Rising fuel quality issues linked to rising fuel costs!

Rotterdam | Over the past few years, the world appears to have moved from one crisis to the next. Most recently, the COVID pandemic causing huge global disruption and restrictions to people and businesses, followed by the recent Russia-Ukrainian conflict and concerns over the innocent loss of lives and the greater worry of potential escalating conflict.

For global shipping, both of these events have given rise to many additional challenges to which ship owners and operators have either had to overcome or continue to tackle.

One key concern for the industry is the escalating cost of fuel due, in the main, to the Russian-Ukrainian war, an issue which is also impacting upon every walk of life. For shipping, the cost of fuel has always been the major cost in relation to every single voyage and the demand for good quality fuel, at competitive prices, remains paramount, especially in these times of significantly increased costs.

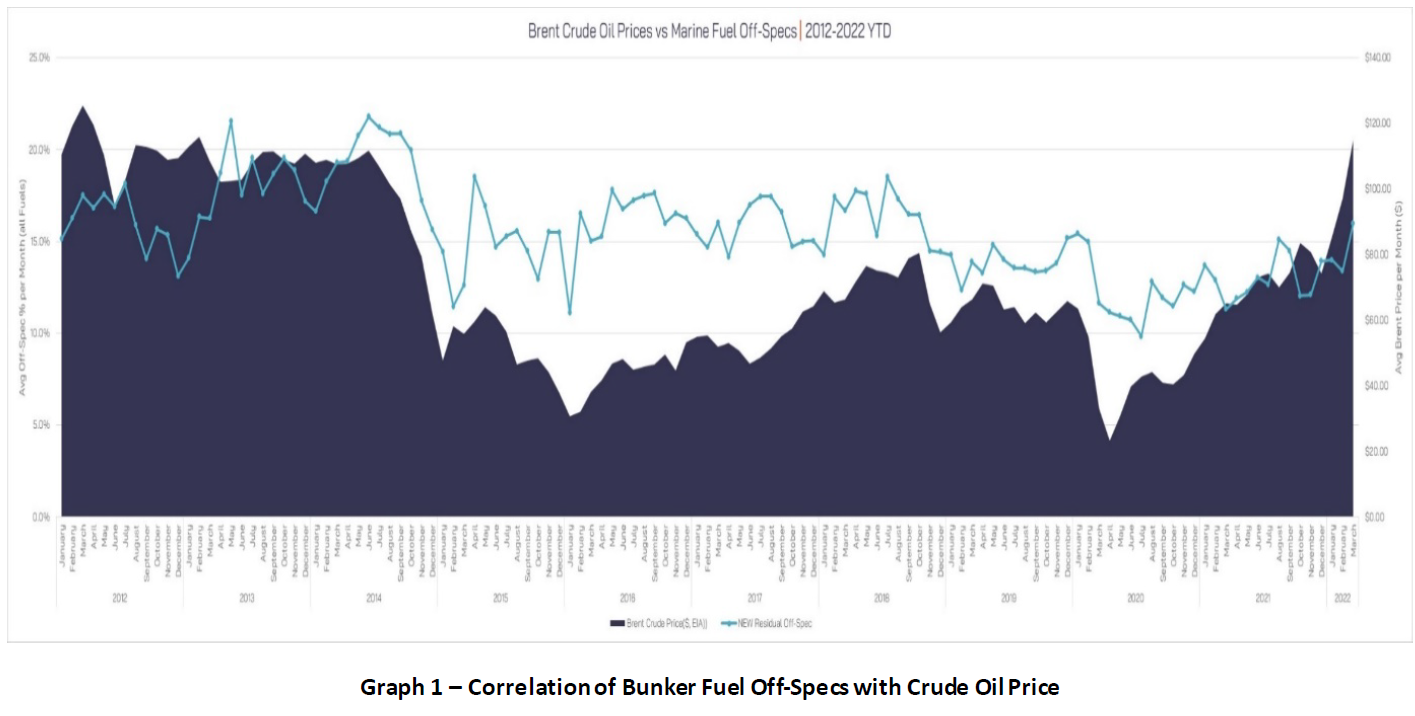

However, in a recent in-depth study carried out by VPS during Q1-2022, a strong correlation between crude oil price and bunker fuel off-specs was identified. Based on data covering the past 10 years and using a huge dataset of our 1.2 million fuel samples tested during this period, a correlation can be shown, which is graphically illustrated in Graph 1:

The relationship between the price of crude oil and bunker fuel quality (measured by the number of off-spec samples) was measured using the Pearson Correlation Coefficient giving a value of 0.701, indicating a strong correlation. This correlation shows that an increase in crude oil price will result in reduced bunker fuel quality and an increase in marine fuel off-specs.

