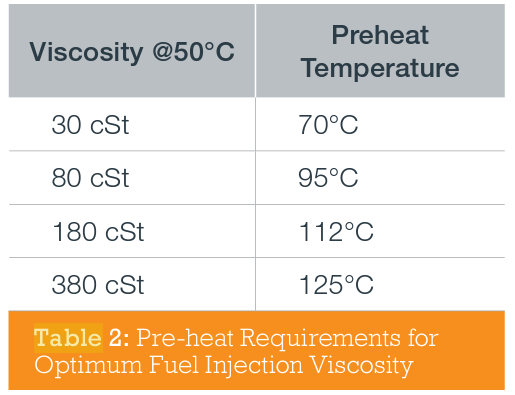

Density values of 882-998kg/m3 show an extremely wide range for the VLSFOs tested to date and one which highlights both commercial and operational implications, from fuel delivery to use. Commercial overstatement of density results in short delivery, or over payment of fuel and as such shows a benefit in undertaking bunker quantity surveys with the inclusion of density analysis. Operationally, there is a need to ensure the vessel’s separators can handle these density ranges and better still, compensate for them. VLSFO viscosities are even more wide ranging from 6.4 centiStoke (cSt) -510 cSt. It is therefore critical that a vessel’s viscosity controllers are working effectively and that the vessel has heaters capable of achieving and maintaining the required injection viscosity. Most engine manufacturers advise that the fuel’s injection viscosity should be 12-15 cSt for optimum engine performance, (Table 2). However, it’s worth noting that if a high separator temperature is required, e.g. 95°C, then lower viscosity fuels may actu-ally require cooling prior to injection.

