By Steve Bee, VPS Group Marketing & Strategic Projects Director

Introduction

2024 saw the continuing evolution and widening of available maritime fuel types and grades, as the global shipping industry continues to gather decarbonisation momentum to reduce its emissions to meet current and future legislation targets. Existing CII and EEXI requirements, plus EU ETS legislation, saw increasing demand for additional testing, lower-carbon fuels, data and digitalisation solutions across the shipping sectors.

As the leading maritime decarbonisation testing and advisory services provider, VPS continued to be at the forefront of marine fuels and lubricants analysis, utilising our experience, expertise and innovative approach, to support the drive for a more sustainable shipping fleet.

Throughout the year, VPS witnessed further fuel quality issues with VLSFOs in terms of, sulphur compliance, cold-flow properties, water and cat-fines. In addition, MGO suffered from cold-flow, flash point and FAME off-specifications.

Biofuels usage saw a continuing increase in demand from the market, leading to increasing queries regarding their fuel management and their “fit-for-purpose” as a drop-in marine fuel. This in turn called upon VPS to provide answers and solutions to customers, utilising our extensive knowledge and understanding of biofuels and their associated test parameters.

The launch of the new revision of the international marine fuel quality standard ISO8217:2024 was very much welcomed by the industry. This new revision saw the specification tables increase from two to four, with the inclusion of a <0.50% Sulphur specification and also biofuels in the form of FAME, HVO, GTL and/or, BTL.

2024 witnessed very strong newbuild contracting (2,765 ships of 124.2m GT), the highest in tonnage terms since 2007 (173.4m GT). With 820 of these vessels being “alternative fuel capable”, showing the fuelling transition is still very much in focus.

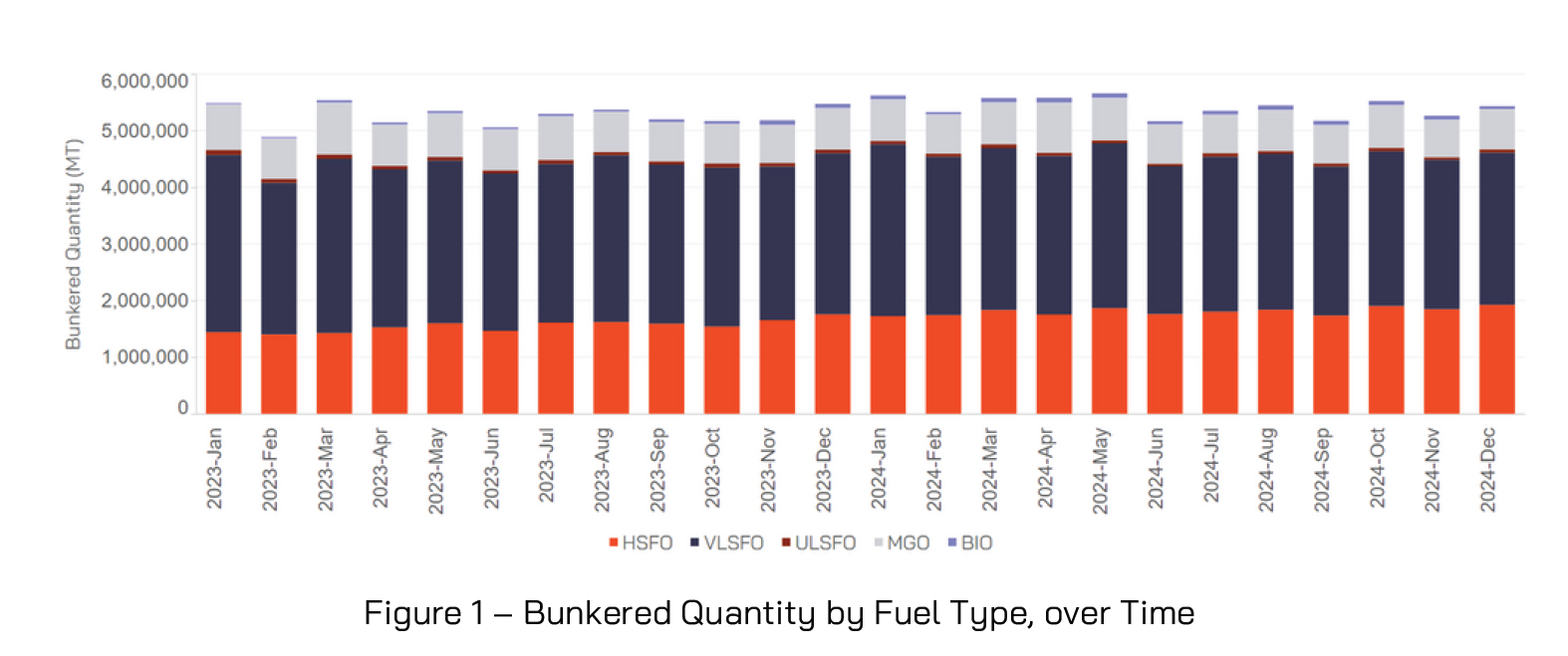

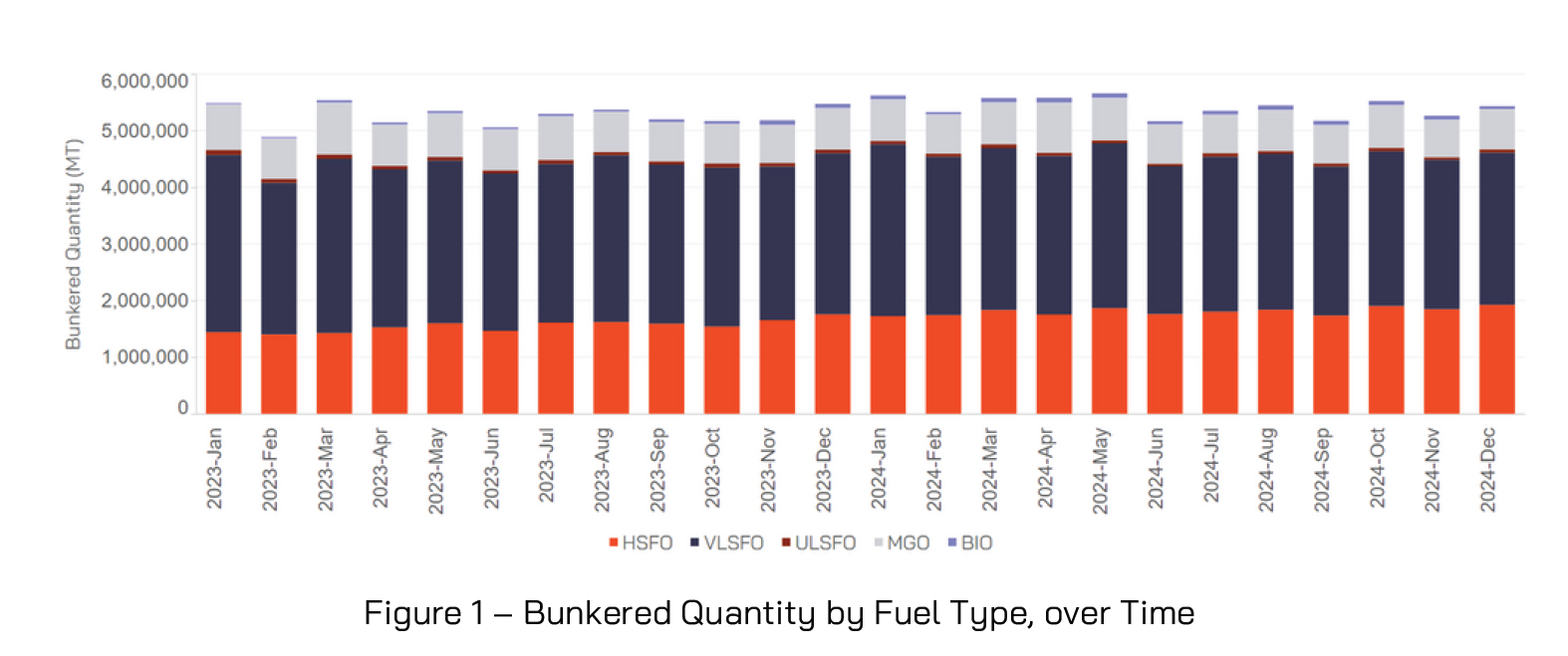

The Marine Fuel Mix

Across 2024, the fuel mix with respect to samples received for testing in VPS laboratories, equated to more than 65 million MT, which averages at 5.4 million MT of marine fuels per month. VLSFO was the most popular marine fuel with 52% of the fuels used, followed by 32% HSFO, 14% MGO, 1% ULSFO and 1% Biofuels. Regarding biofuels usage, the samples tested by VPS equated to an increase from 558,000 MT in 2023 to 800,000MT in 2024.

VPS Bunker Alerts

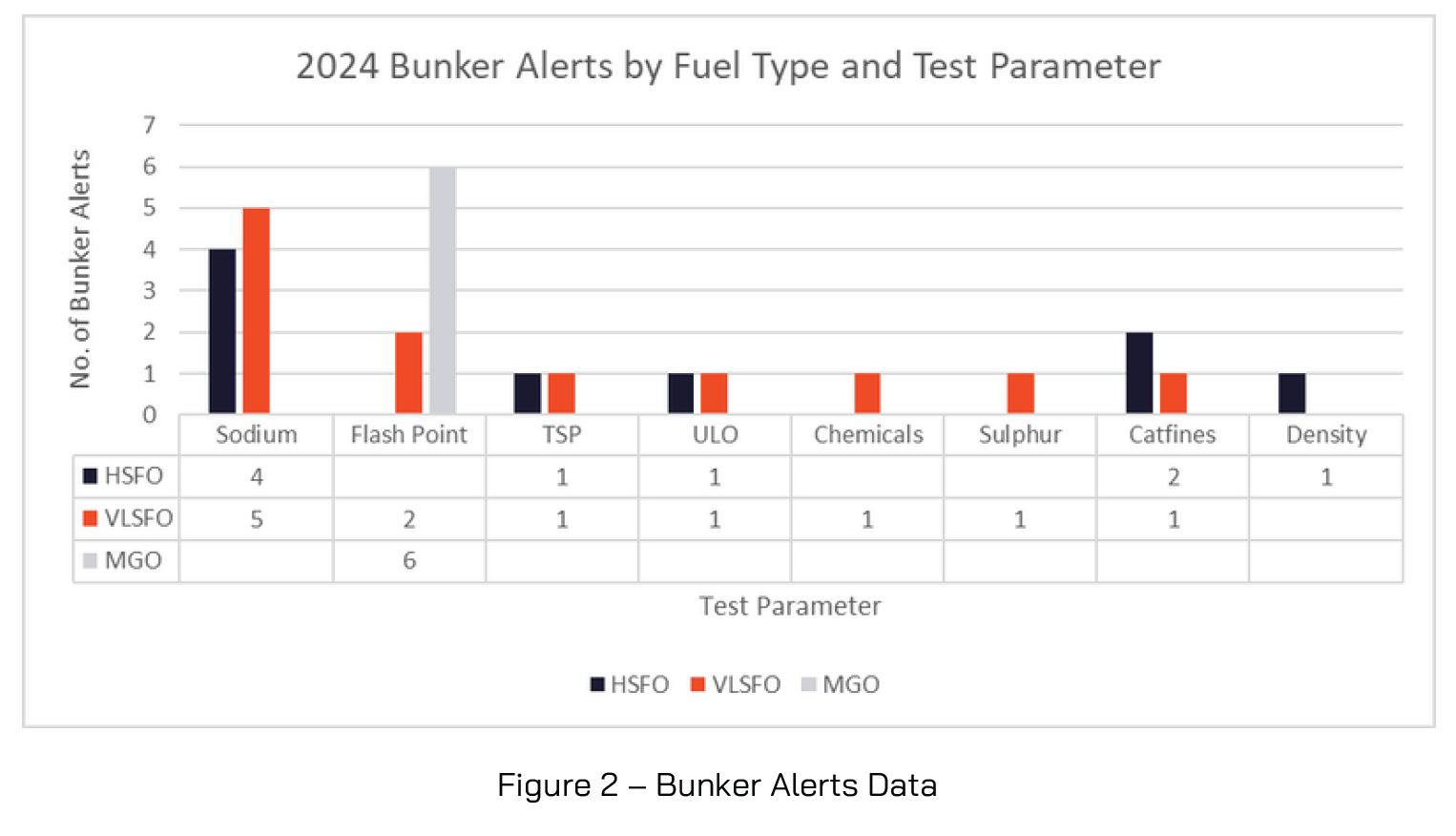

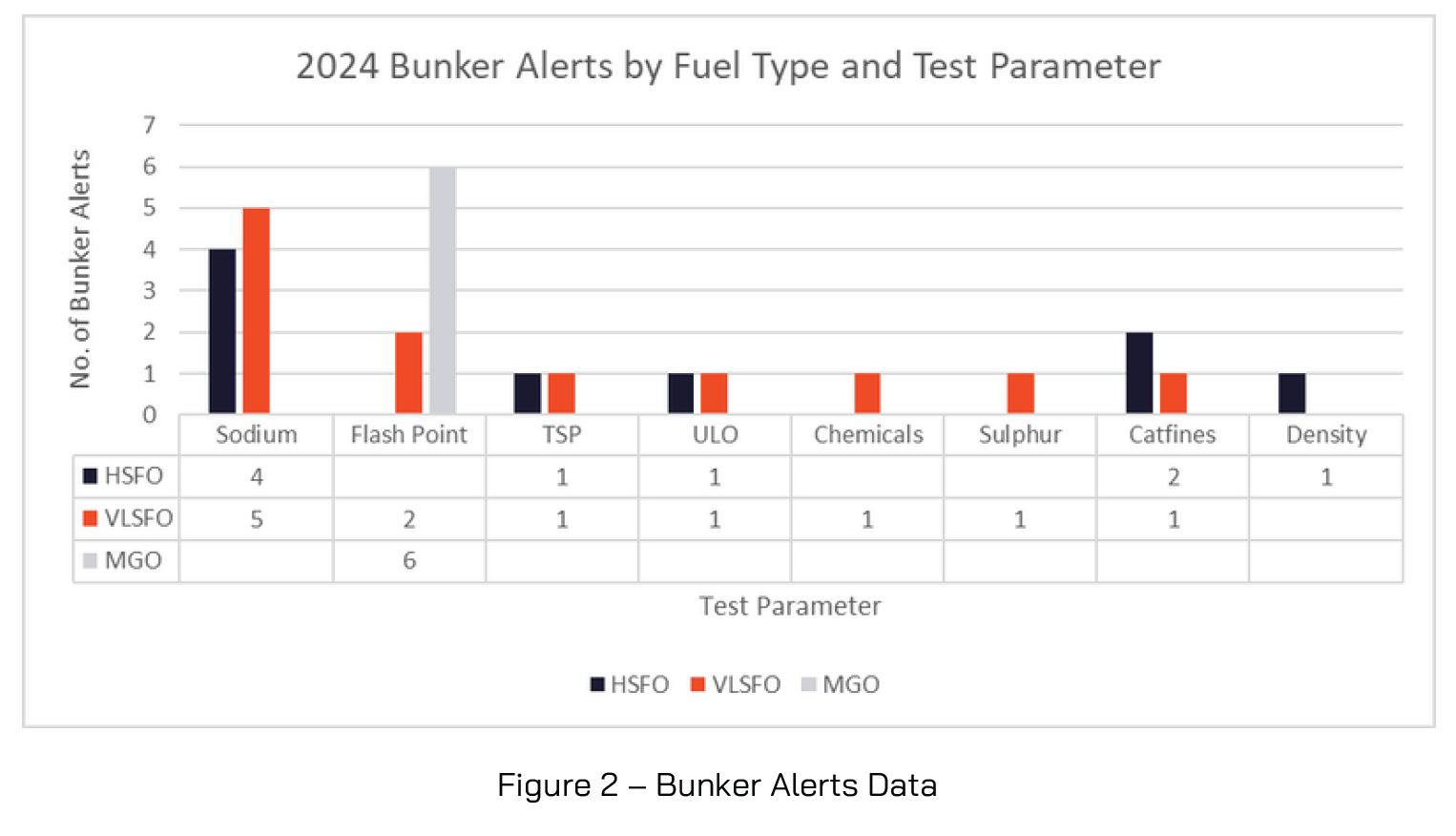

Bunker Alerts highlight short term quality fuel quality issues identified by VPS, for a specific test parameter of a specific fuel grade/type in a specific port. The service provides valuable information to customers, to assist in avoiding potentially problematic fuel types in a highlighted port or region, to further protect the customer’s asset and crew.