In recent weeks, VPS has seen an increase in the number of Bunker Alerts (BAs) issued corresponding with crude oil price, with a 60% increase this year versus the corresponding period in 2021. It should be noted that VPS only issues a BA when we have an off-spec parameter for 3 vessels within one week for the same port and parameter. The BAs that we have issued in 2022 have been across a range of 8 different ports for 9 different parameters and for the different bunker fuel types of VLSFO, HSFO and MGO. This suggests a general reduction in fuel quality across geographies caused by different factors and fuel types.

A good example of the type of off-spec parameter that we have identified resulted in a major marine fuel quality issue identified in Singapore. This quality issue was in relation to chemical contamination of HSFO fuel delivered to over 200 vessels, which caused major operational problems to approximately 80 vessels. VPS led the way in identifying and quantifying the specific contaminants as several chlorinated hydrocarbons and assisted its customers in overcoming the subsequent issues of receiving and in many cases burning this affected fuel. The fuel had been supplied by two suppliers, with one actually providing the other with this contaminated product. It is alleged the first supplier blended a contaminated cutter stock to HSFO fuel, prior to it being sold.

VPS can only stress that the asset protection provided by proactive fuel management and testing has never been so important in protecting vessels from damage. Therefore, ISO8217 testing, plus chemical screening by GCMS-Headspace analysis, additional cold-flow properties testing, such as wax appearance temperature (WAT) testing and routine fuel system checks (FSC), can provide even greater added-value to ship owners and operators, at a time of great uncertainty and increased risk, with respect marine fuel purchase and usage.

For further information on how VPS can advise and support you in protecting your vessels, crew and the environment please contact: info@vpsveritas.com

VPS completes the first methanol Bunker QuantitySurvey

World Leading Maritime Decarbonisation Advisory Services company VPS, is the first company to complete a methanol bunker quantity survey (BQS) operation in Singapore, on 27th July 2023.

The global shipping fleet is working towards meeting challenging decarbonisation targets set by the International Maritime Organisation (IMO) for 2030 and 2050, along with additional regional legislative requirements. As part of this drive, many low-carbon and zero carbon fuel options are being considered to assist in the reduction of emissions from vessels, including methanol.

VPS was appointed by Maersk and Hong Lam Marine Pte Ltd, to undertake the very first bunker quantity survey (BQS) of a methanol fuel delivery, supplied by Hong Lam to the Maersk vessel, which is yet to be officially named, on its maiden voyage to Europe. The operation was overseen by the Maritime Port Authority (MPA), ensuring all parties met the stringent safety requirements, following their MPA associated vetting.

Nick Clague, VPS Head of Sustainable Fuels, stated, “This bunkering of methanol represents a significant milestone in the steps being taken by the shipping industry to reduce emissions and ultimately decarbonise.”

Prior to this first methanol delivery, various levels of pre-delivery work were required including, the delivery barge tank-cleaning operation and a partial loading of methanol to the barge, to ensure no crosscontamination could take place, during the actual delivery.

VPS, as part of the BQS operation, also undertook the required closed-sampling procedure to harvest representative samples of the methanol delivered to the vessel, which have now been transferred to a VPS Laboratory for quality testing.

Over the past 12 months, as the world’s leading marine fuel testing company, VPS has invested heavily in new laboratory equipment and R&D to provide a comprehensive methanol testing service in relation to methanol as a marine fuel.

Captain Rahul Choudhuri, VPS MD AMEA, said, “For VPS to have been involved in such a high-profile and historic event here in Singapore, has been a privilege. Maersk and Hong Lam have taken a major step forward in shipping’s drive towards decarbonisation, along with the support of the MPA, and we are proud to have played our part today and in the future.”

Additionally in his role as Chair of the Technical Committee (TC) for Bunkering (Ambient Liquid Fuels) under the Singapore Standards Council (SSC) & SDO@SCIC (Standards Development Organization), Captain Choudhuri added, “Such a demonstration of successful methanol bunkering operations will facilitate the future development of the Technical Reference (TR) for methanol bunkering in Singapore and lay the basis of considerable competitive advantage for Singapore as a go-to multi-fuel port of the future”.

The Maersk vessel will now sail to Port Said, Egypt, where once again VPS will undertake the BQS, sampling and testing of a second delivery of methanol.

The final leg of the voyage, will see the vessel arrive in Rotterdam towards the end of August, with VPS completing their nominated work for BQS, sampling and testing at that time.

