How Fuel System Check Monitoring Will Reduce Risks, Save Time & Money

By Steve Bee – VPS Group Marketing & Strategic Projects Director

Statistically, data indicates that a vessel will suffer between one and two incidences of main engine damage over the course of its operational lifetime. The average damage costs have been estimated at around $650,000 per incident, with even more damaging incidents costing up to $1.2 million per claim. Therefore, it is important to identify the main causes of this damage and understand how it can be prevented.

Prevention of damage is, of course, preferable to cure. Fuel quality and handling issues remain a leading contributor to critical main engine failures. VPS frequently observe that such issues could have been prevented through the implementation of a robust and well-structured fuel management programme onboard vessels.

A common misconception is that a fuel meeting the international marine fuel quality standard, ISO 8217, means it is “fit for purpose”. But this is definitely not the case as even fuels that are “on specification”, at the point of delivery to the vessel, can cause major engine damage if not properly managed post-delivery. ISO 8217 specifies the requirements for petroleum fuels for use in marine diesel engines and boilers, prior to appropriate treatment before use, which means that fuels should then be treated onboard between delivery and being burnt.

Catalysts used in petroleum refining are made of Aluminium Silicates, which over time breakdown. The resulting, coarse, dense fragments composing of aluminium and silicon, eventually reside in the residual portion of the refining stream. Known as “Cat-Fines”, these particles are highly abrasive and can cause severe damage to vessel engine parts.

Major marine engine manufacturers recommend a fuel should contain less than 10-15 mg/kg Aluminium plus Silicon (Al+Si) at the engine inlet. However, assuming a delivered fuel meets the stringent ISO8217:2024 limits of 40-60 mg/kg Al+Si, dependent upon the fuel grade, the fuel treatment plant would have to operate at an efficiency level capable of removing 75%-83% of these highly abrasive particles in order to meet the engine manufacturers’ requirements.

Furthermore, the International Council on Combustion Engines' (CIMAC’s) recommendation regarding fuel quality states “Fuel analysis is the only way to monitor the quality of fuel as delivered at the time and place of custody transfer, before and after the fuel cleaning onboard and at the engine inlet. Regular monitoring of the fuel cleaning plant will provide information, which will help to make decisions about the maintenance cycles of the equipment as well as potential engine problems resulting from malfunctioning or inadequate operation.”

Yet one of the most important, but often overlooked processes, is that of regular Fuel System Checks (FSCs) in order to assess the level of aluminium and silicon catalytic fines within fuel. The presence of “cat-fines” within fuel can be extremely damaging, causing rapid engine-part wear. Monitoring cat-fine levels before they can enter vessel engines, can prevent such damage. Therefore, sending samples for analysis which are taken Before & After purification processes, on a quarterly basis is the most effective way to monitor cat-fine levels. FSCs will also help comply to the engine manufacturers general recommendation of a maximum of 10-15 mg/Kg level of cat-fines in the fuel, entering the engines and assess purifier efficiency.

There are numerous reasons why regular fuel system checks are critical:

- Help identify potential risks & operational issues before major damage occurs.

- Confirm that the system’s flow rate, temperatures, discharge cycles are properly adjusted to handle the specific fuel that is being treated

- Verify that the fuel treatment system is properly maintained

- Reduce operating cost and increase lifecycles of critical components

- Identify presence of unusual components that can enter fuel post- delivery.

Periodic sampling from the fuel treatment system will also identify problems such as water ingress from ballast systems, leaking heating coils and cargo contamination. The last thing anyone wants to see is a purifier working as a pump!

A prime example and case study is highlighted below:

An LPG Tanker bunkered HSFO in Fujairah where its fuel met ISO 8217 specifications. However, after using the bunkered fuel, the Chief Engineer reported the main engine expansion tank low level alarm, with the main engine exhaust gas temperature high on cylinder unit 2 & 4. The vessel commenced a gradual slowdown of the main engine. The Chief Engineer reported the vessel was unable to run the engine due to suspected leaks on the main engine cylinders. The vessel drifted for about 10 hours before dropping anchor off the coast of India.