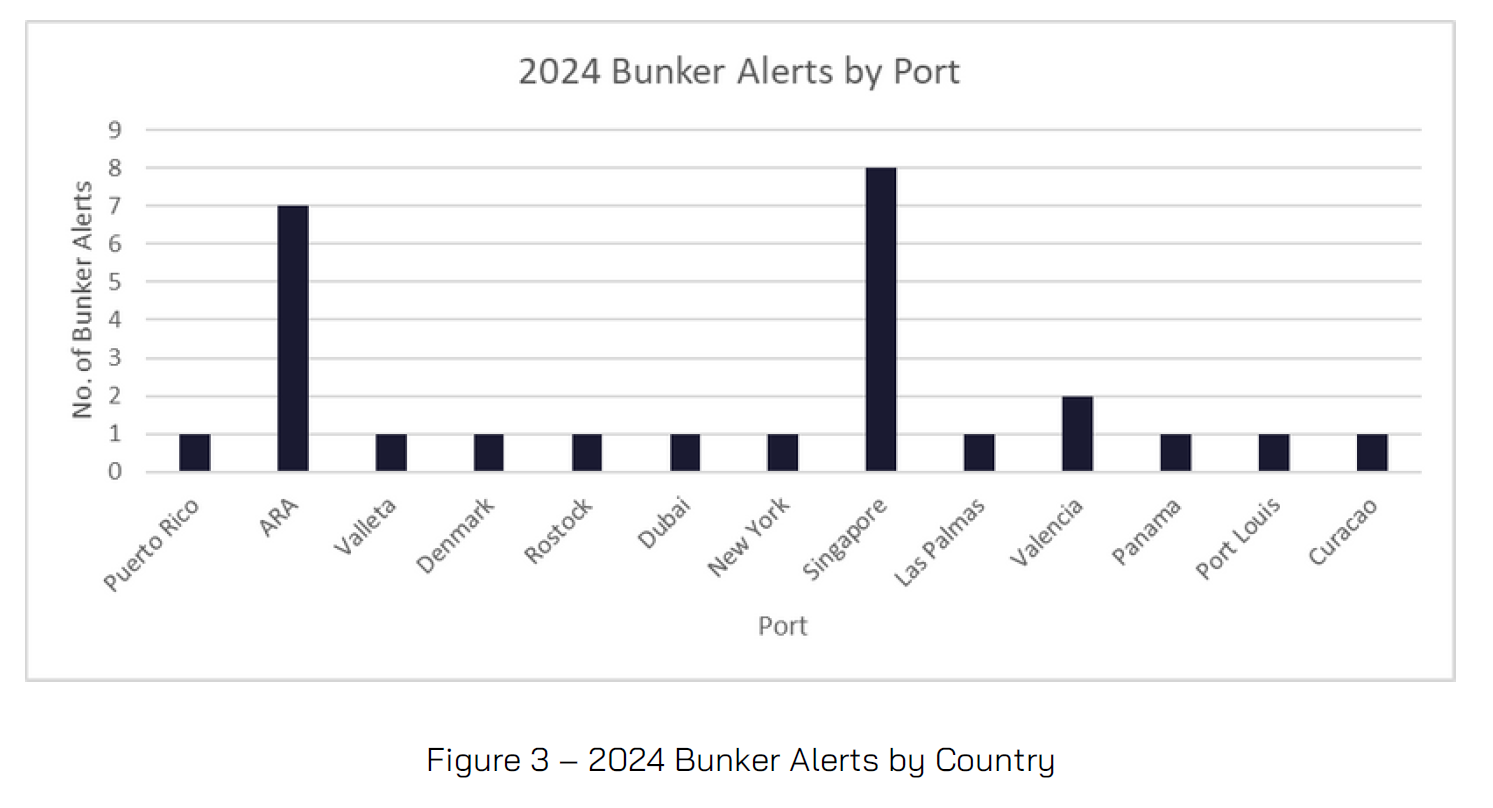

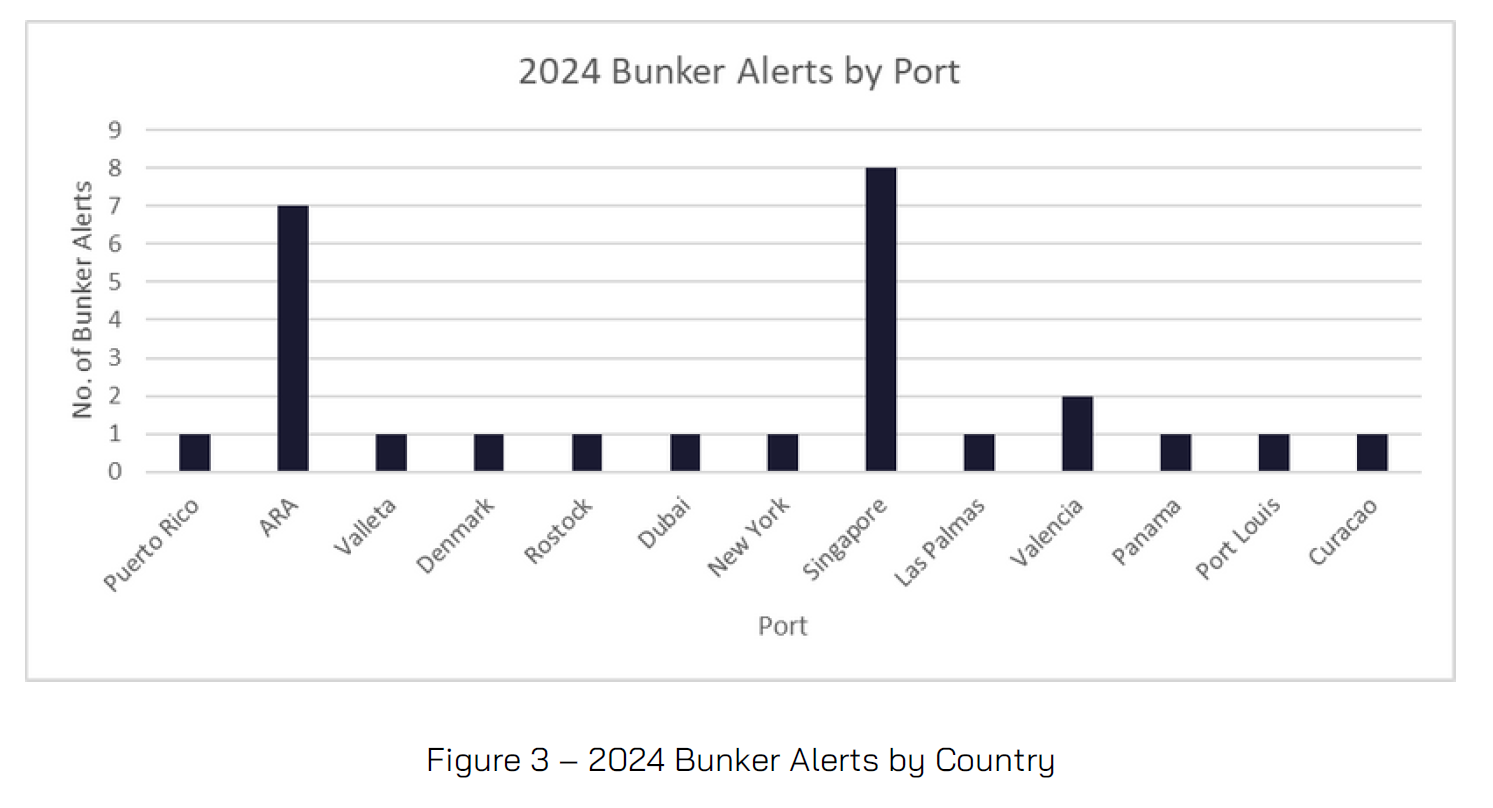

In 2024, VPS issued 27 Bunker Alerts, one less than in 2023. The 2024 Bunker Alerts included the major fuel grades, i.e. VLSFO, HSFO and MGO, 8 different test parameters and 13 ports.

46% of the 2024 Bunker Alerts were for VLSFO fuels, followed by 32% for HSFO fuels and 21% for MGO. The most common problematic parameter was Sodium (9), accounting for 33% of the Bunker Alerts, followed by Flash Point (8) accounting for 30% of the Bunker Alerts.

Singapore (30%) and ARA (26%) were the regions/ports most frequently requiring a Bunker Alert to be issued. But as these are the two busiest bunkering regions, it is not too surprising.

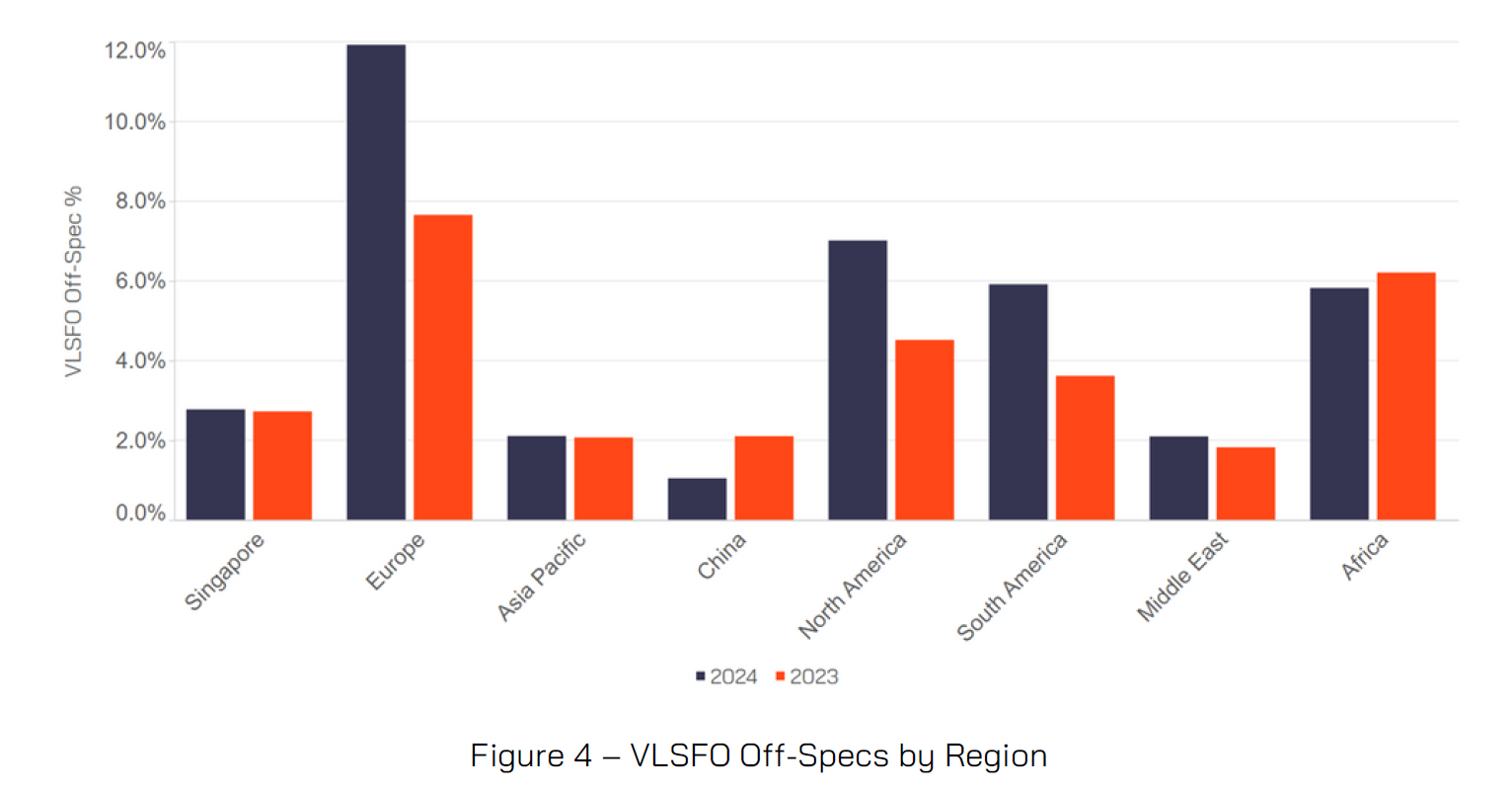

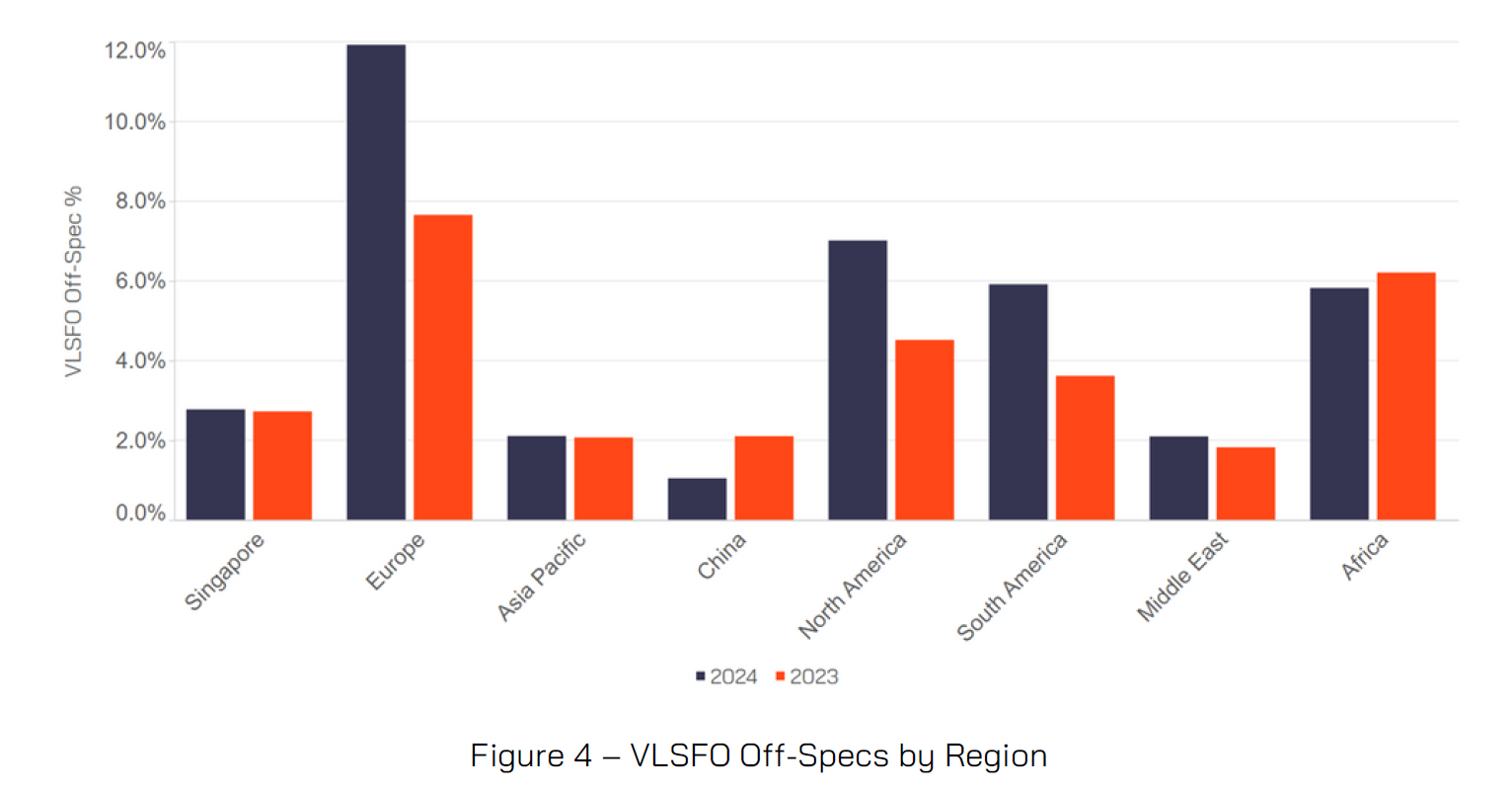

VLSFO Fuel Quality

As the most used marine fuel type, VLSFO accounts for more than half of the fuels tested by VPS. In terms of quality, VLSFO had an off-specification rate of 5.4% in 2024. Of the 5.4% VLSFO off-specifications, Europe provided the highest level of off-specification VLSFOs in both 2024 (11.9%) and 2023 (7.9%). North America provided the next highest level of off-specification VLSFO with 7% of fuels tested exhibiting at least one off-specification parameter in 2024 and 4.4% in 2023. South America had the third highest VLSFO off-specification rate with 5.9% off-specs versus 3.8% in 2023.