Contact

For further information regarding VPS Services relating to methanol as a bunker fuel, please contact Steve Bee, VPS Group Commercial Director, steve.bee@vpsveritas.com

VPS update on recent Houston fuel contamination

Monday 7th August 2023: VPS, a leading global marine decarbonisation advisory services company, deliver an update to it’s 10th July 2023 Press Release which announced that, via it’s fuel testing services, it had identified a marine fuel contamination issue in Houston.

At that time, VPS informed its customers and the wider market, of the presence of Dicyclopentadiene (DCPD) isomers at significantly high levels within VLSFO bunker fuel deliveries in Houston. The contaminants were detected using in-house GC-MS (Gas Chromatography – Mass Spectrometer) analytical methodologies.

Initially, VPS highlighted eleven vessels had suffered operational issues, such as loss of power and propulsion whilst at sea. These effects resulted from fuel leakage in the ICU (Injection Control Unit) units and fuel pumps not being able to develop the required fuel pressure, affecting only the Auxilary engines and not Main engines. The contaminated VLSFO had been delivered in Houston, by one single fuel supplier.

Four weeks later, VPS can now provide a further update on the spread of this fuel contamination issue: Fourteen vessels in total, have now received this contaminated fuel and suffered some form of damage to their auxiliary engines and fuel delivery systems. Twelve of the vessels received their fuel in Houston, whilst a further two vessels received their fuel in Singapore, with the fuel delivered by four suppliers.

The specific contaminants are:

- Di-hydro dicyclopentadiene - Chemical CAS Number: 4488-57-7

- Tetra-hydro dicyclopentadiene - Chemical CAS Number: 6004-38-2

DCPD’s are unsaturated chemical compounds which can polymerise and oxidise under certain conditions. However, the rate of this polymerisation process can be reduced by the presence of inhibitors that are typically found within fuel oil.

Should these compounds start polymerising, the fuel begins to exhibit a level of stickiness and become more viscous, making it difficult for moving components, such as fuel pump plungers and the fuel injector spindles to move freely. These effects cause damage to the fuel injection system. Over a period of time excessive sludge formation is likely to be experienced.

The DCPD compounds that were detected in this fuel ranged from 3,000 to 7,000 ppm (0.3-0.7%) per delivery.

VPS employed it’s own proprietary GCMS Vacuum distillation methodology to detect DCPD, in preference to the ASTM D7845, Standard Test Method for Determination of Chemical Species in Marine Fuel Oil by GCMS. The VPS methodology is capable of detecting and measuring the DCPD and its isomers, whereas the ASTM D7845 methodology is limited to detecting only 29 chemical contaminants, which does not include DCPD species.

In addition to the fourteen vessels suffering damages from burning this fuel, a further 18 vessels who received the contaminated fuel from thirteen additional suppliers, either witnessed no adverse reactions, or simply did not provide any feedback regarding any damages.

In total, the volume of contaminated fuel delivered to the 32 vessels, was 61,494 metric tonnes.

Three vessels de-bunkered the contaminated fuel prior to burning, following a “Caution” result from the VPS Chemical Screening service, highlighting the value of this pre-burn service.

A further three vessels de-bunkered the fuel after suffering initial engine damage from burning the fuel. Whilst another two vessels burnt the fuel in their main engines without issue after switching it from their auxiliary engines, where it had caused operational damage.

Figures Showing sludge formation in filters (left) and ceased fuel pump plunger (right).

Contact

For further information regarding VPS chemical contamination detection services contact, Steve Bee, Group Commercial & Business Development Director: steve.bee@vpsveritas.com

Why do VLSFO's still require quality considerations?

Article by Steve Bee - Group Commercial Director

As the world of shipping quite rightly focuses on reducing its carbon footprint and endeavours to comply with a host of decarbonisation legislation, it may be easy to forget that traditional fossil fuels are still the main energy source for the majority of the global fleet. As such, the fuel management of fossil fuels and their quality, continues to be an important factor in protecting vessels, their crew and the environment.

As the most widely used fossil fuel, Very Low Sulphur Fuels (VLSFOs) require more focus than others, in terms of their fuel management. VLSFOs currently account for 55% of all marine fuel samples received by VPS for fuel quality testing. There are still no official standard specifications within ISO8217 for VLSFOs. As such, most VLSFOs are tested against the RMG380 specifications, knowing that the viscosities of VLSFOs in particular, are very much lower than 380cSt. Currently, 68% of all VLSFOs tested have a viscosity between 20cSt-180cSt. This can have a significant impact on the transfer and injection temperatures onboard a vessel, requiring much less heating of the fuel to achieve the optimum injection viscosity. It would be beneficial to see the introduction of a minimum viscosity specification limit for VLSFOs, as well as a current maximum viscosity limit within ISO8217?