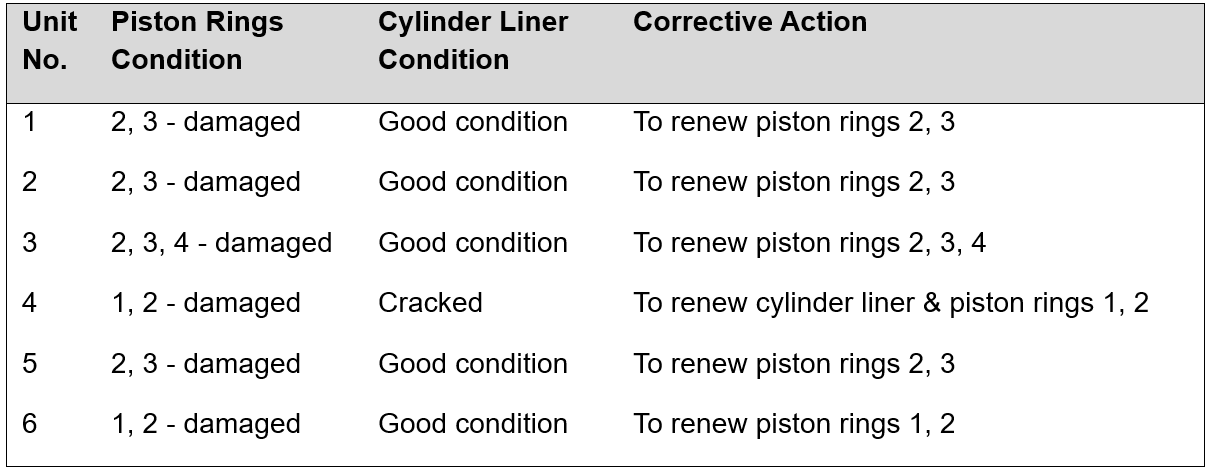

Upon dismantling the engine, the following findings were made:

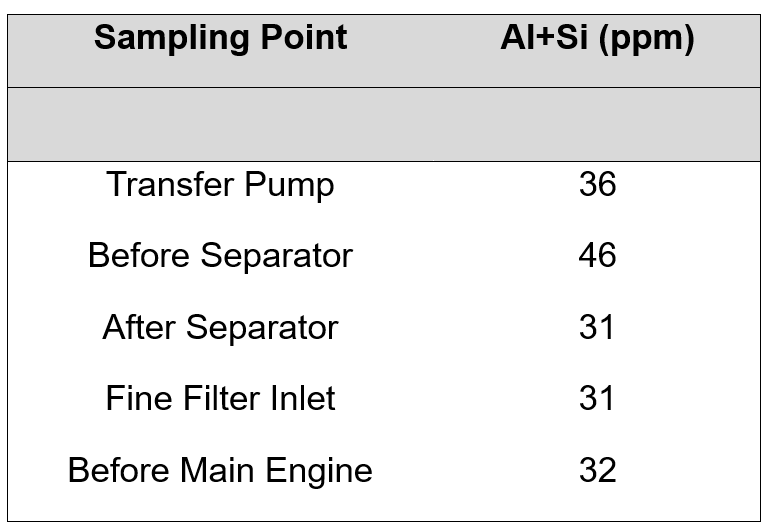

The VPS Technical Advisor recommended the vessel submit fuel system samples and upon checking, the results from the system, these indicated that the purifier was in fact only working like a pump.

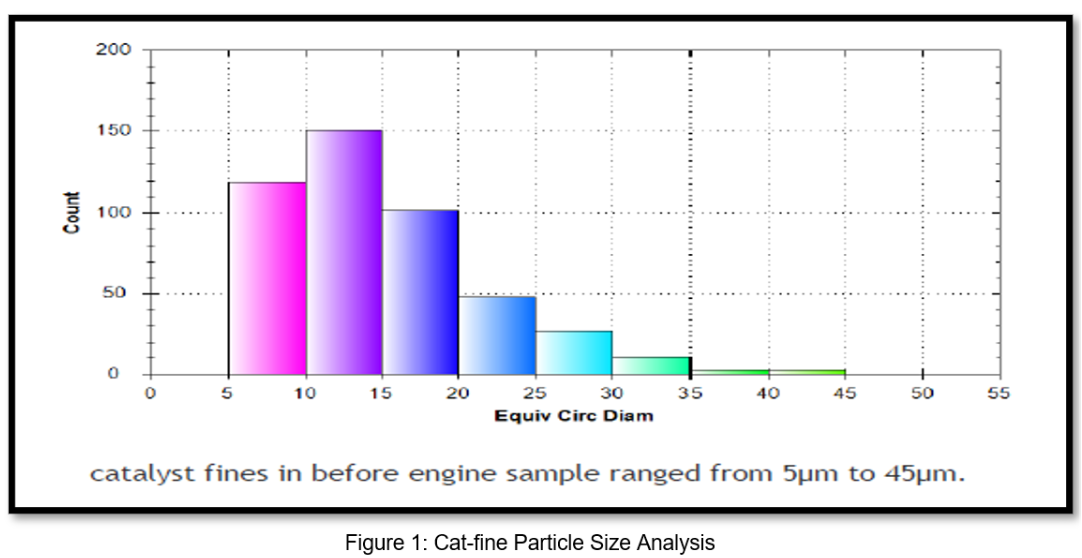

The screening size of Al+Si on the before engine sample further confirmed why the vessel was having problems, as the physical size of Al+Si particles ranged: 5-45 µm.