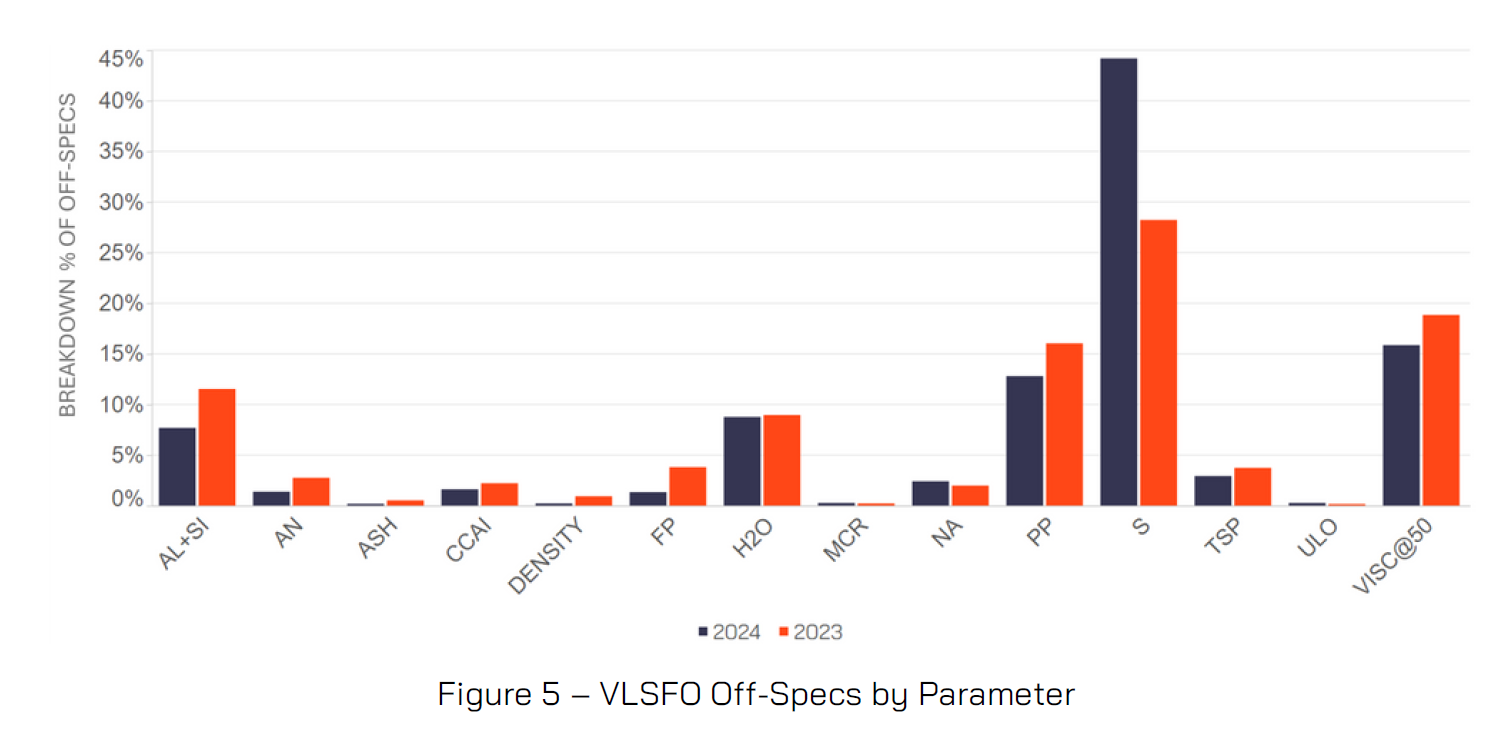

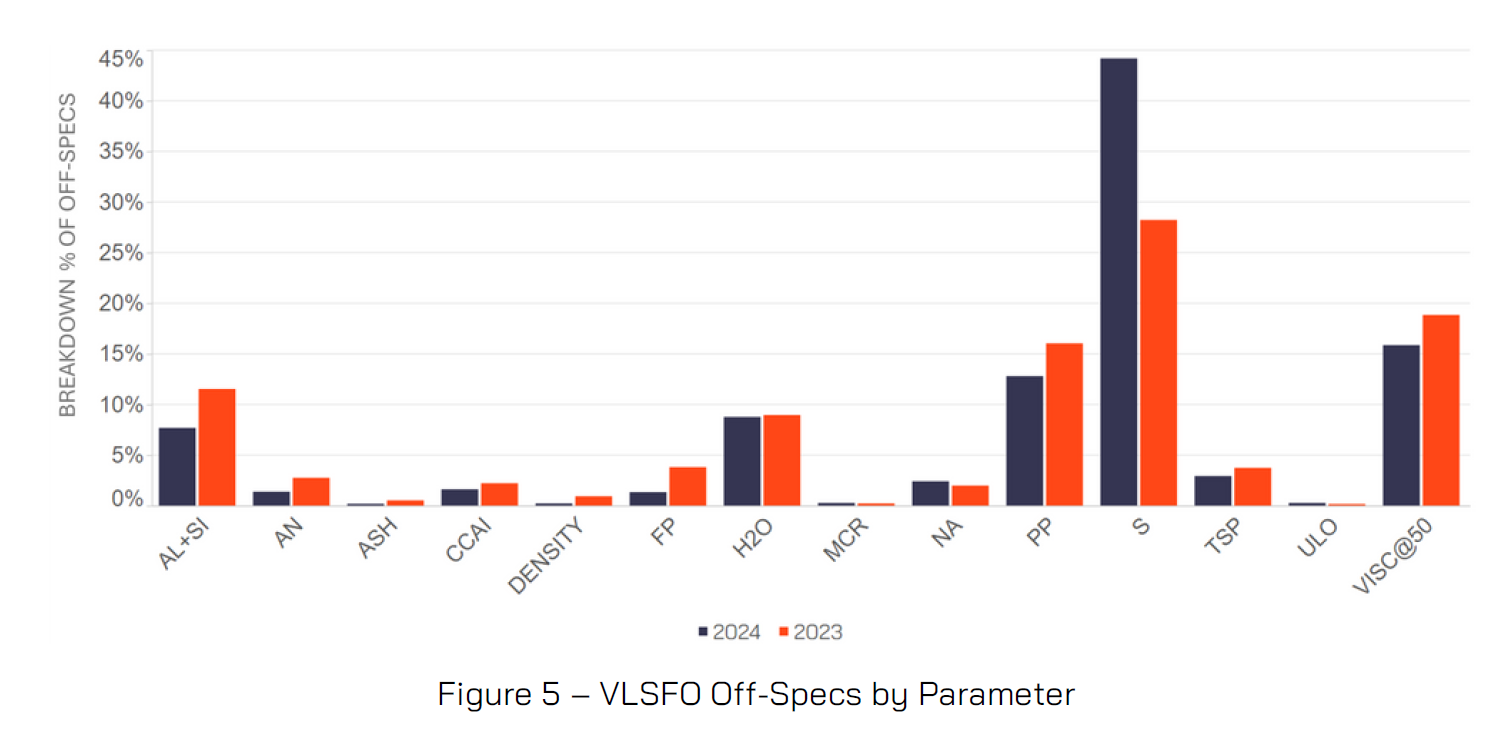

Sulphur is the most common off-specification parameter of VLSFOs, accounting for 44% of VLSFO off-specs in 2024 and 28% in 2023. When it comes to looking at all VLSFOs tested, 0.5% had a sulphur content >0.53%, whilst 1.9% of samples tested were between 0.50%-0.53% sulphur and the remaining 97.6% had a sulphur content of <0.50%.

Pour Point was also a common off-specification parameter for VLSFOs with 13% of VLSFOs off-specs relating to this parameter, a decrease against the 16% level witnessed in 2023.

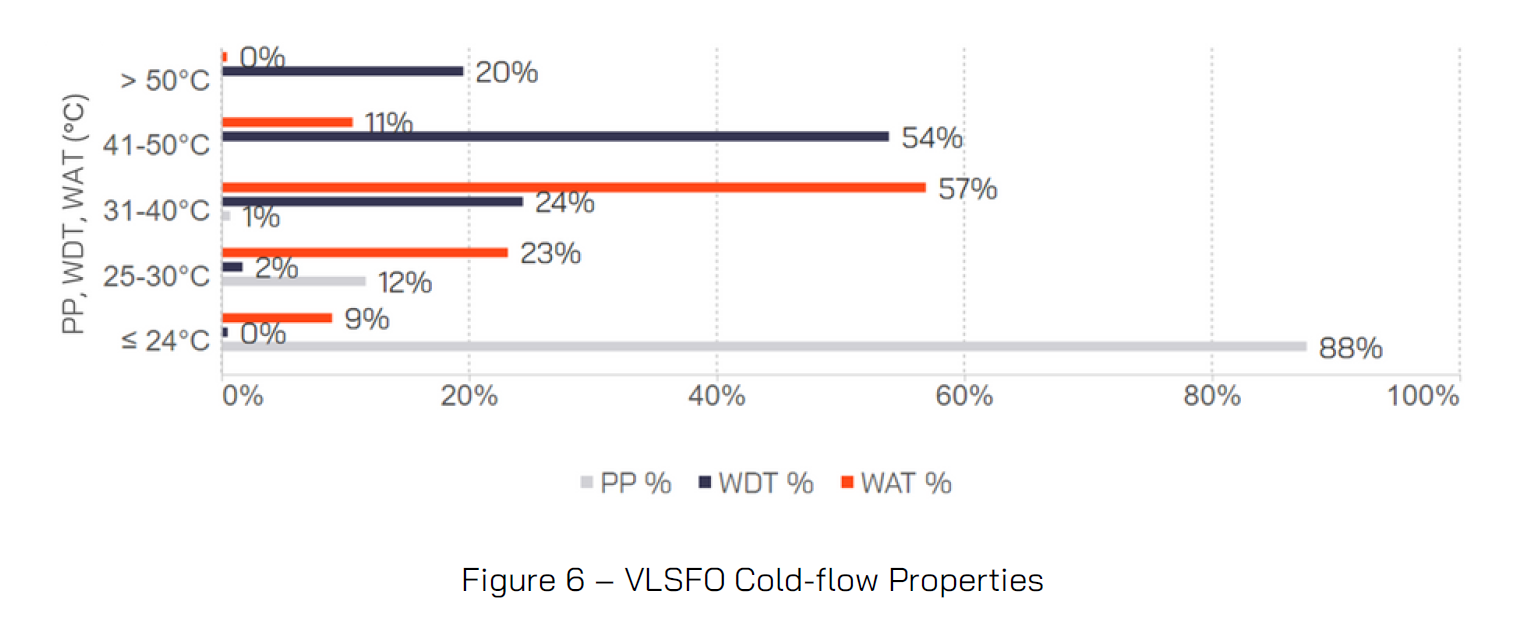

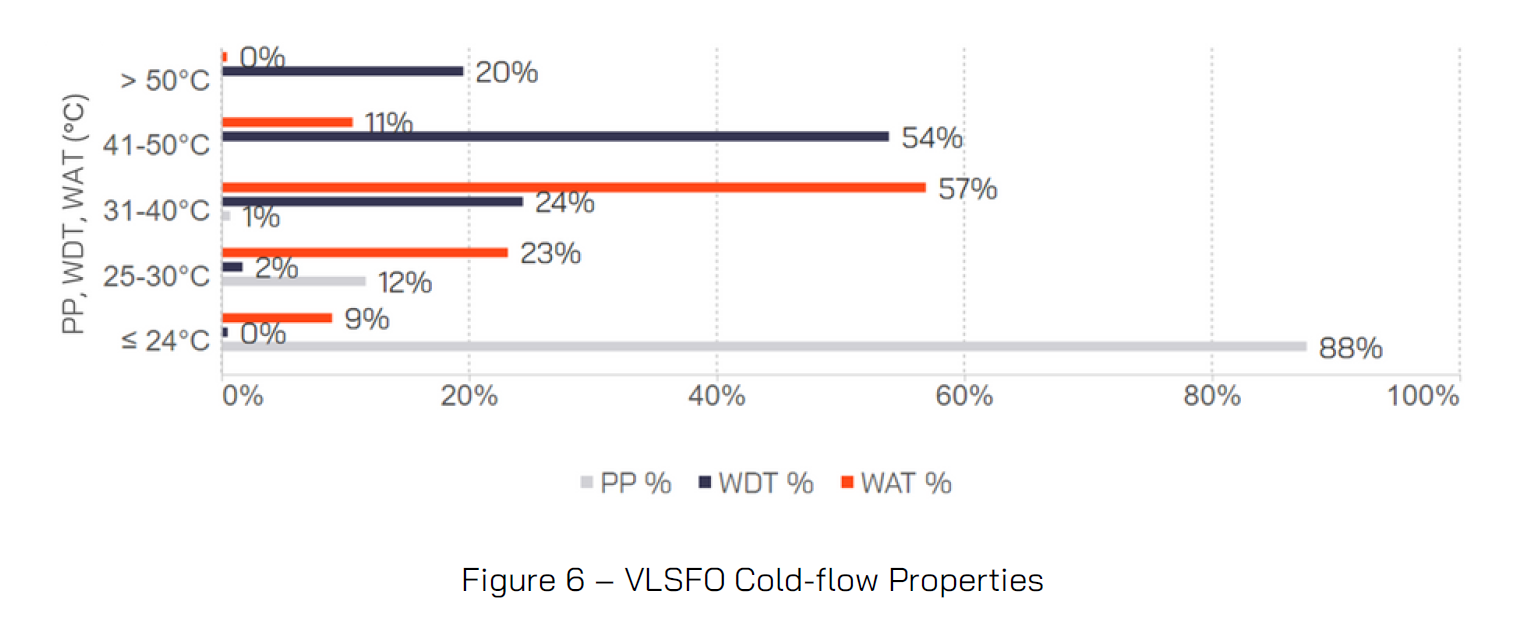

The importance of the additional cold-flow test of Wax Appearance Temperature (WAT) and Wax Disappearance Temperature (WDT), was further highlighted in 2024 with 57% of VLSFOs exhibiting WAT of 31-40ºC and 11% having WAT between 41-50ºC. 54% of VLSFO samples had a WDT of 41-50ºC, with 20% having a WDT of >50ºC. VLSFOs cold-flow properties are a definite concern with wax precipitating from the fuel at temperatures way in excess of 10ºC above the pour point, potentially causing numerous operational problems such as filter and pipework blockages.