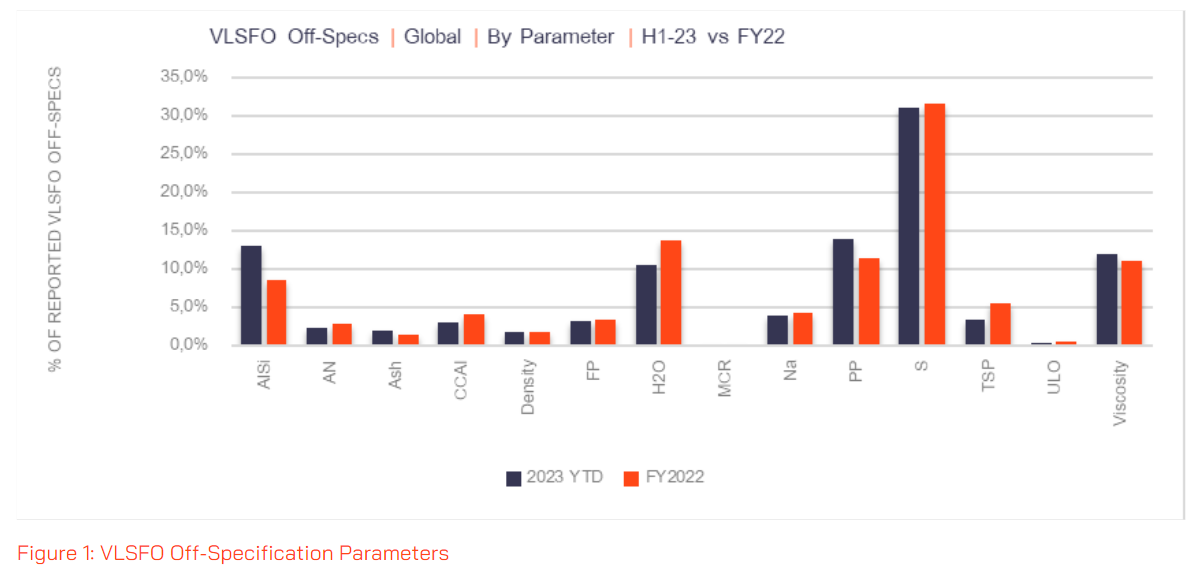

Currently 3.8% of all VLSFOs tested have at least one off-specification parameter. This compares favourably with the off-specification rates for HSFO fuels at 11.4% and MGO fuels at 16.9%. However, the VLSFO off-specifications are potentially more concerning than some of those associated with HSFO and MGO. Sulphur, water, cold-flow properties and cat-fines are the most frequent of VLSFO off-specification parameters.