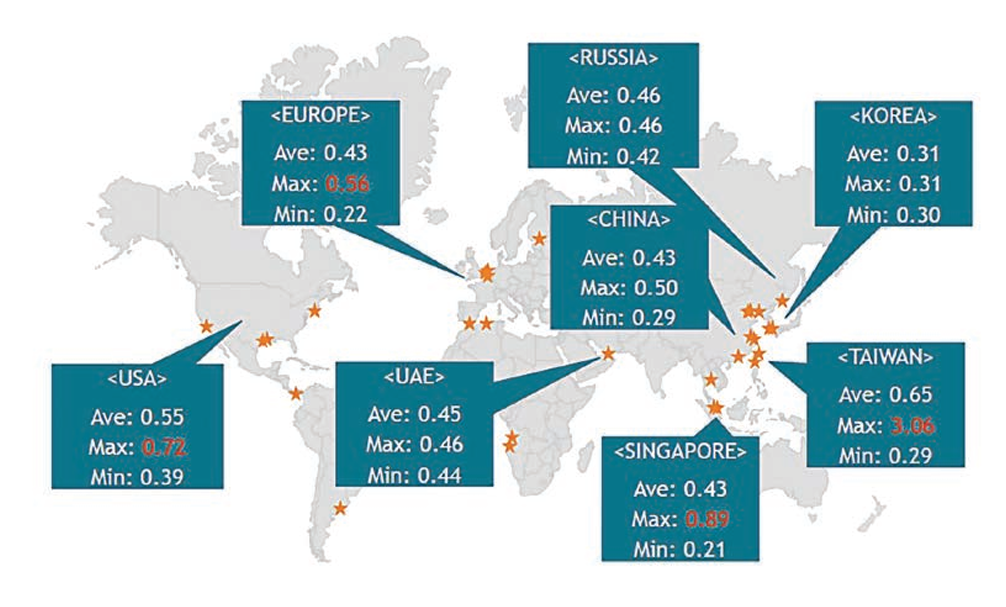

For example, a 30 cSt fuel at 95°C would result in an injection viscosity of only 8 cSt, which is below the optimum viscosity and would result in lower engine performance. As expected, densities and viscosities of VLSFOs have been found to be wide rang-ing and therefore any CCAI calculation may well be seen as meaningless with these new fuels. Fuel Combustion Analysis (FCA) testing provides much more detailed information regarding a fuel’s ignition and burn properties, such as ignition delay, combustion delays, rates of heat release and estimated cetane number, to name but a few, all of which highlight key characteristics of the specific fuel. Testing to date has shown catfine (Al+Si) levels vary greatly across VLSFOs from 2-82 parts per million (ppm). Whilst 89% of catfines tested were less or equal to the ISO8217:2017 specification limit of 60 ppm, more than one third of the fuels tested had a catfine level of >40ppm, a level VPS uses as a trigger to undertake a fuel system check (FSC). FSCs are a means of monitoring separator efficiency and performance in order to protect the engine from unnecessary damage caused by cat-fines. Almost 3% of VLSFOs tested had a Total Sediment Potential (TSP) exceeding the 0.10% ISO8217 specification limit. This is a higher number of off-specifications than we see for the more traditional residual grades of fuels, which is <1%. If we consider the concerns relating to stability and compatibility of VLSFO, then higher TSP values and certainly off-specification TSP could very well result in sludging of fuel more frequently, especially if commingling fuels. Aside from the compatibility issue, another consideration regarding commingling of fuels relates to unpumpable material, especially when moving to VLSFO use for the first time. Let’s assume a vessel has clean tanks but a small amount of unpumpable material is intended to be mixed with the first VLSFO delivery. For example, filling a 400 mt tank with a VLSFO which has 0.49%S, where the unpumpable material has 3.5%S. It would only take 6 mt of the unpumpable material to render the mix with the VLSFO in excess of the sulphur specification limit. So, how much ‘bang-for-your-buck’ do these new VLSFOs offer? VPS has seen a net energy range of 35-42.5 KJ/ Kg, but with the average at 41.5 KJ/Kg, they are in a similar range to distillate fuels, offering good energy performance. Of course, the ultimate aim for these fuels is to have a compliant sulphur content and so far, 75% of all samples tested have achieved 0.50% sulphur or below and 89% have been within the 95%-confidence limit of 0.53% sulphur. There have been a couple of samples at >3% sulphur, which is surprising! (Figure 1). However, it is worth noting that the Marine Environment Protection Committee (MEPC) 75 is expected to adopt specific criteria relating to the application of confidence limits for the sul-phur content of marine fuels.