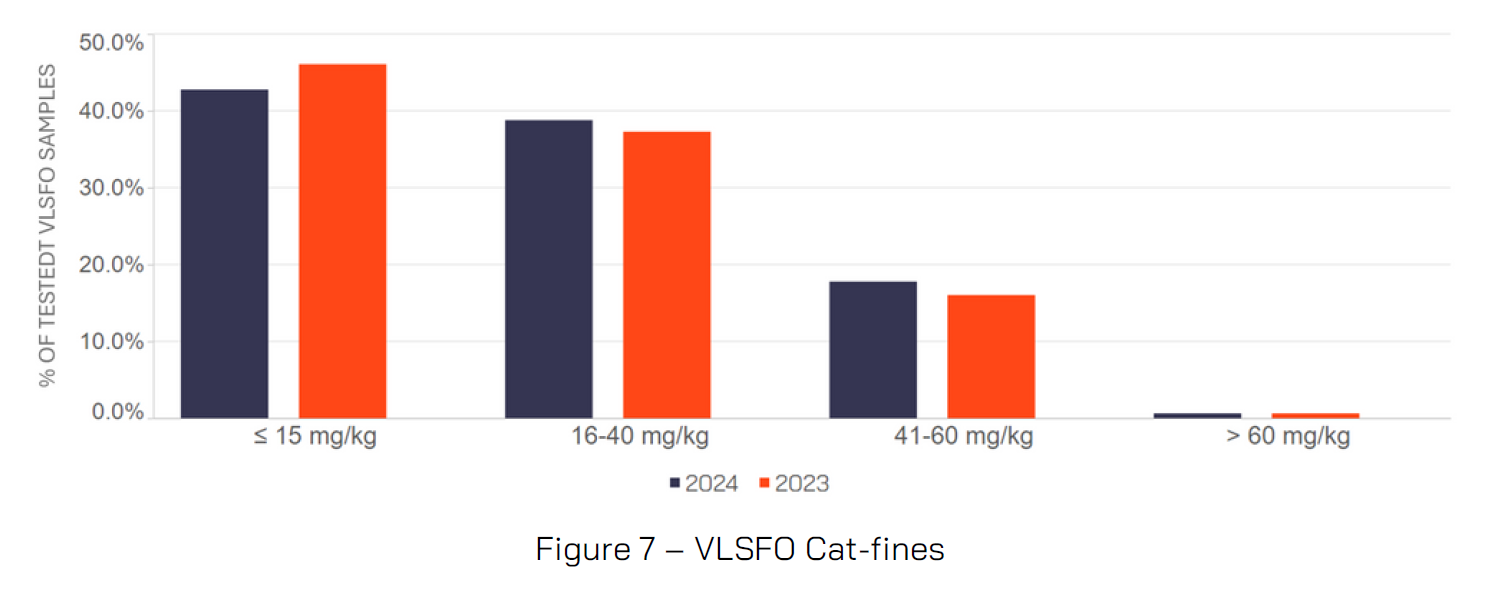

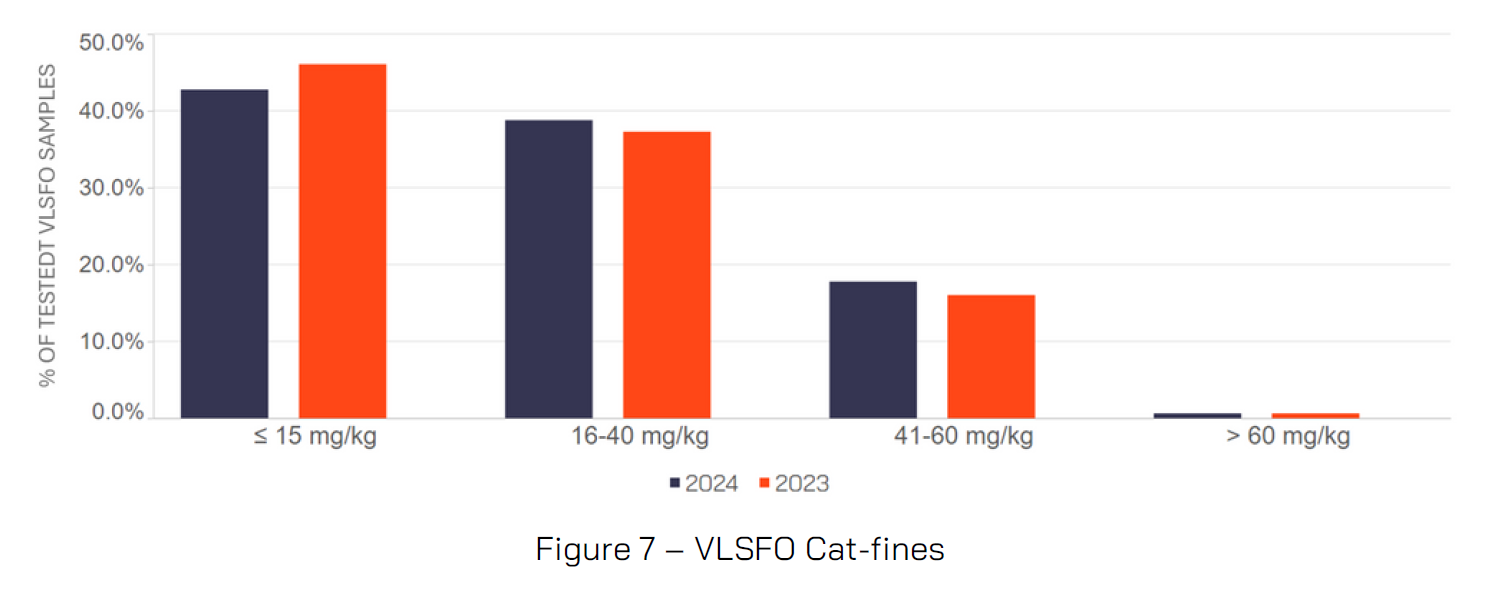

2024 saw a very similar distribution of cat-fines results across all VLSFOs tested compared to 2023, with only 0.6% of samples showing cat-fine levels of greater than 60ppm and hence off-specification. 19% of all VLSFOs showed a cat-fine level greater than 40ppm. Frequent checking of purifier efficiency via VPS’ Fuel System Checks (FSC) service is a highly recommended proactive safeguard in respect to increased cat-fines within VLSFOs.

HSFO Fuel Quality

HSFO represents almost 32% of all bunker samples received by VPS for testing, indicating a relatively high level of scrubber usage onboard vessels today. 10.4% of HSFOs tested in 2024 were off-specification for at least one test parameter. In terms of regional HSFO off-specifications, South America accounted for 29% of off-specs, compared to 30.5% in 2023. Second highest off-spec region was Europe, with 21% in 2024 compared to 21.4% in 2023 and North America was third with 11.5% of HSFO off-specs in 2023, compared to 9.5% in 2023.

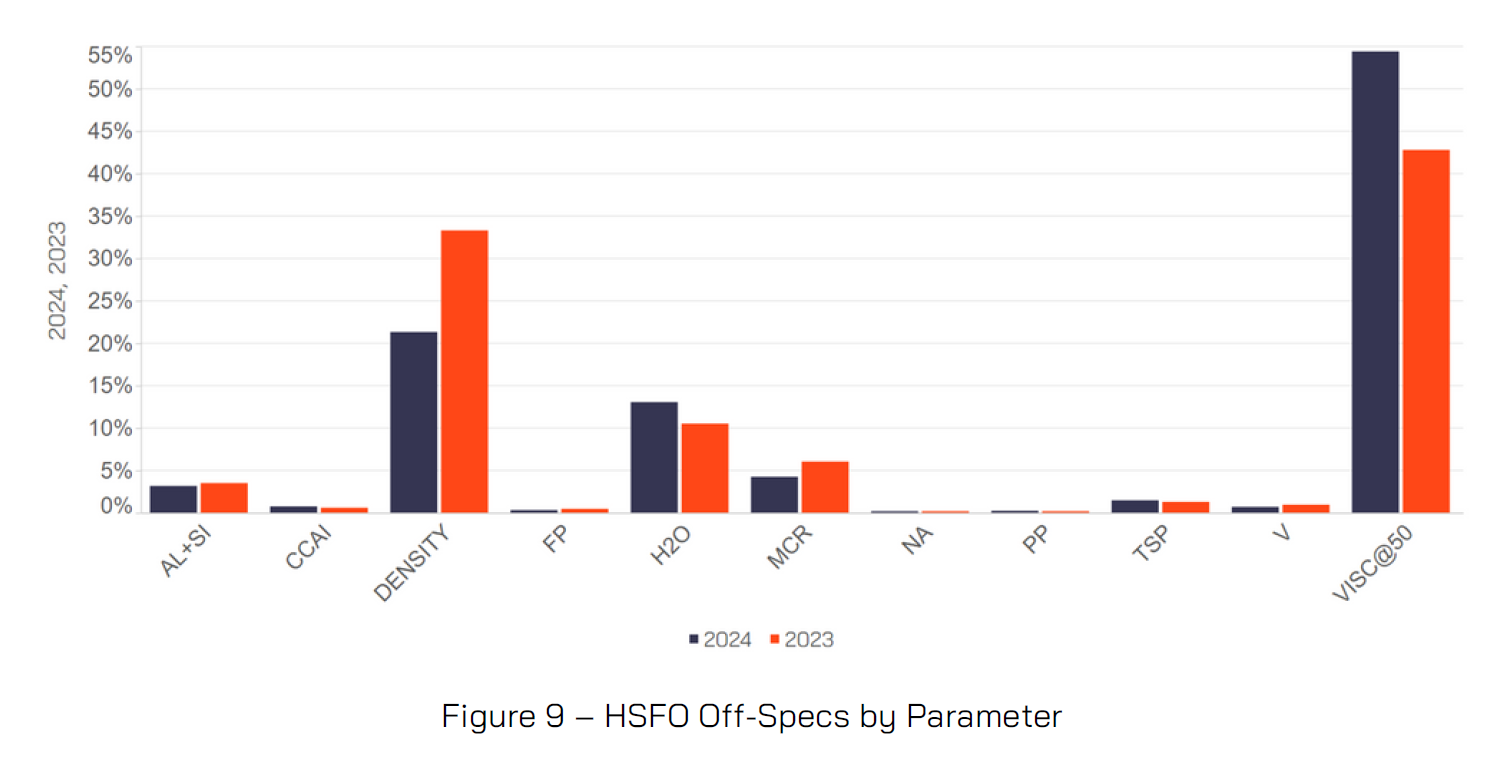

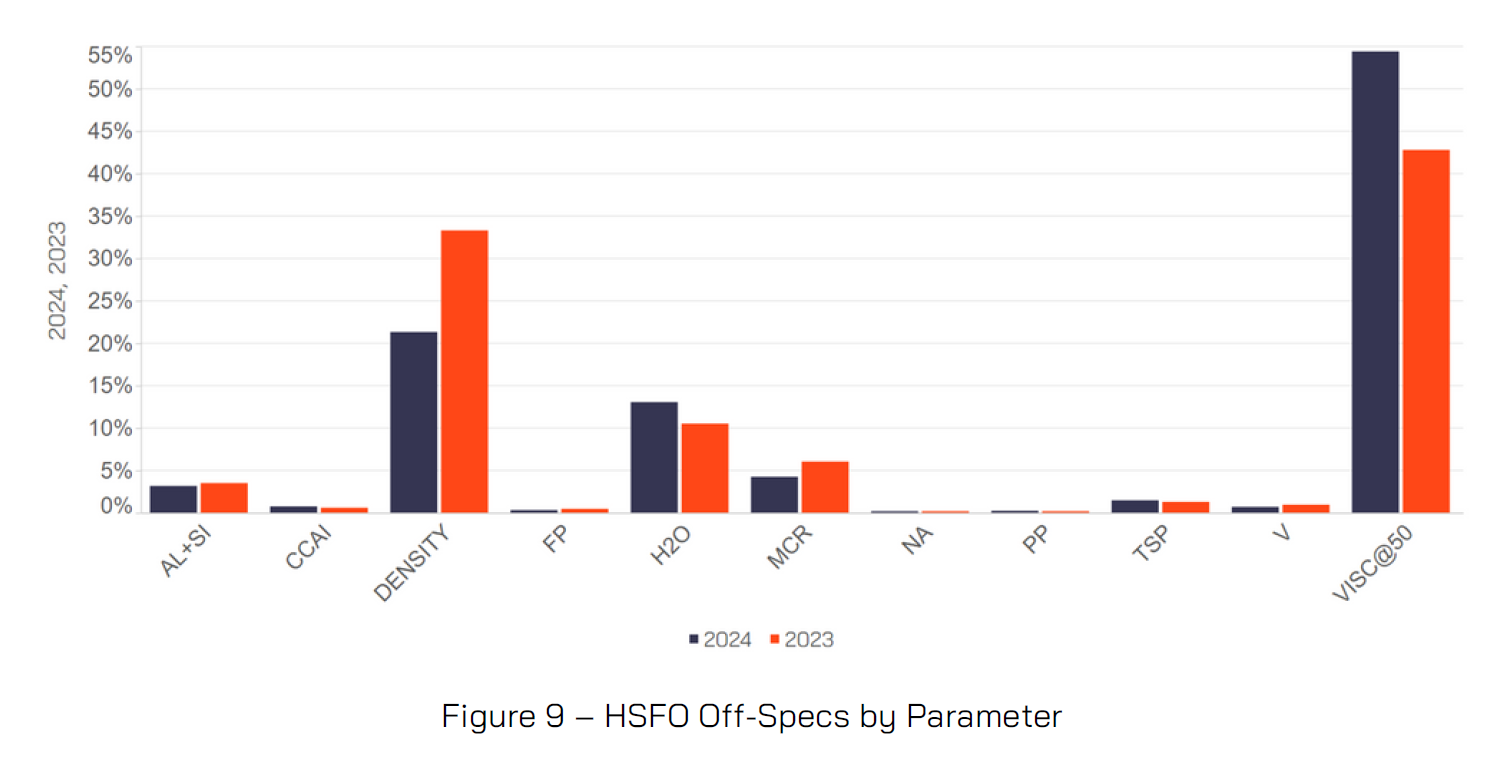

As usual, viscosity and density were the two most common HSFO off-spec parameters in 2024, with 54% of the off-spec attributed to viscosity and 21% to density, compared to 43% and 33% respectively in 2023. Water was the third most frequent HSFO off-specification parameter in 2024, with 13% off-spec level compared to 10.5% in 2023.

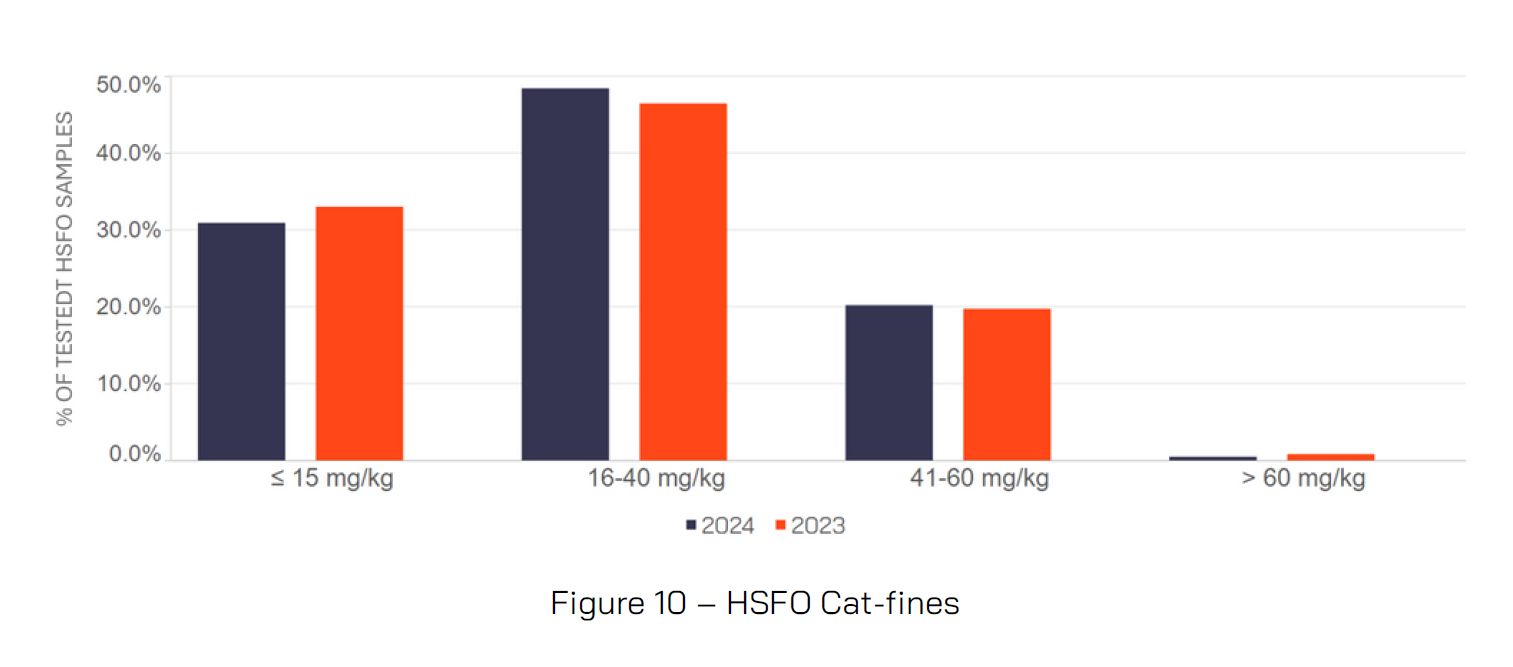

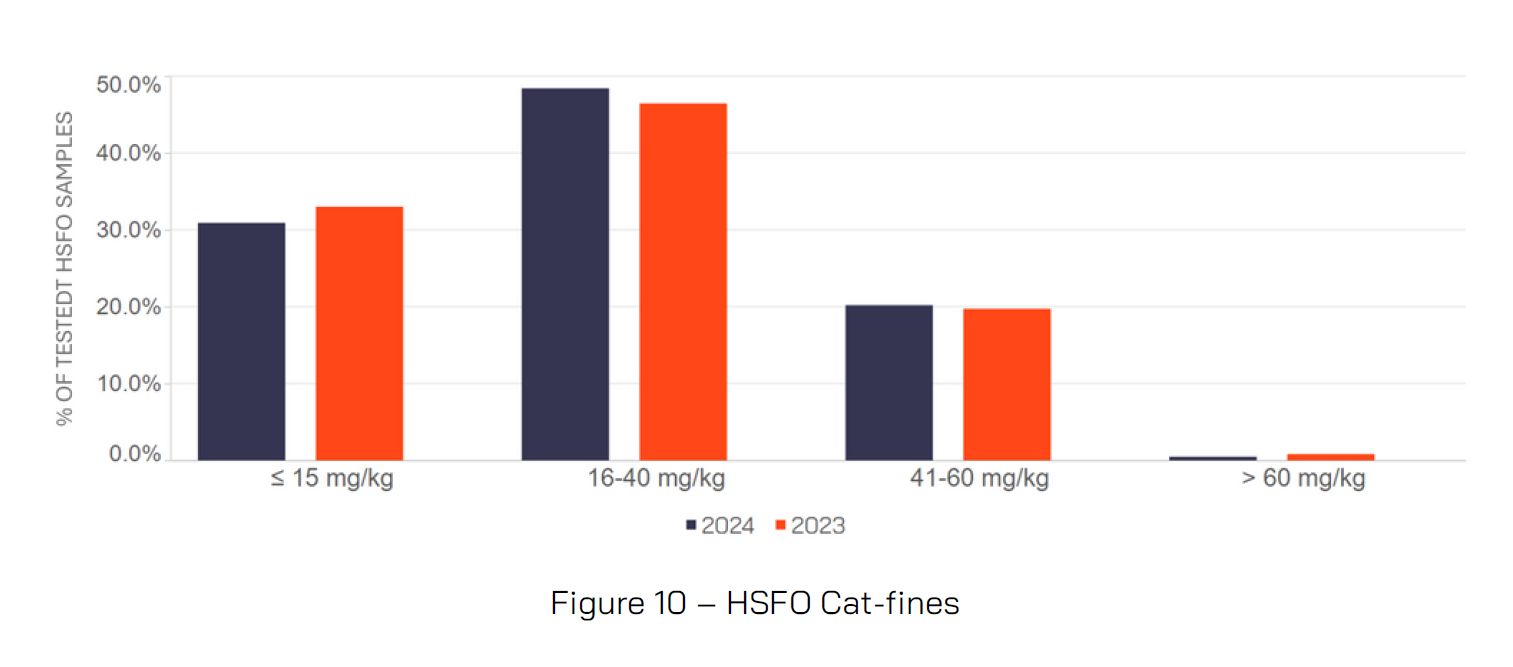

Whilst cat-fines accounted for 3% of HSFO off-specs in 2024, this was lower than the 2023 level of 4%. Again, like VLSFOs it highlights the importance of Fuel System Checks (FSC) to protect the engine from potential damage from this corrosive contaminant, by improving purifier efficiency. 20% of HSFOs had a cat-fine level of >40ppm in 2024.