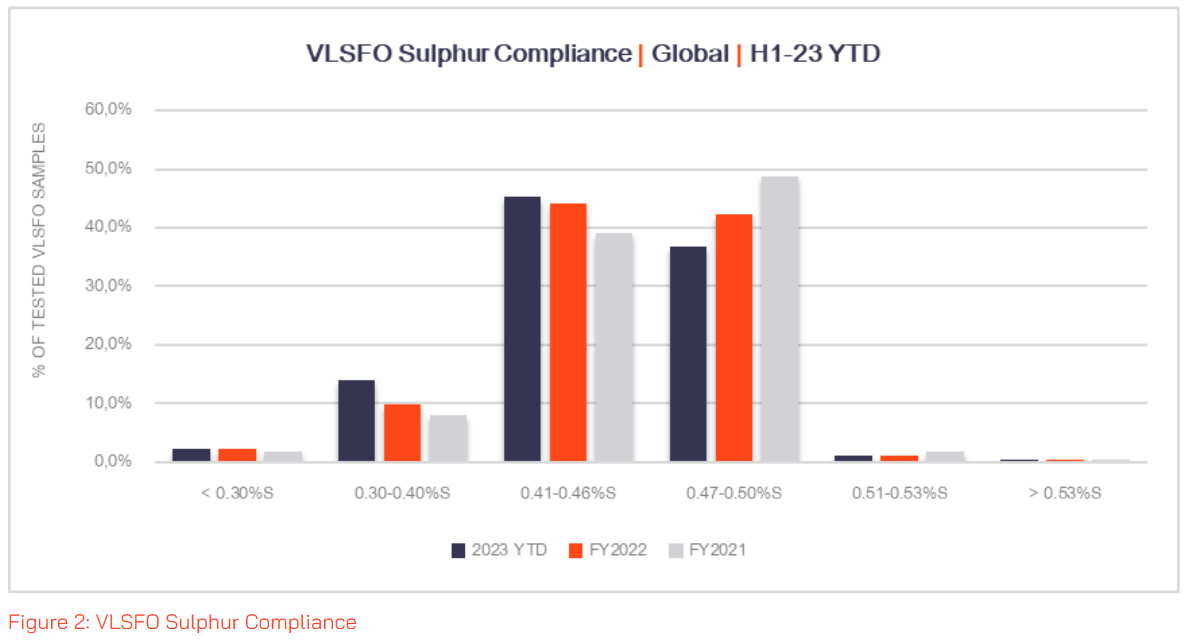

Sulphur off-specification is the most common of all VLSFO off-specifications, with over 30% of all off-specifications being attributed to this one parameter. However, recent test results have shown that sulphur off-specification is certainly better today than it was back in 2021, with only 1.6% of VLSFOs tested being >0.50% Sulphur compared to 2.4% >0.50% in 2021.

Also, it would appear that so far this year, suppliers are producing more fuel in the 0.41%-0.46% Sulphur range, than the 0.47%-0.50% range, than over the past two years, which means that there is less chance of the VLSFOs falling outside of the 95%-confidence interval, or being off specification.

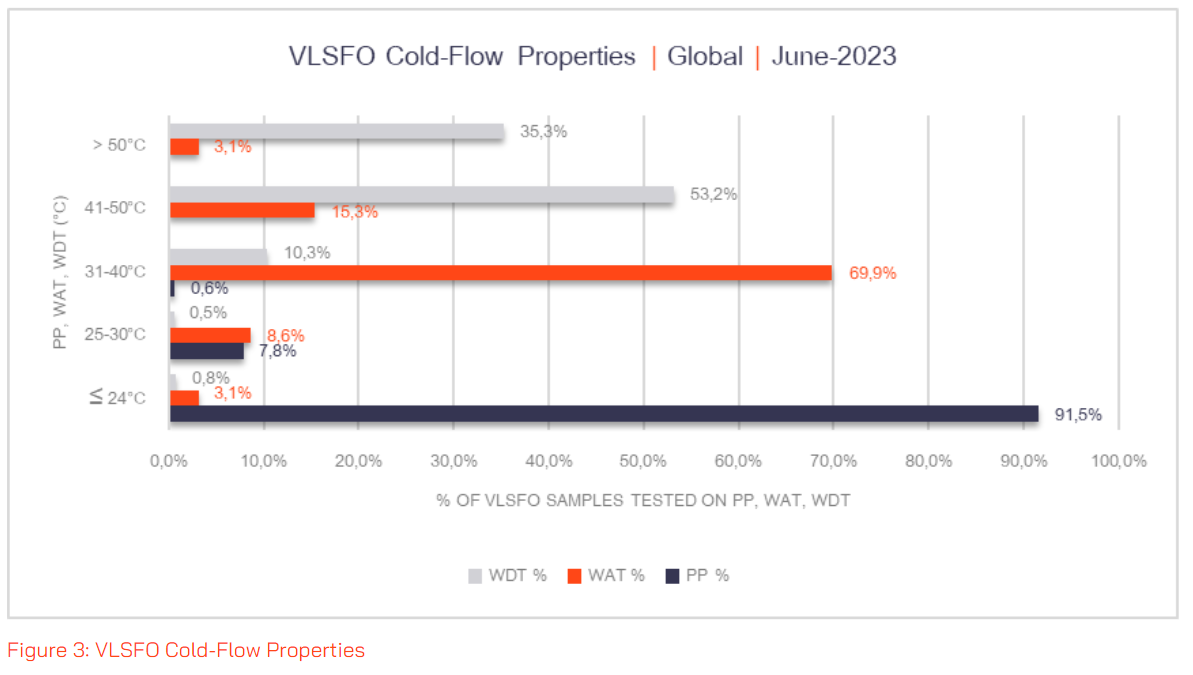

Due to the higher level of paraffinic content of VLSFOs over HSFO fuels, it is more likely to see wax precipitation occur with VLSFOs, when subjected to colder temperatures.

The formation of wax crystals during storage and consumption is a potential major source of operational problems with VLSFOs. Therefore, it is vitally important to test for wax appearance (WAT) and wax disappearance temperatures (WDT), as the pour point of the fuel is not a reliable indicator of potential cold-flow issues.

During 2019, VPS developed a proprietary test to be able to measure both WAT and WDT in VLSFOs, which many of our customers have become reliant upon to safeguard their vessels from wax precipitation and it’s potentially damaging consequences.