The ideal particle size range of cat-fines that can be effectively removed by a marine vessel's purifier system typically falls between 5 to 15 µm. Purifiers are designed to target these smaller particles, as they are the most common size found in heavy fuel oil and can cause significant wear and damage to engine components

If the particle size of catalytic fines is greater than 15 µm, it can pose significant risks to marine engines. Larger particles are more abrasive and can cause severe wear and damage to critical engine components such as cylinder liners, piston rings, and fuel injectors.

Potential Issues:

- Increased Wear: Larger cat-fines can embed themselves in softer metal surfaces, leading to accelerated wear and tear

- Engine Efficiency: The presence of larger cat-fines can reduce engine efficiency and increase fuel consumption.

- Maintenance Costs: More frequent and costly maintenance may be required to address the damage caused by these particles.

Mitigation Strategies:

- Enhanced Filtration: Using advanced filtration systems to capture larger particles before they enter the engine

- Regular Monitoring: Continuously monitoring fuel quality and performing regular maintenance to detect and address cat-fines early.

- Fuel Treatment: Employing fuel treatment systems to reduce the concentration of cat-fines in the fuel.

This VPS fact finding was highly appreciated by the vessel Chief Engineer and the ship owner, following their realisation of what was the cause of the problem. They subsequently put in place routine sampling of fuel system check (FSC) samples to prevent the same incident from reoccurring.

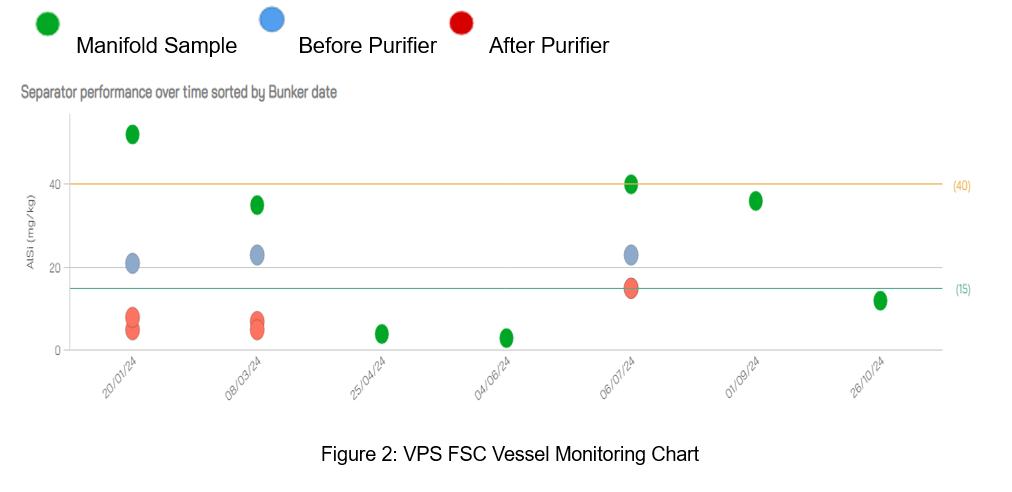

As part of the VPS FSC service, each vessel has a monitoring chart checking the cat-fine level upon receipt of the fuel, then the before-purifier level and the after-purifier level. Should any submitted FQT (Manifold) sample show >40mg/Kg Cat-fines, then the vessel will be advised to send an additional sample for Fuel System Check. The before-purifier sample should always have a lower cat-fine level than the manifold sample. Then the after-purifier should always be below 15mg/kg cat-fines, if the purifier is working efficiently.