MGO Fuel Quality

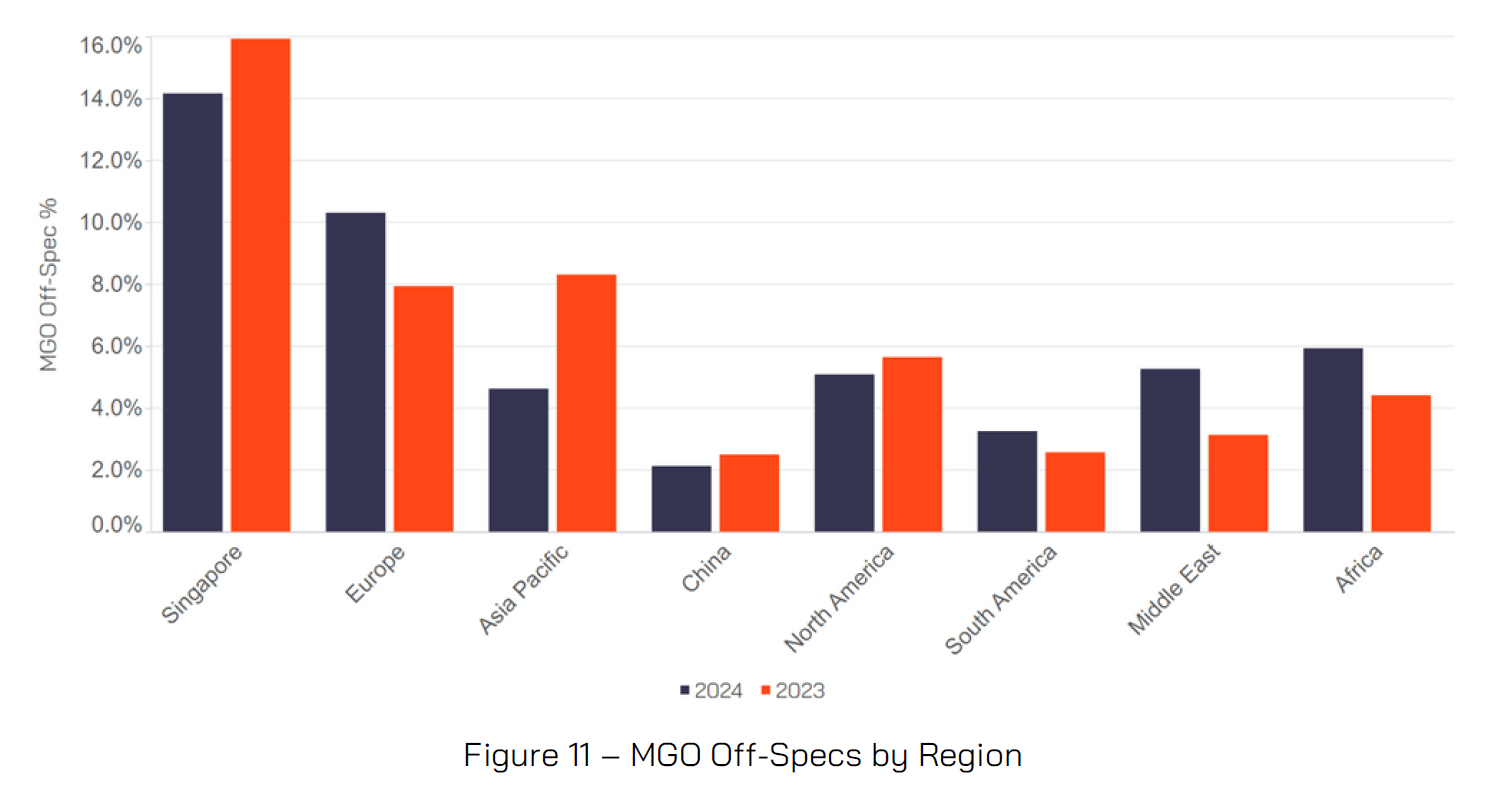

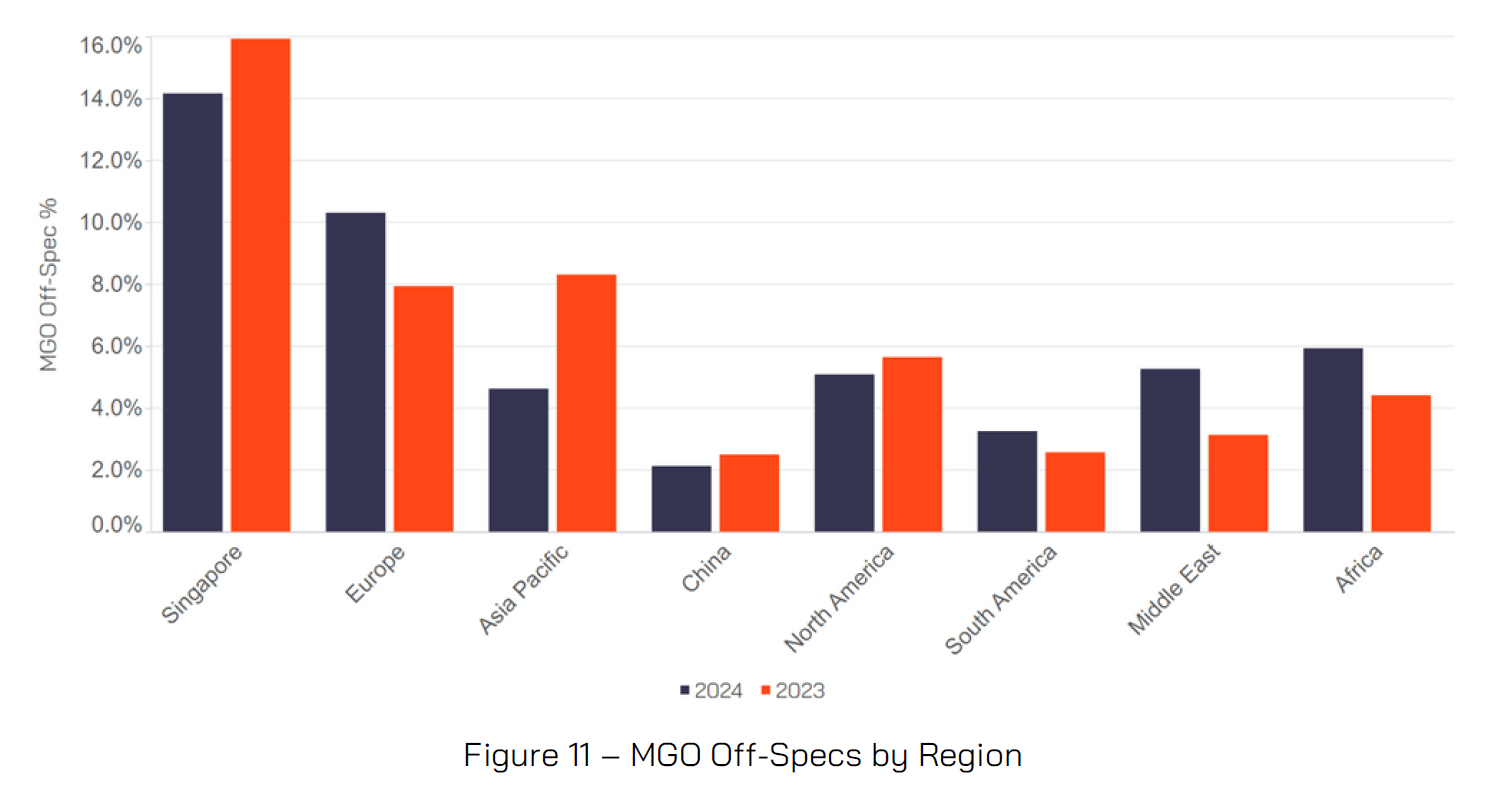

MGO accounts for 14% of all samples received by VPS for testing. Many ship owners and operators choose not to test MGO, believing this fuel type is problem-free. However, this could not be further from the truth. In 2024, 7.9% of all MGO samples tested were off-specification for at least one test parameter. Singapore accounted for 14.2% of all MGO off-specifications, which was a decrease on the 15.9% Singapore experienced in 2023. Europe was the next highest region in terms of MGO off-specs with 10.3%, followed by Africa showing 6% of all MGO off-specifications.

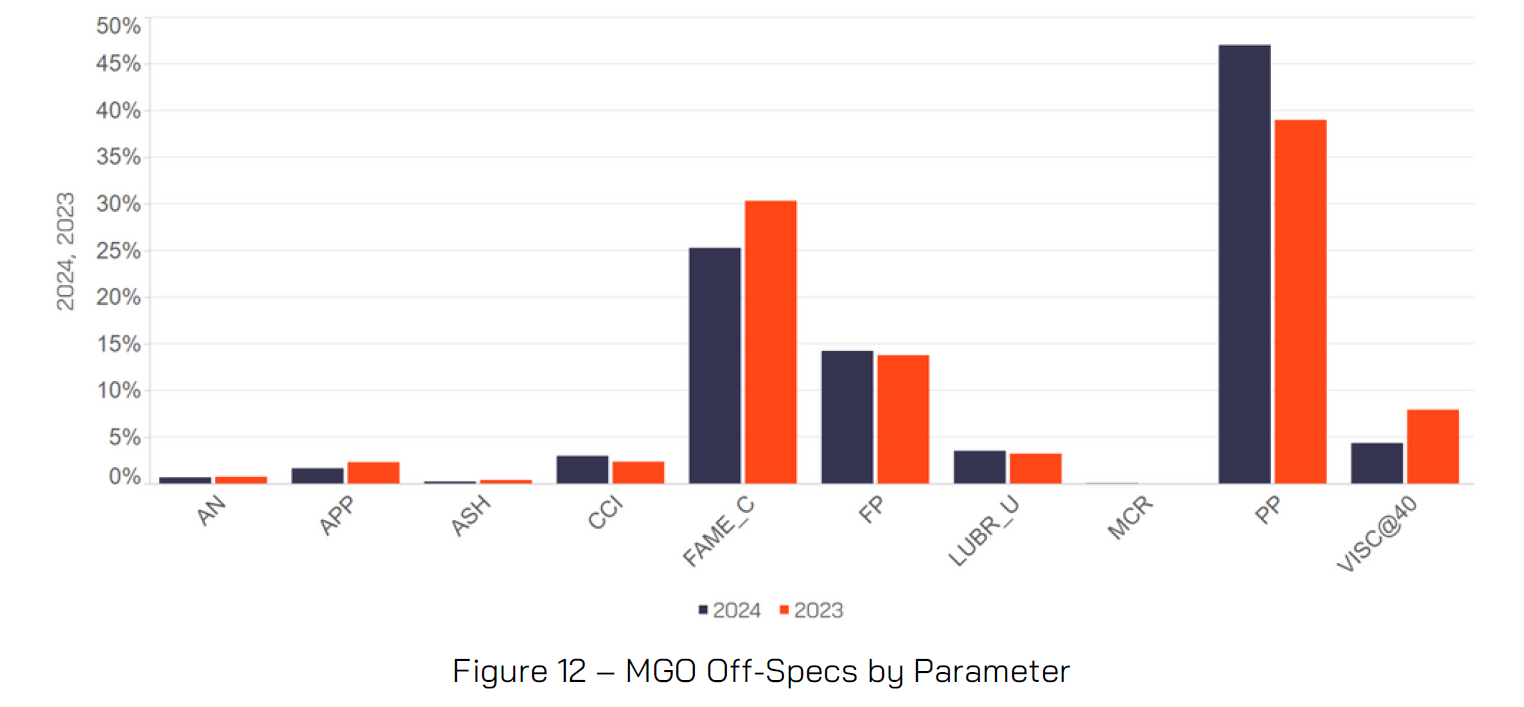

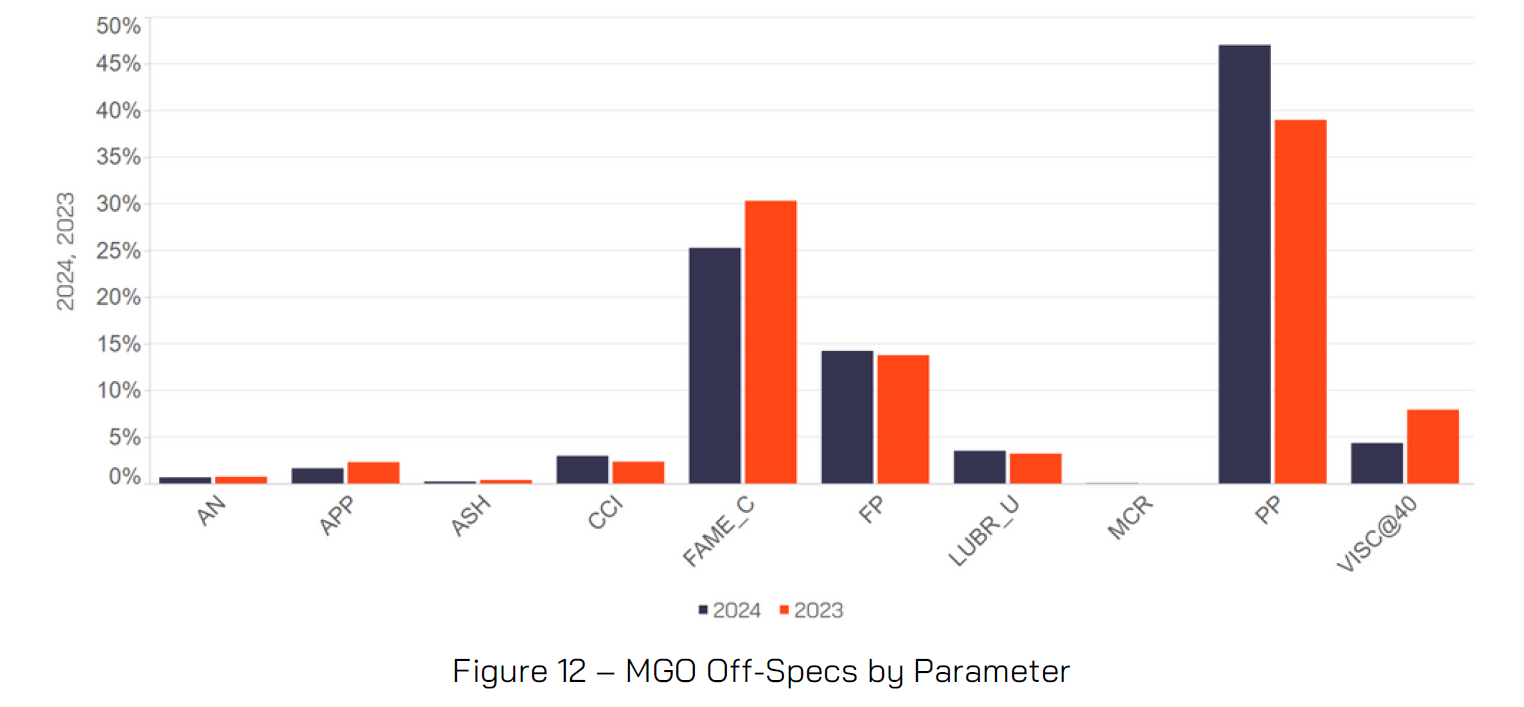

Pour Point was the most common MGO off-specification parameter in 2024, with 47% of MGO off-specs attributed to Pour Point compared to 39% in 2023. FAME contamination was the second most common MGO off-specification parameter accounting for 25% of all MGO off-specs. As FAME is a common component within automotive, aviation fuels and now some marine fuels, it is not surprising we are seeing such levels of off-specification.