Current global averages show VLSFO Pour Point is 16°C, whilst the average WAT is 38°C, and the average WDT is 48°C. These figures illustrate why using +10°C above the pour point as an indicator of the cold-flow properties of VLSFO blends is simply insufficient, as well as inappropriate as a risk mitigation measure.

When WAT and WDT results are high, vessels need to consider raising the temperatures of their onboard separators, as well as the temperatures within storage, settling and service tanks. However, VLSFOs with a short shelf life and high WAT may not be suitable for storing, as heating such fuel accelerates the ageing process and increases the likelihood of fuel sludging.

VLSFOs with low viscosity but high WAT & WDT, need to be heated to ensure a stable flow and to prevent wax formation. Such fuels will likely need to be cooled before entering the main engine, due to their low viscosity. This could present operational issues such as wax formation when the fuel temperature drops below the WAT.

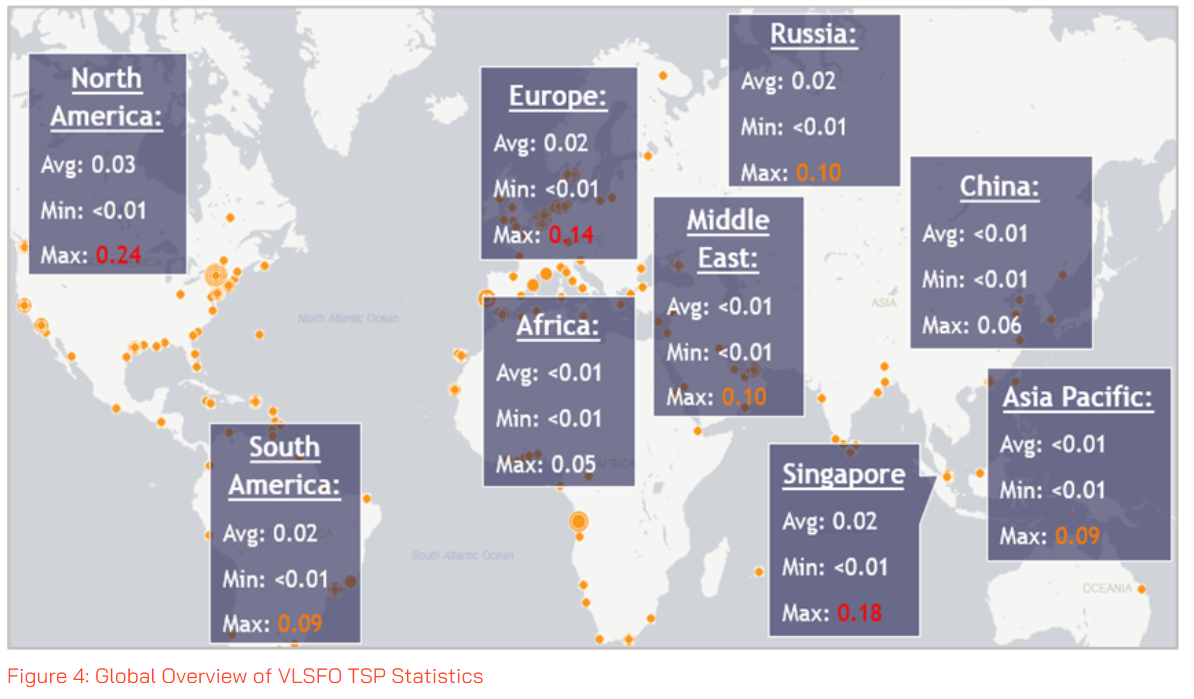

Stability issues relating to VLSFOs have been a concern since their introduction in 2019. To this day we still witness spikes in Total Sediment Potential (TSP) across the world.

Some VLSFO blends appear stable on bunkering but become unstable over time (within a week or two). Heating the fuel in the tanks (to maintain suitable storage and transfer) and purifiers (to achieve efficient purification) deteriorates the fuel’s stability and fastens the ageing process.

VLSFOs that are incompatible can cause separator sludging and clogging of filters. As such, numerous vessels have witnessed incompatibility issues when the vessels change from MGO to VLSFO or (vice versa).

VLSFOs with high WAT/WDT and high cat-fines create a need to operate separators at higher temperatures, at shorter discharge intervals. When this is practice is undertaken, wax starts to form, affecting purifier operation as well as clogging the fuel system’s filters.