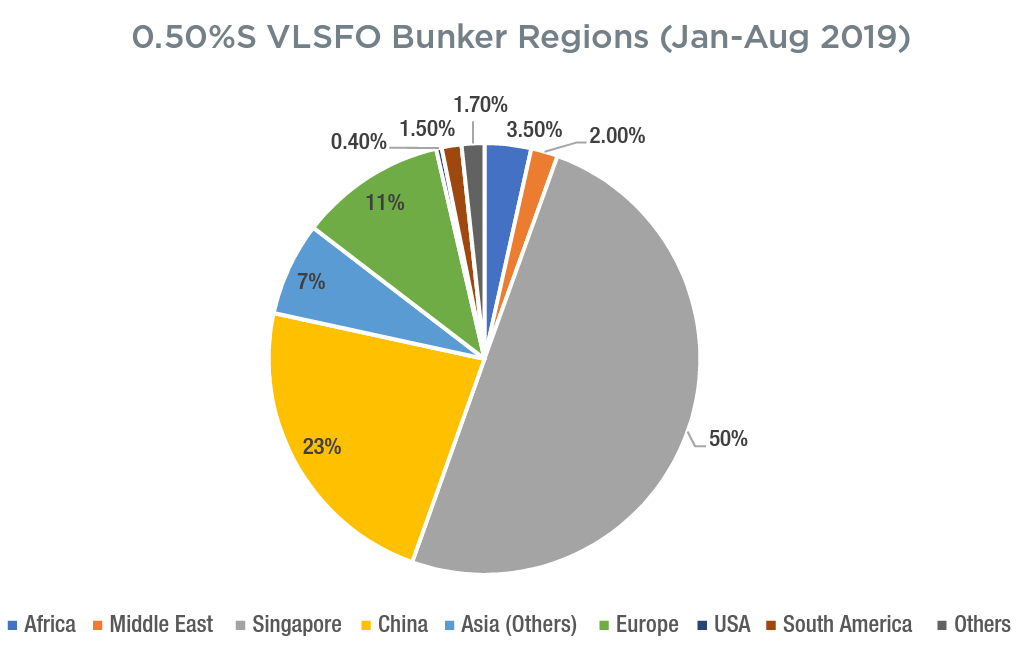

In essence, there will be three sampling points for vessel fuel: 1. MARPOL Annex VI Sample, where the 95%-confidence will not apply. The sulphur level must be at or below applicable limit (0.10%S or 0.50%S) to be considered as having met requirement, i.e. it is the ‘absolute’ limit of 0.50% for VLSFOs and it will be the supplier who is accountable for this. 2. Onboard sample and the in-use sample, where both will be allowed to apply the 95%-confidence limit, i.e. up to 0.53%S. The responsibility here lies solely with the vessel. Looking at the data regarding commercially available VLSFOs between January-August 2019, there are currently 39 ports around the globe supplying 0.50%S VLSFO products. It must be highlighted that 80% of the samples tested by VPS have come from Asian ports, mainly due to the fact China is already actively operating a 0.50%S fuel directive in its territorial waters. As we enter the final quarter of 2019, VPS fully expect to see a significant increase in 0.50%S VLSFOs samples from Europe and Americas as vessels prepare for the transition to the new global sulphur cap prior to 1 January 2020

.

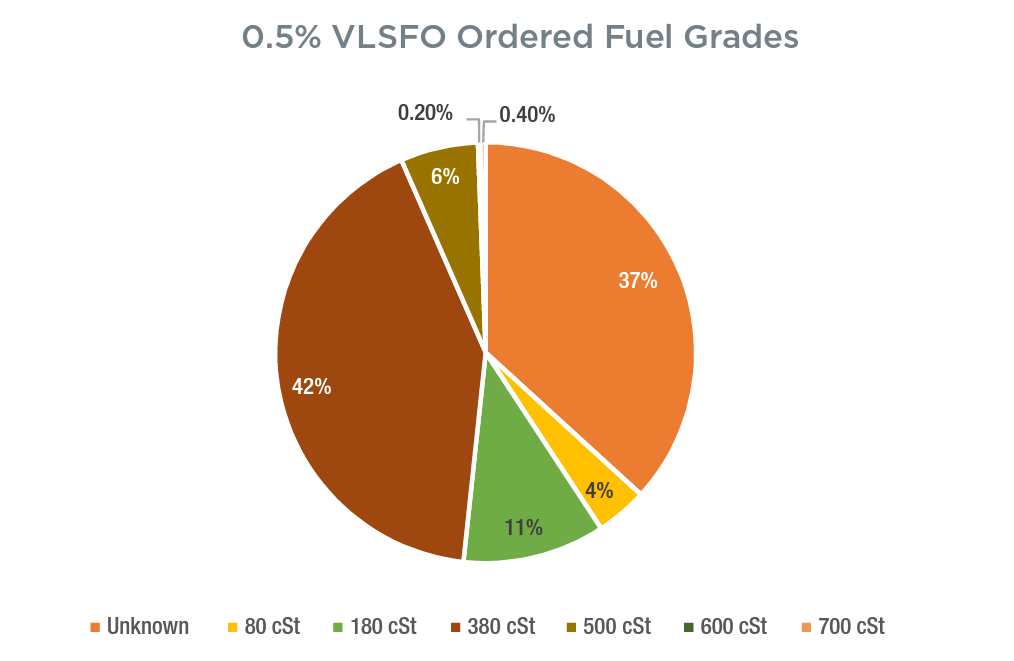

In addition, it is also worth highlighting that VLSFOs are, on numerous occasions, being ordered against specific grades (cSt) between 80-700 cSt. However, note the average viscosity is 155 cSt and the viscosity test data to date shows a wide range of 6.4-510 cSt. To date, there are more than one third of VLSFOs being ordered without a specified ‘grade’. However, as stated earlier, viscosity is a key operational parameter and any major deviations from the expected viscosity can result in poor engine performance. In conclusion, based on the 0.50%S VLSFO test data produced by VPS between January-August 2019 and feedback from shipowner/operators, these fuels are in the main, performing well, but do require additional considerations regarding stability, compatibility and catfines. Sediment and waxing are parameters which require monitoring from a storage and handling perspective, whilst regular fuel delivery system monitoring in relation to separator efficiency in particular, will assist in protecting the engine from avoidable wear and tear.

So far, it’s safe to say that 0.50%S VLSFOs are not a ‘witches brew’, but with planned, effective fuel management, they are, in fact, good, fit-for-purpose and compliant fuels. Returning to IMO2020 and to Shakespeare’s MacBeth, ‘when the hurly burly’s done, when the battle’s lost and won’ seems to descriptively summarise the industry’s activity relating to IMO 2020 over the past few years. And when 2020 is over and we head off into this coming decade, what then for marine fuels? Well, we probably move our attentions towards the next Act, ‘Carbon-Neutral Fuels. To be continued...

Search

Search

Customer

Customer