Flash Point was the third most common MGO off-specification parameter, with 14% of MGO off-specs attributed to Flash Point. Flash Point, accounted for 21% of the Bunker Alerts in 2024, with three out of eight Flash Point Bunker Alerts being for MGO fuels.

Biofuels

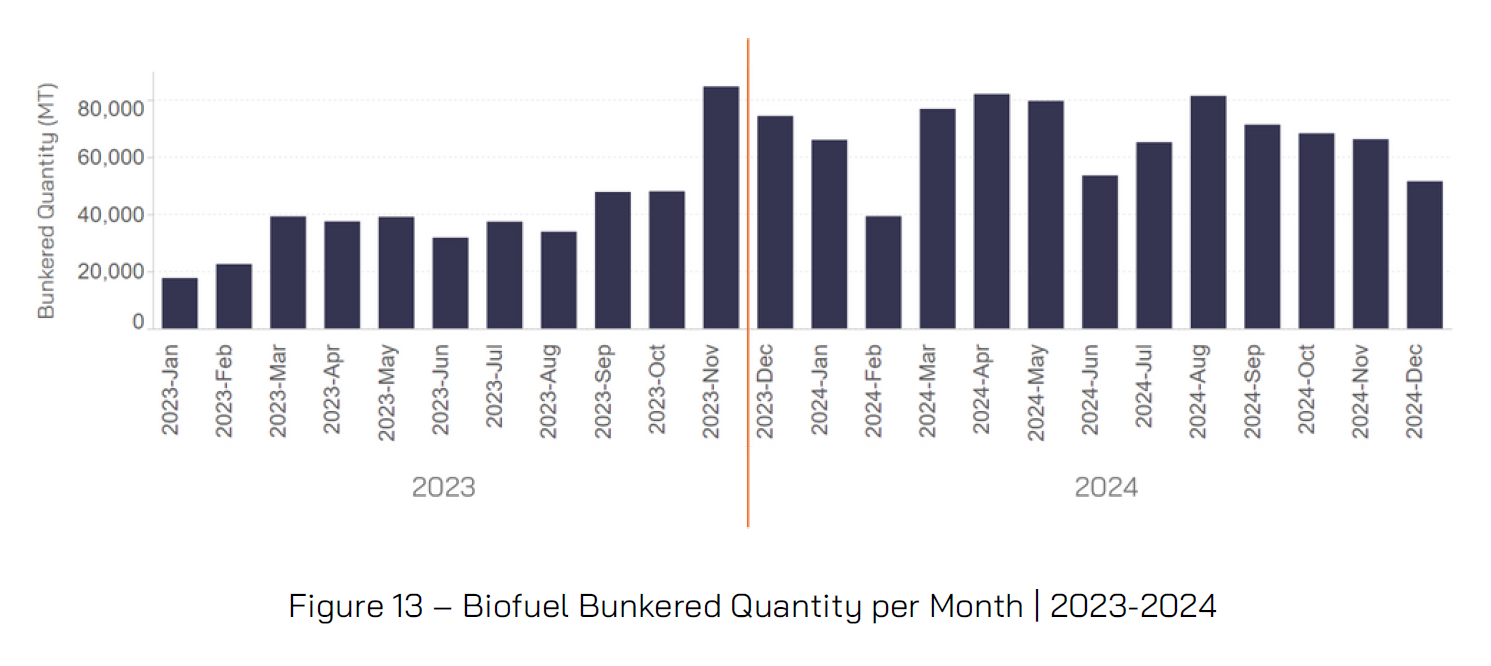

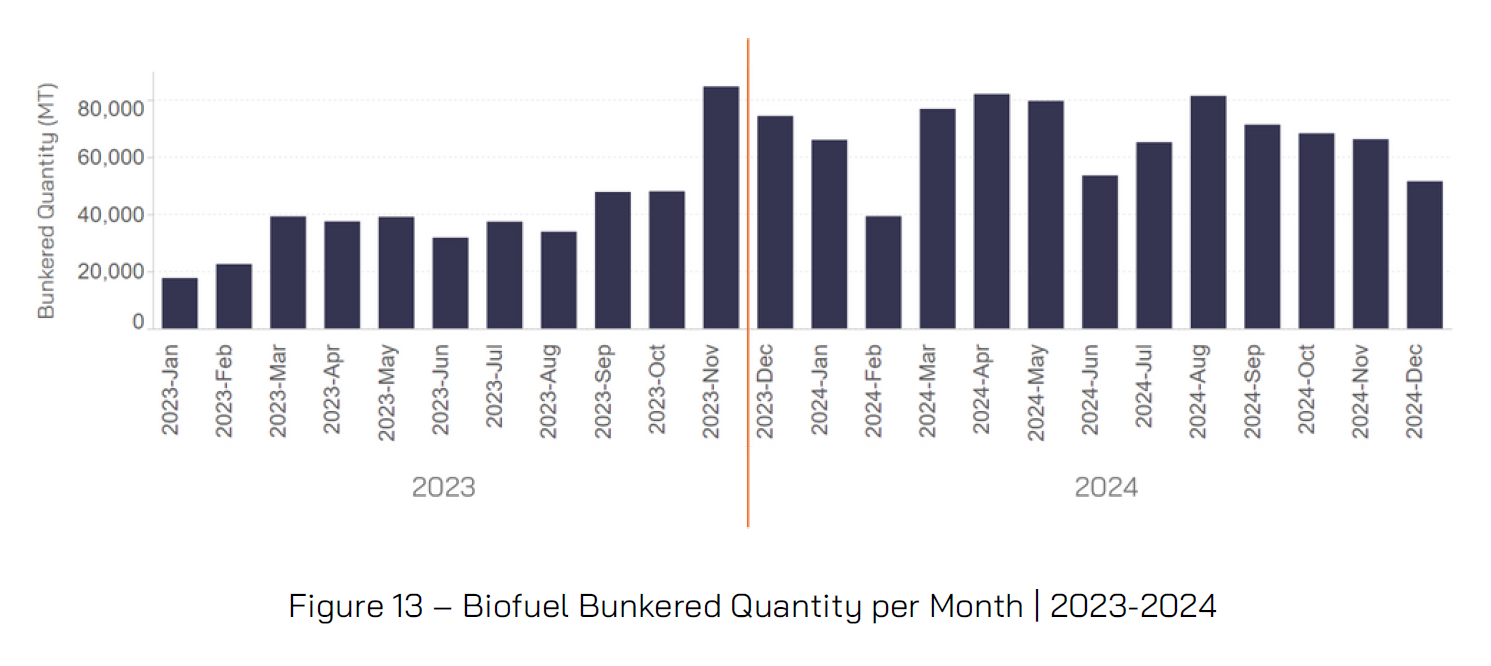

As global shipping looks towards low-to-zero carbon fuels to answer many emissions reduction challenges, biofuels offer an immediate “drop-in” solution. As such VPS tested the equivalent of approximately 800,000 MT of biofuels in 2024 compared to 550,000 MT in 2023.

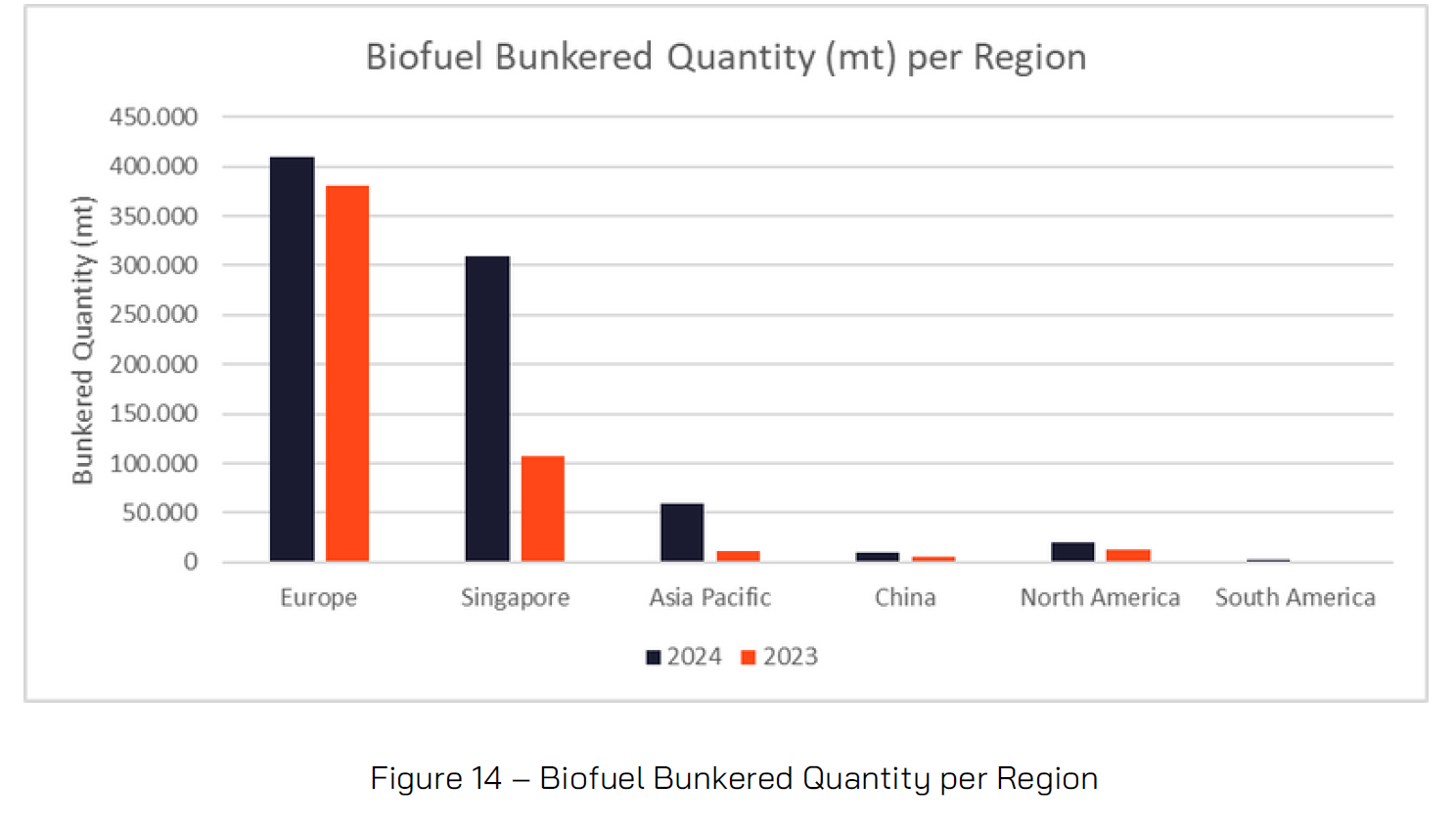

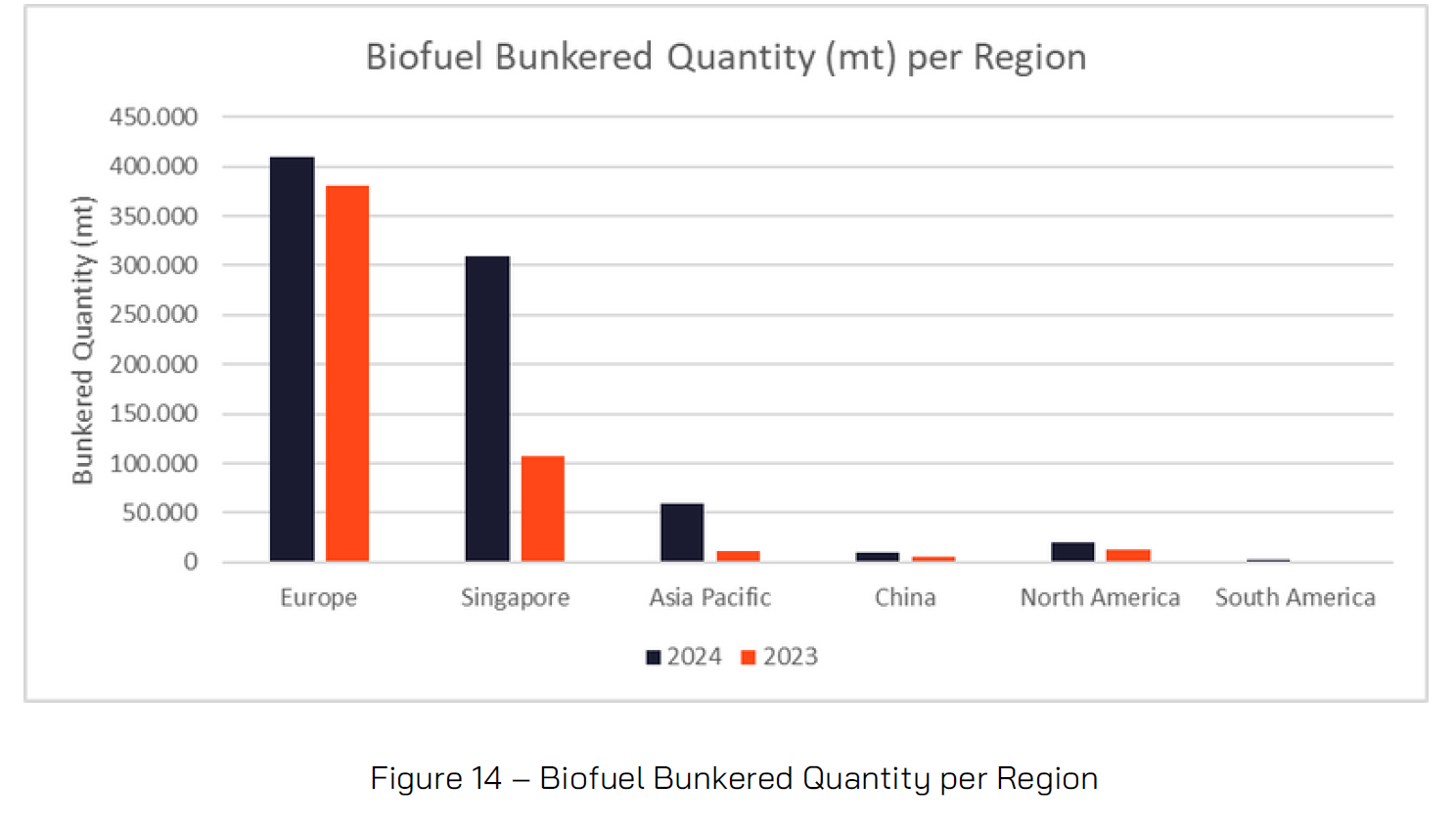

Europe, (mainly ARA-region) provided the highest volume of biofuels over 400K MT (ca. 50%) and Singapore second (ca. 38%), providing just over 300K MT. Singapore tripled its biofuel bunkerings over a 12-month period. Whilst Asia Pacific grew 5-fold in 12 months.