Finally, regarding stability, VLSFOs with high WAT/WDT, that also have chemical contamination, followed by low viscosity, will unlikely to be handled on-board of vessels. In such cases, the only solution is to de-bunker the fuel.

Between Feb-July 2023, VPS detected contamination in VLSFO fuels in Houston. This contamination saw the presence of two specific isomers of Dicyclopentadiene (DCPD) at concentrations between 1,000ppm-40,000ppm. The specific isomers were:

•Di-hydro dicyclopentadiene Chemical CAS Number: 4488-57-7

•Tetra-hydro dicyclopentadiene Chemical CAS Number: 6004-38-2

DCPD’s are unsaturated chemical compounds which can polymerise and oxidise under certain conditions. When DCPD polymerises, the fuel begins to exhibit a level of stickiness and becomes more viscous, making it difficult for moving components, eg fuel pump plungers & fuel injector spindles to move freely. These effects cause damage to the fuel injection system. Over a period of time excessive sludge formation is likely to be experienced.

This specific case saw 12 vessels which bunkered the fuel in Houston suffer major operational issues and damages to auxiliary engines & fuel delivery systems, from fuel supplied by 4 suppliers. The type of problems witnessed were fuel leakage in the ICU (Injection Control Unit) units and fuel pumps not being able to develop the required fuel pressure.

In order to mitigate the risks associated with chemical contamination of VLSFOs, VPS recommend their GCMS-HS Chemical Screening service with each VLSFO bunkering. This service is a pre-burn, rapid, low-cost test, which can identify the presence of volatile chemicals within VLSFOs such as styrene, DCPD and chlorinated hydrocarbons, to name but a few and provide an elevated level of protection to the vessel.

To summarise, VLSFOs as the most widely used marine fuel powering today’s global fleet, can potentially create numerous operational and compliance issues, due to their varying quality. In order to mitigate the potential risks caused by, poor cold-flow parameters, fuel stability, chemical contamination, low viscosity and sulphur non-compliance, effective fuel management and testing can certainly help reduce and even eliminate such risks.

Contact

To find out more about VPS fuel testing and advisory services, please feel free to get in touch with Steve Bee - Group Commercial Director at: steve.bee@vpsveritas.com

VLSFO Fuel Management

Article by Wolf Rehder, VPS Area Manager Germany

Why correct VLSFO temperature management is required to protect your assets

With the introduction of the IMO sulphur cap as of 1 January 2020, correct fuel management increased in importance. One of the challenges faced on-board is finding the optimal fuel temperature throughout the fuel system.

We have seen that Very Low Sulphur Fuel Oil (VLSFO) can quickly destabilise once on-board the ship, with some of these fuels having a shelf life of less than three months. This process of destabilisation accelerates when the fuel is heated. As a result, excessive sludging can be experienced, leading to issues such as clogging filters and separators.