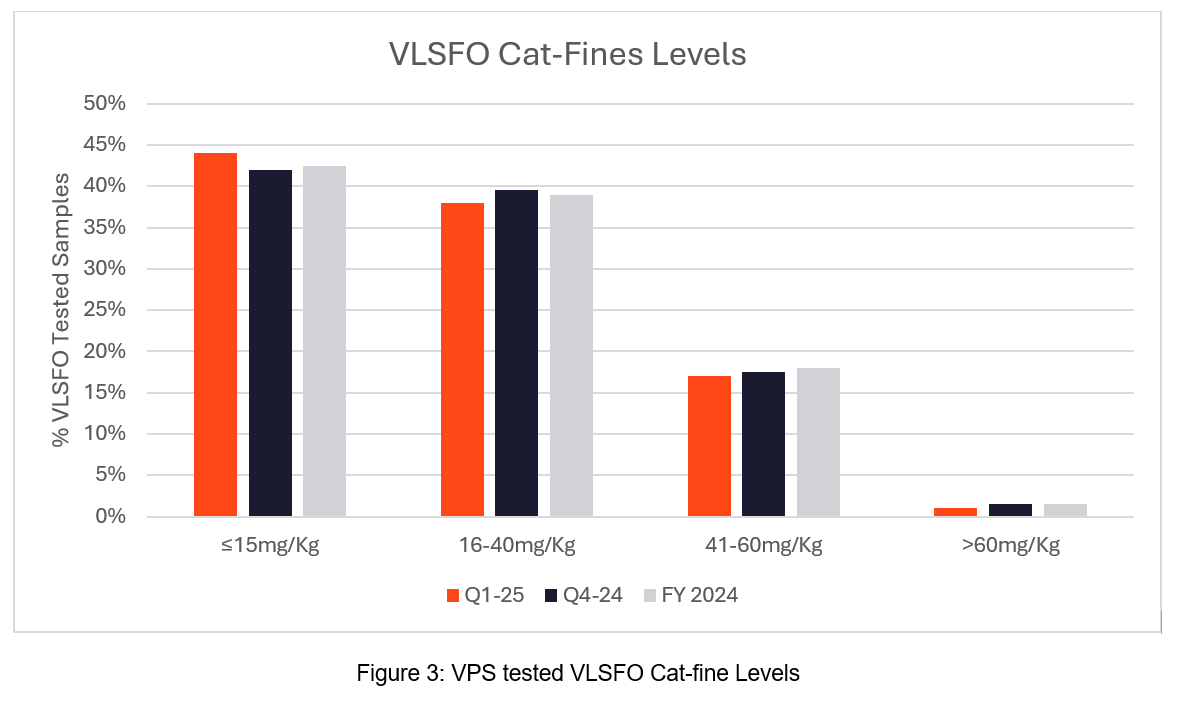

Currently 52% of all samples received by VPS for testing are VLSFOs, with a further 32% being HSFOs. As the two leading fuel grades used in global shipping, they are the two which will and often contain varying levels of cat-fines.

For VLSFOs across Q1-2025, 17% of all samples tested had cat-fine levels between 41-60 mg/Kg, which was slightly lower level than Q4-2024 and full year 2024, at 18%. These levels are high enough to cause concern and would trigger the request for additional FSC samples to be sent for analysis.

Across 2024 and Q1-25, less than 2% of samples tested exceed the ISO8217 specification limit of 60 mg/Kg.

So, around 19% of VLSFOs delivered in Q1-2025 had cat-fine levels >40mg/Kg. Should the recipient vessels not have effective, efficient, purification of their fuel, then they run the risk that 1 in 5 fuel deliveries could cause engine damage.

For HSFOs across Q1-2025, 12.5% of all samples tested had cat-fine levels between 41-60 mg/Kg, which was lower level than Q4-2024 and full year 2024, at 19% and 20% respectively. These levels are also high enough to cause concern and would trigger the request for additional FSC samples to be sent for analysis.

Again, like VLSFOs, HSFOs across 2024 and Q1-25, showed less than 2% of samples tested exceed the ISO8217 specification limit of 60 mg/Kg.

So, around 13% of HSFOs delivered in Q1-2025 had cat-fine levels >40mg/Kg. Should the recipient vessels not have effective, efficient, purification of their fuel, then they run the risk that 1 in 7 fuel deliveries could cause engine damage.

In summary, Cat-fines found in the residual component of VLSFO and HSFO fuels, are highly corrosive materials, which can cause considerable and costly damages to vessels. Regular monitoring of onboard purifier performance efficiency, as part of a routine preventive maintenance programme, should be a key tool in mitigating such risks.

It is therefore, recommended that a vessel submits “before and after purifier” samples, for each onboard purifier, four times per year. This way the efficiency of the purifiers can be checked and advice provided to ensure optimum efficiency is being achieved and the engine is being protected to the highest level possible.

For further information on how Fuel System Checks (FSCs) can help you protect your vessels from costly breakdowns, damages and repairs, please contact marketing@vpsveritas.com

Search

Search

Customer

Customer