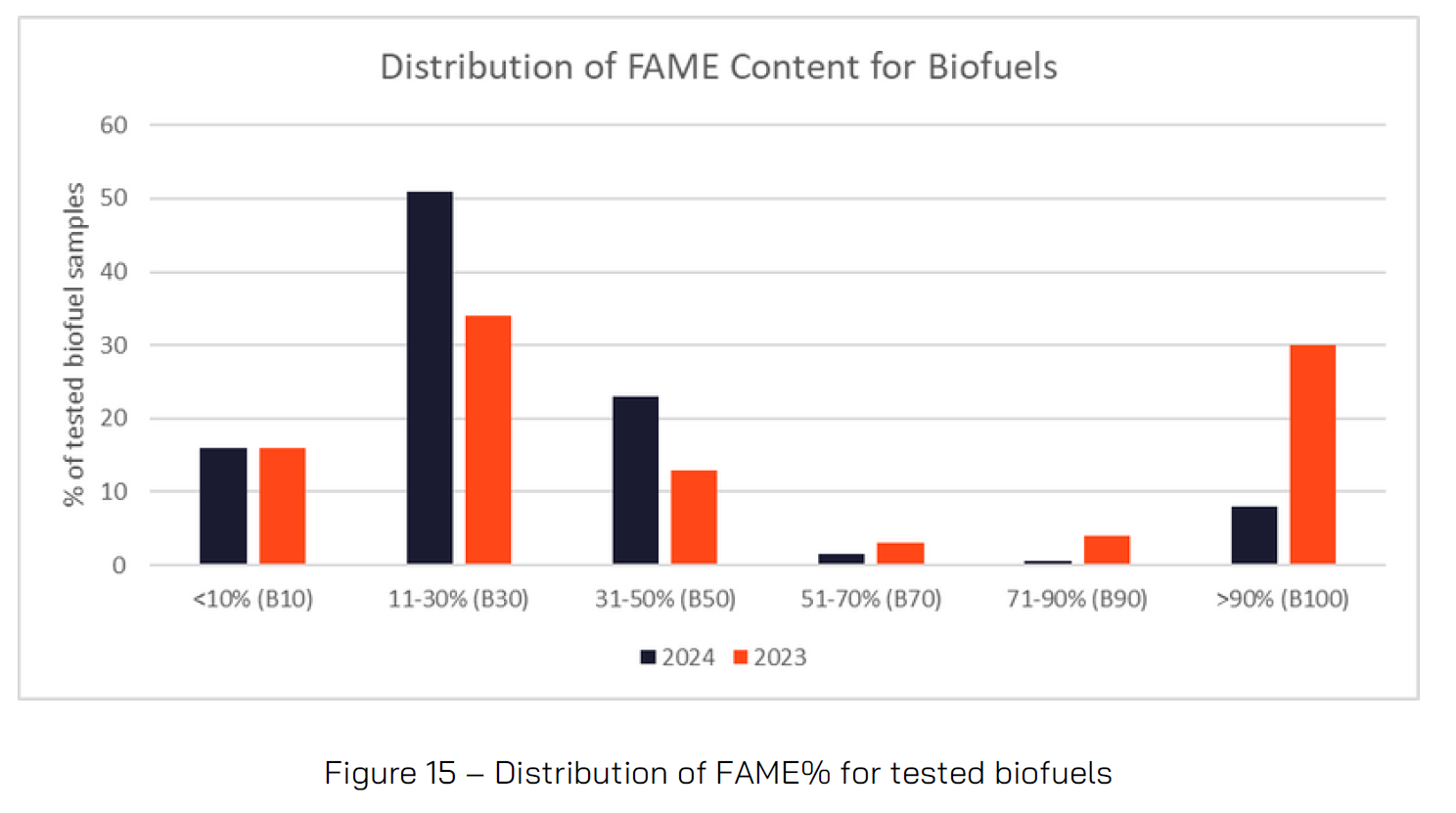

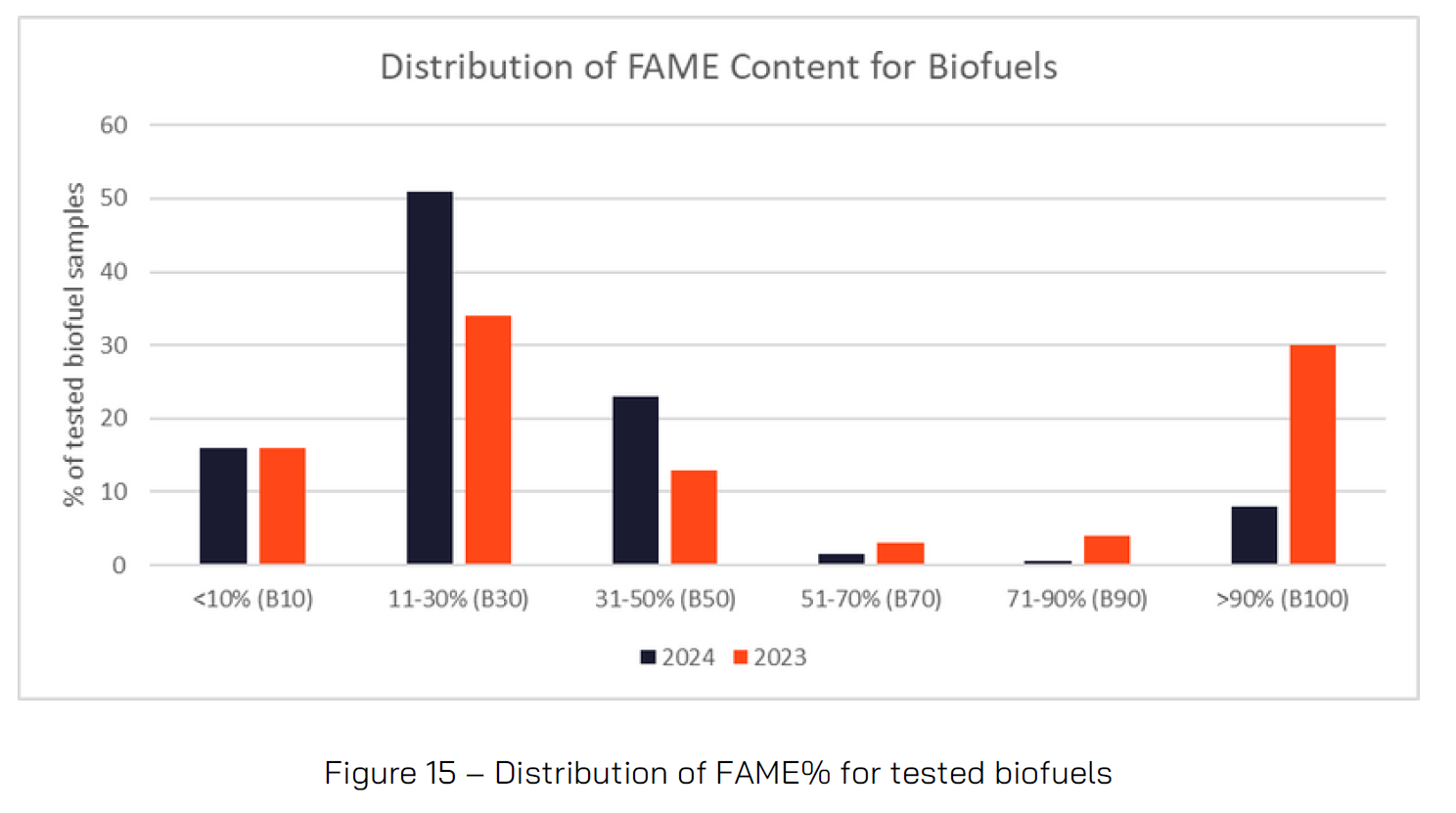

The most common biofuel blend was B30 (11-30% bio), which accounted for 51% of biofuel samples tested by VPS an increase from 34% in 2023. Yet, there was a significant move away from B100 in 2024 compared to 2023, 8% compared to 23% respectively. This may be due to fuel cost and/or availability.

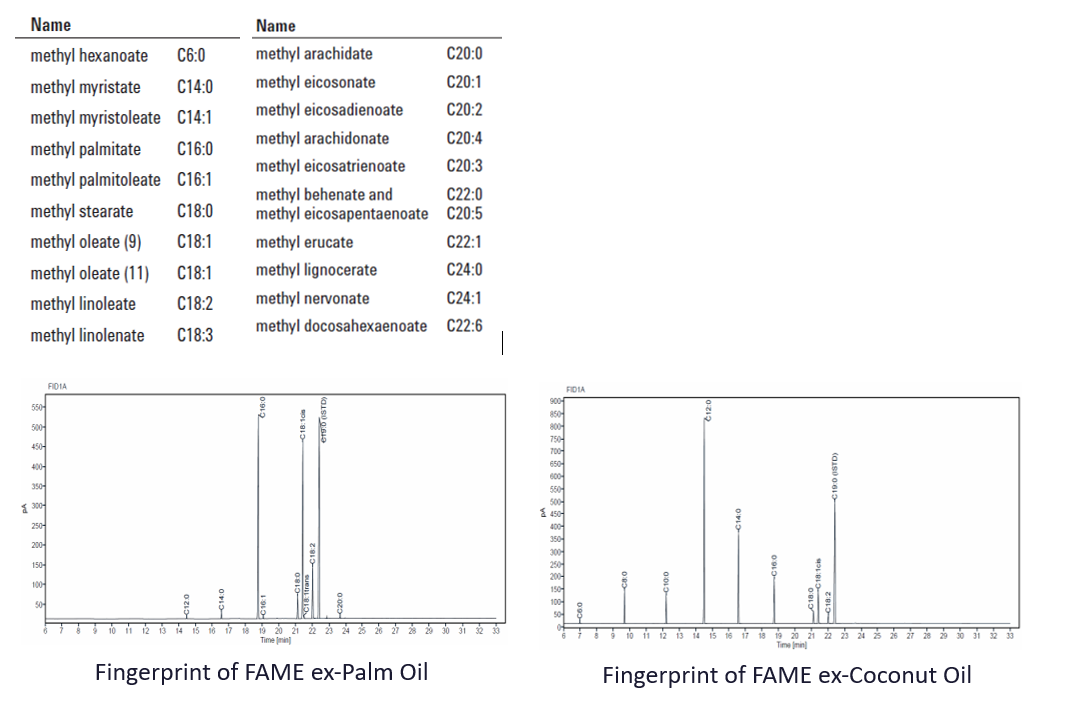

The majority of biofuels contained Fatty Acid Methyl Esters (FAME) as the bio-component, although VPS did test others containing HVO, HEFA, Cashew Nut Shell Liquid (CNSL) and Tyre Pyrolysis Oil (TPO).

Where FAME is the bio-component within marine biofuels, the key considerations are:

- Energy Content,

- Renewable Content

- Fuel Stability,

- Cold-Flow Properties

- Corrosivity,

- Microbial Growth

It is fully expected that the growth in biofuels usage for marine applications will continue to increase across 2025 and the VPS Additional Protection Service (APS) when using biofuels, will only increase in importance as the industry looks for more information regarding the fuel management of biofuels.

Gas Chromatography Mass Spectrometry (GCMS) Services

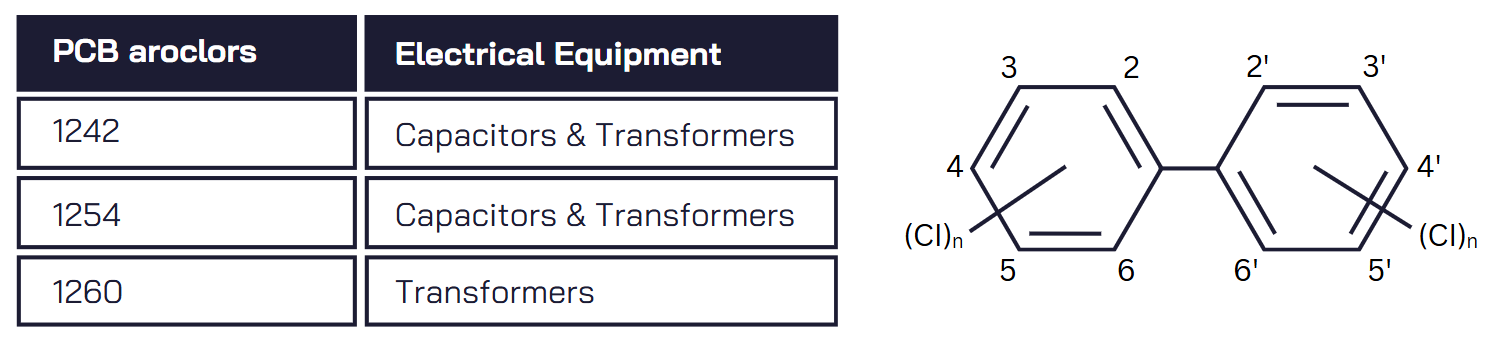

With both VLSFO and HSFO we continued to see cases of vessel damages due to chemical contamination during 2024. The recommended first step in identifying potentially problematic chemicals is to use the VPS GCMS-Head Space Chemical Screening service, as a pre-burn, damage prevention service.

In 2024, 23% of marine fuel samples received by VPS undertook this analysis, with 8.2% of samples tested, giving rise to a “Caution” result, indicating the presence of at least one chemical contaminant.

Following a “Caution” result, VPS provide numerous GCMS forensic methodologies to accurately determine and quantify the contaminants identified. These range from:

- GCMS-Head Space-Extended: For more accurate determination of volatile chemicals

- GCMS-Vacuum Distillation: For the determination of volatile and semi-volatile chemicals

- GCMS-Acid Extraction: For the determination of acidic-based chemicals such as acids, phenols, alcohols.

- GCMS-Direct Injection: For the determination of semi-volatile and non-volatile chemicals.

At the end of the year, VPS developed a further unique screening service, GCMS-HS Advanced, which can detect and identify, volatile, semi-volatile and non-volatile chemicals, in one analysis, providing a more comprehensive pre-burn screening service.

Operational Issues Reported in 2024

During the course of 2024, various vessels reported operational issues arising from the consumption of certain bunker fuels, where more than 50 vessels reported fuel-related problems mainly affecting either their Main engines, Auxiliary engines, or both, with at least eight cases resulting in de-bunkering of the fuel.

Out of the 50 reported cases, 20 incidents involved main engine-related issues, 8 incidents involved generator engine-related issues and 6 vessels experienced issues with both main and auxiliary engines.

The most common main engine-related issues were, Fuel Pump Failures (60%) caused by excessive wear, leading to the inability to maintain the required fuel oil pressure.

Followed by Filter Blockages and Sludging (40%), which resulted in heavy sludge accumulation at purifiers and blockages to fuel filters.

A significant cause of purifier and filter failures was the use of bunker fuels with, High Total Sediment Potential (TSP ≥0.06%) accompanied by high catfines content (>40 ppm).

These fuels caused severe sludge accumulation in purifiers, reducing de-sludging intervals.

Auto-backwash filters experienced blockages, triggering high differential pressure alarms and frequent backwash cycles.

Vessels with poorly maintained purifiers struggled to remove catfines to acceptable levels, increasing the risk of abrasive damage to engine components.

Additionally, several vessels reported issues with fuels exhibiting poor cold-flow properties, particularly those with high Wax Appearance Temperature (WAT) and Wax Disappearance Temperature (WDT), which contributed to fuel line blockages.

More than 14% of the reported operational issues were attributed to chemical contamination, identified through various VPS GCMS techniques. A notable concern was the presence of Cashew Nut Shell Liquid (CNSL) in bunker fuels, where at least 18 vessels reported severe operational issues linked to CNSL contamination. The “new” GCMS-HS Advanced test method, which can detect and identify, volatile, semi-volatile and non-volatile chemicals, in one analysis, will certainly be an extremely valuable tool in providing a more comprehensive pre-burn screening service.

The most commonly affected systems were generator engines, where fuel pumps experienced severe wear and corrosion, resulting in engine failures and loss of power supply and consequent loss of propulsion.

In cases of severe operational impact, CNSL levels in tested fuels exceeded 1%, highlighting the corrosive and poor combustion nature of this contaminant.

These reported issues reinforce the importance of robust fuel quality monitoring and regular fuel system maintenance to safeguard vessel operations.

The above statistics are based solely on cases where ship operators reported their issues to VPS and may not represent all incidents globally.

ISO8217:2024

A major development during 2024 was the release of the new revision of the marine fuel quality standard ISO8217. This, the seventh revision of the standard was released as:

1. There has been no revised version since the start of 0.50% sulphur regulation, IMO 2020 and the introduction of VLSFO fuels.

2. The existing version (8217:2017) did not cater for the use of biofuels.

3. This latest version now caters for VLSFO fuels and biofuel blends.

The key changes from the previous revision are:

In ISO8217:2024 there are now 4 tables (Table 1, Table 2, Table 3 & Table 4) unlike the previous version where there were only two tables.

Table 1: Distillate and Bio-distillate Marine Fuels, including ULSFO-Distillate type, FAME and HVO/GTL/BTL up to 100 %. (DMX,DMA, DFA, DMZ, DFZ, DMB, DFB)

Table 2 Residual Marine Fuels with S≤ 0.50%: This is to cater for fuels that are currently supplied and used in the marine industry including VLSFO and ULSFO. (RMA20-0.5, RMA20-0.1, RME180-0.5, RME180-0.1, RMG380-0.5, RMG380-0.1, RMK500-0.5, RMK500-0.1)

Table 3 - Bio-Residual Marine Fuels, includes all residual fuels ULSFO, VLSFO and HSFO containing FAME. (RF20, RF80, RF180, RF380, RF500)

Table 4 – Residual fuels for Sulphur > 0.50%: includes fuels for use with approved abatement technologies. (RME180H, RMG180H, RMG380H, RMK500H, RMK700H)

All four tables now include a minimum viscosity limit, as well as a maximum limit. Plus all four tables include Clauses 1 to 10 as “General Requirements”.

In terms of biofuels, Table 1 accepts FAME, HVO, GTL and BTL as bio-components.

VPS fully support the publication and introduction of ISO8217:2024 as a major improvement to the international marine fuel standard for current modern-day fuels. VPS also recognise there is only so much time available to produce this highly anticipated and much needed revision. Throughout the ISO8217 development work relating to the preparation of this revision of the standard, VPS has represented Ship Operator views across numerous Working Group meetings, by our most senior technical and strategic management. Preparation of the standard must, by necessity, take on board divergent views and as such during its preparation, not all of the issues and recommendations raised by VPS and other committee members, made it into the final version.

As a result, we still expect ship owners and operators to require additional tests, beyond the scope of ISO8217:2024 testing, to ensure an even greater level of protection and safety to their vessels.

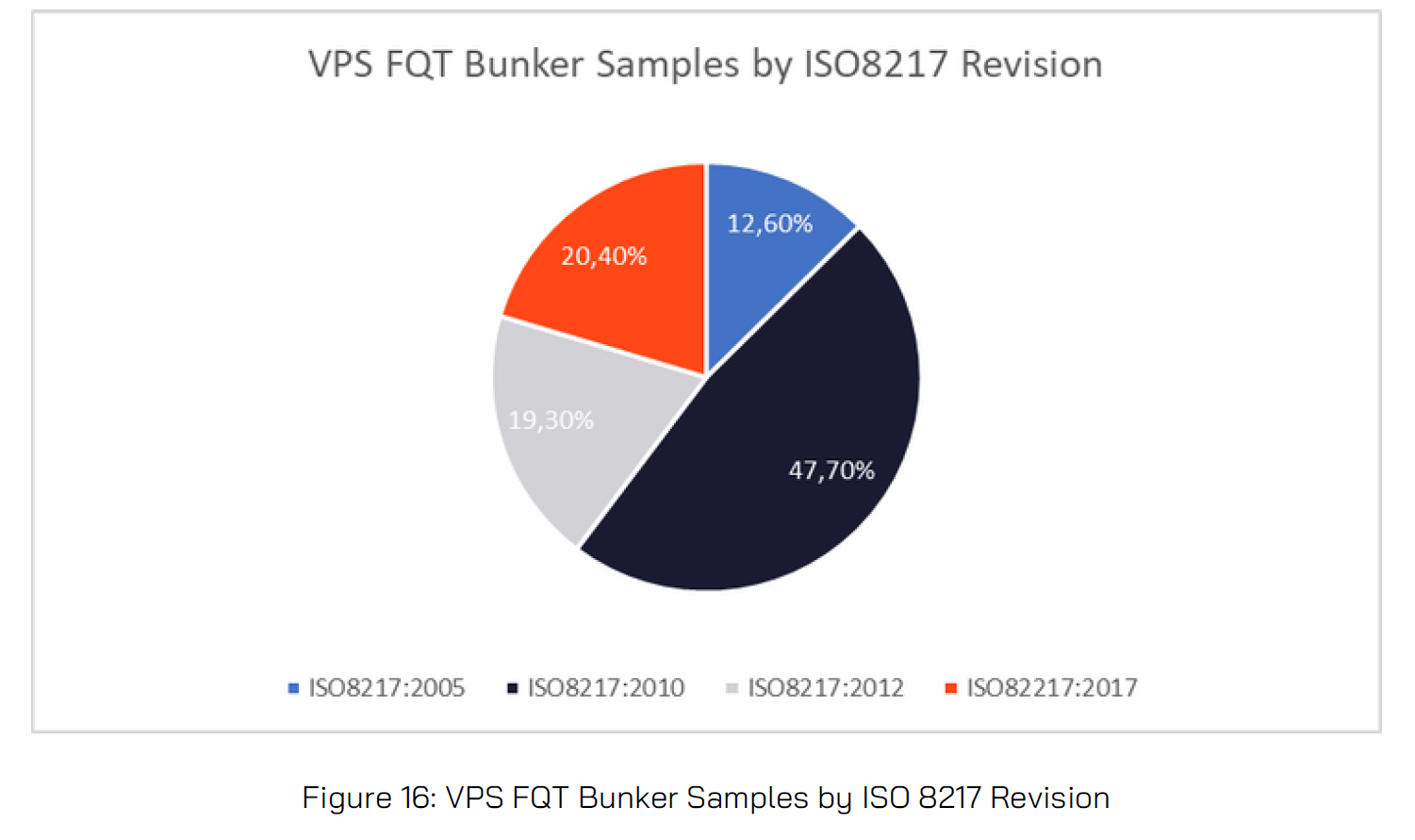

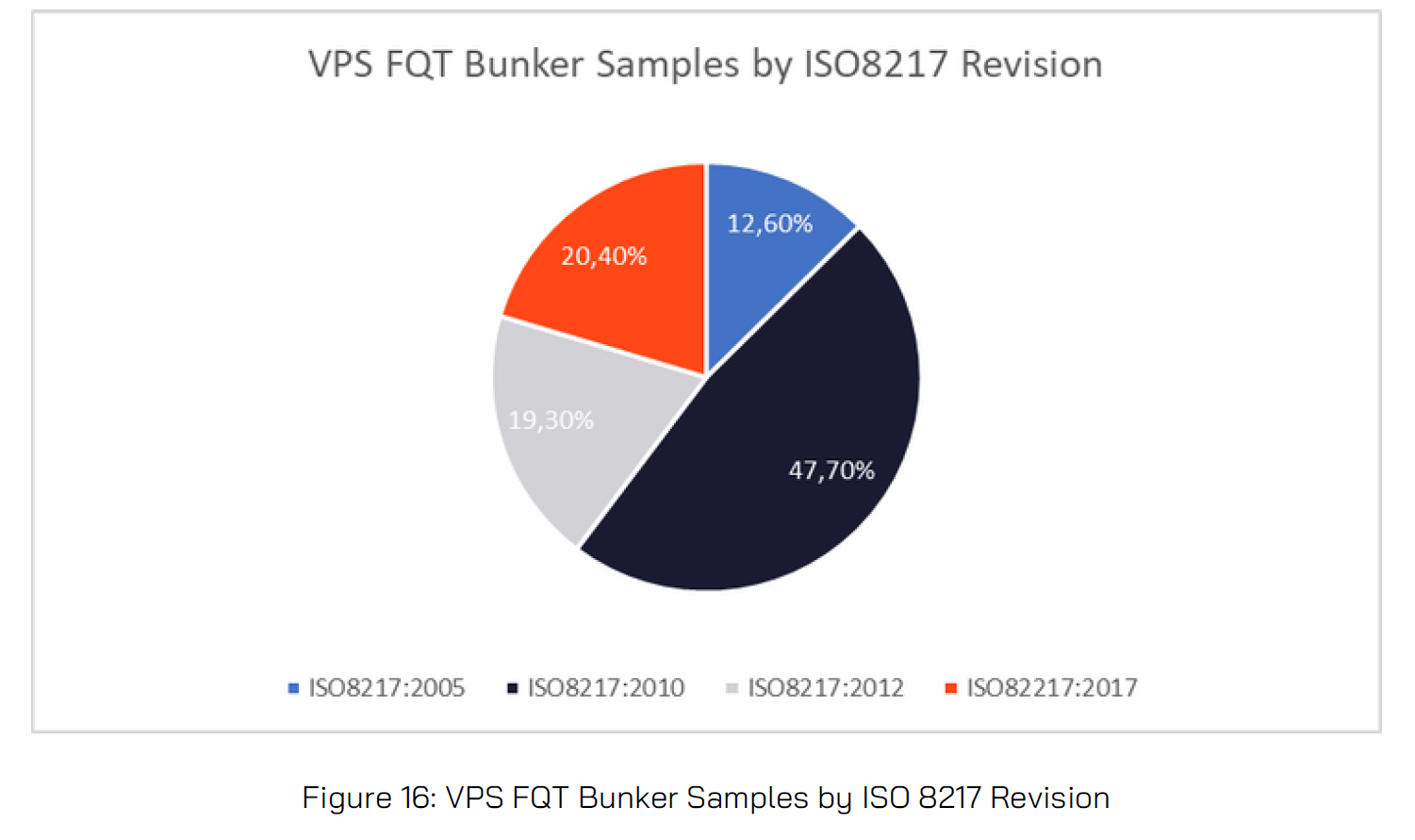

How soon will this revision be taken up by the industry? If past performance is any indication, where the industry has a slow conversion rate to the newer revisions, it may take some time. Today, many vessels are purchasing fuel against many of the older revisions. VPS still see over 12% of samples received for testing against the 2005 revision, whilst 67% of samples received are to be tested against 2010/12 revisions:

Methanol

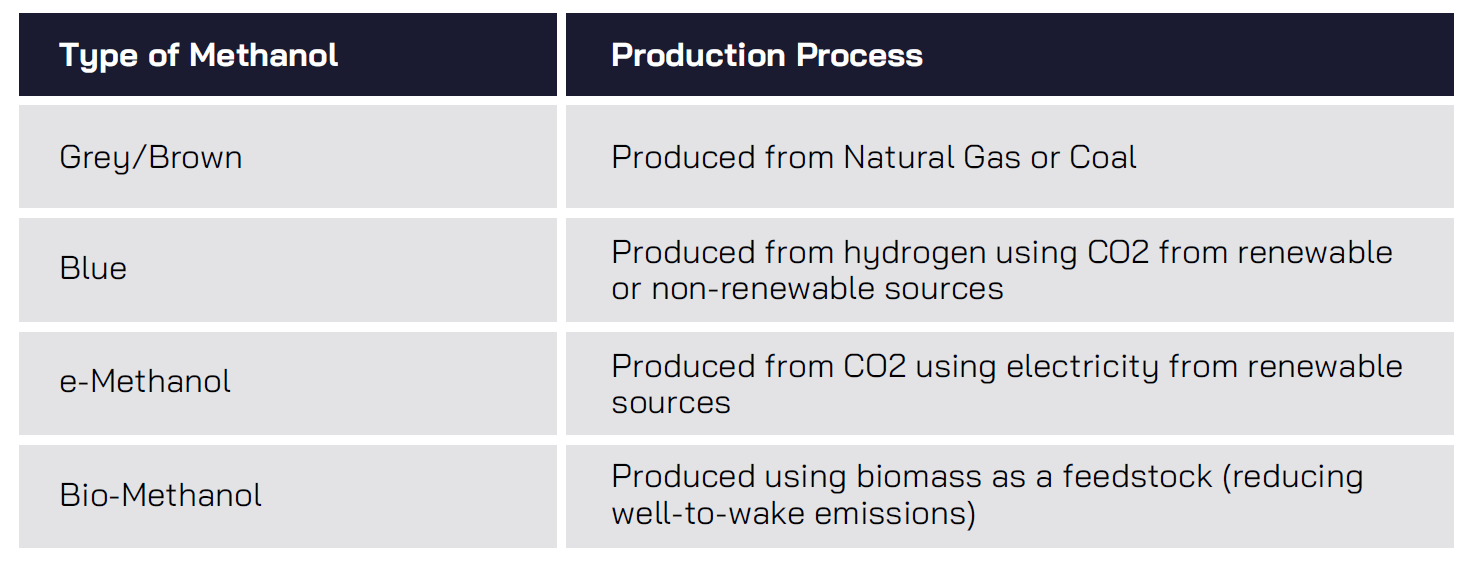

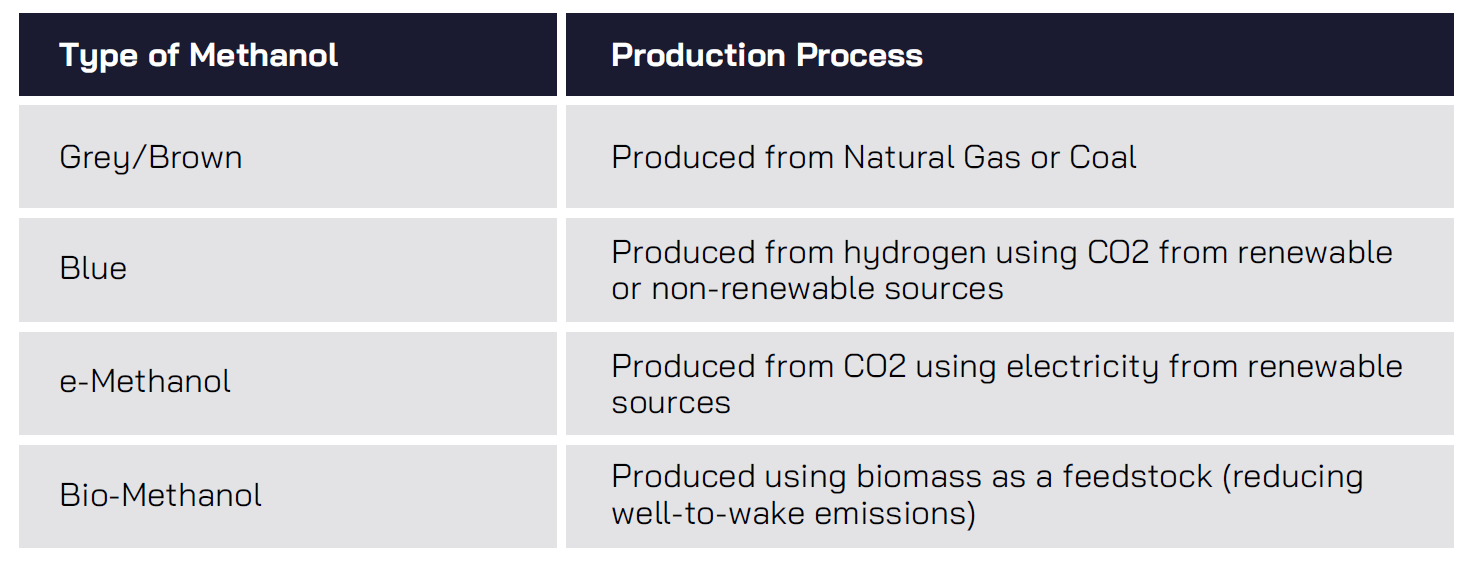

Methanol bunkers and bunkering facilities continue to grow with 13 ports now offering methanol. But this methanol is predominantly grey, and Tank-to-Wake emissions from grey methanol are similar to conventional fossil fuels. The maritime sector must look to use the sustainable “green” methanol options of e-methanol, bio-methanol, or blue methanol:

IRENA forecast e-methanol will reach a production level of 250M mt and bio-methanol will reach 135M mt by 2050.

Currently we see 39 methanol-powered ships on our sees, but more than 260 methanol-powered vessels are on order.

As with all fuels, there are numerous pro’s and con’s to using methanol as a marine fuel: Methanol fuel handling and management is certainly easier than that for LNG, with retrofit costs being less expensive and easier. Plus, green methanol sources offer almost near-zero GHG emissions.

In terms of ECA compliance Methanol conforms to SOx, NOx and PM content. It is biodegradable, miscible with water and a liquid at atmospheric pressure, all of which are positive factors in terms of fuel management and handling.

However, methanol has half the energy of maritime’s current fossil fuels and a Flash Point of only 12ºC. In addition, current availability of green methanol, is still an issue, but as demand grows, methanol should become more cost competitive, with increasing number of ports providing methanol.

In October 2024, it was announced at SIBCON-24, that Singapore will release a new technical reference standard for Methanol. This will cover fuel transfer, quality and quantity measurements as well operational and safety instructions as well as crew training. VPS has been closely involved in the development of this new Methanol Standard by being part of the Working Group.

The announcement from Singapore was followed by a further notification from the International Standards Organisation (ISO) in November 2024. The ISO announcement highlighted the release of the publication of the first edition of their international standard for methanol as marine fuel, ISO 6583:2024. This standard sets the requirements and limits for three methanol grades for marine: MMA, MMB and MMC. It uses the IMPCA specifications as a starting point, with some properties less critical for marine and other fuel related aspects not covered. Grade MMC allows for wider tolerances in certain characteristics compared to MMB, while MMA includes additional requirements for lubricity and cleanliness. The new Singapore Methanol Standard will make reference to the ISO 6583 for quality requirements under its custody transfer section.

Summary

With over 50 reported cases of major operational issues, covering main and auxiliary engine cases plus, fuel delivery system related problems, due to fuel stability, sludging, cat-fines, cold flow properties and chemical contamination, 2024 once again highlighted the importance of bunker fuel quality testing, as a proactive means to protect vessels, their crew and the environment. With additional tests, currently not included within ISO8217, providing further vital information in achieving heightened levels of protection.

Biofuels usage continued to increase in demand and importance, as ship owners and operators look to achieve improvements through CII, EEXI, as well as looking to counter the financial impact of the EU ETS scheme.

The revision of ISO8217 released on 30th May 2024, was a welcomed improvement on previous revisions, but still not a fully comprehensive solution in vessel, crew and environmental protection. Therefore, additional tests continue to hold an important role in fuel management.

Methanol demand and usage will also grow, with a rapidly growing order book for methanol-powered vessels. Yet, methanol also comes with a host of fuel management challenges, with testing playing a major role in ensuring quality and fit-for-purpose considerations.

So, 2025, suggests another year of widening marine fuel types and grades coming to market, coupled with their growing fuel management considerations.

Contact

For further support to your fuel management issues, please contact marketing@vpsveritas.com

Search

Search

Customer

Customer