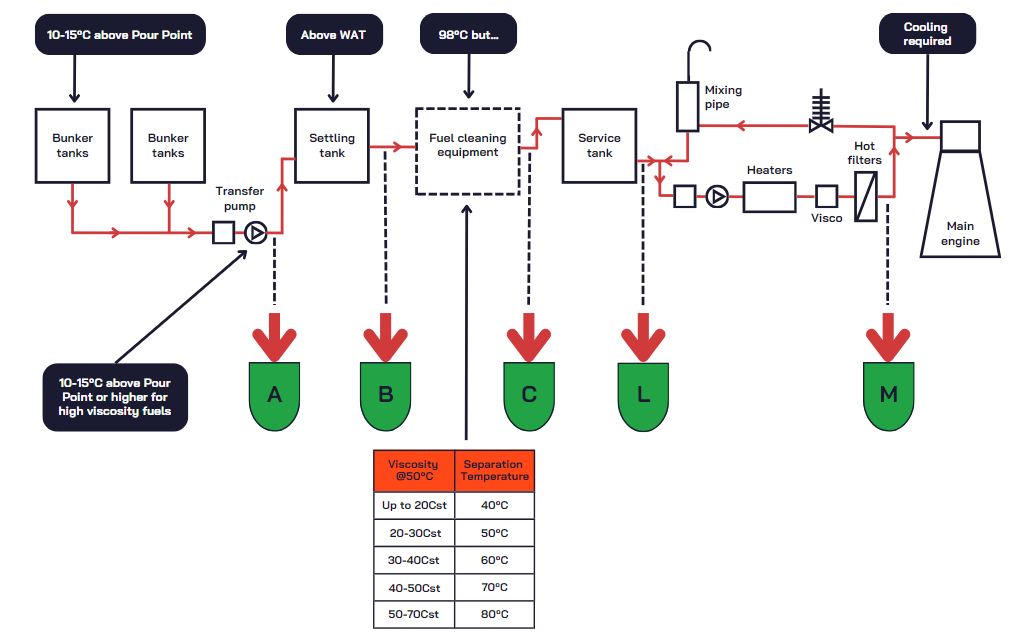

VLSFOs are by nature, more paraffinic than “conventional” High Sulphur Fuel Oils. Should the fuel not be kept at a sufficient temperature, then wax formation maybe the resulting outcome, affecting separators operation, as well as clogging fuel systems including filters. The historical advice of storing fuels at 10°C above the pour point can sometimes be misleading with regard to VLSFOs, as wax formation may start at temperatures higher than the pour point. VPS global statistics on Very Low Sulphur Fuel Oil indicates that Wax Appearance Temperature (WAT) is about 20°C above Pour Point.

Maintaining settling tank temperatures below the WAT can lead to wax precipitation in the tanks which could then block the suction line and could also reduce the heating efficiency if the wax covers the heating coils. Therefore, knowing the exact WAT is essential to ensure correct fuel management.

WAT test method that was introduced by VPS in 2019, has helped numerous ship owners and operators to overcome this problem.

Keep fuel temperature as low as possible - but as high as necessary

Fuel temperature must be managed on a case-by-case basis and is a fine balance between the viscosity and WAT. Heating the fuel in the storage tanks for an extended period is not recommended as it would significantly deteriorate the condition of the fuel and fasten the ageing process.

However, heating the fuel to achieve the appropriate purification temperature and injection viscosity cannot be avoided, since this is for a relatively short period assuming the fuel leaving the purifier is immediately consumed, the damage is limited.

In the past a separation temperature of 98°C was carved in stone. With the onset of VLSFOs since 2020, we have seen a significant reduction in viscosity which means lower separating temperatures at the purifiers.

As shown in the above figure 1, we can see the separator manufacturers generally recommend the storage and separation temperatures based on the viscosity of the fuel. Where the recommended separation temperature is below the WAT, this results in separator sludging or complete blockage in the worst case.

This problem can be more severe in cases where cat-fines are high and viscosity is low. The problem of heating a low viscosity fuel above the WAT, is that the viscosity becomes so low that the fuel booster pumps of the vessel cannot produce sufficient pressure, introducing leakages and can potentially leading to vapour lock. When a vessel cannot increase the temperature above the WAT, due to operational restrictions, the fuel is essentially unusable.

For this reason understanding the correct WAT is critical when using VLSFO.

Contact

To find out more about how we can help you with your fuel management, please contact Wolf Rehder at: wolf.rehder@vpsveritas.com

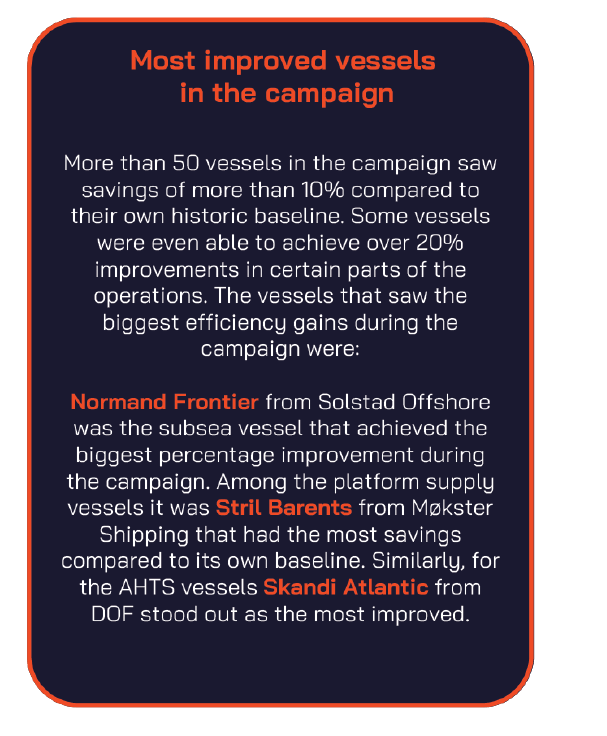

Unprecedented collective action slashes 10.000 tons of CO2 emission

Press Release by By Sindre Stemshaug Bornstein - VP Commercial Decarbonisation

In a remarkable display of determination, 133 vessels from 8 prominent offshore vessel owners joined forces this summer to see how much CO2 could be saved when rallying around a common goal. The total emission savings in the two-month period exceeded an incredible 10,000 tons of CO2. The ambitious campaign was initiated by data- and fuels specialist VPS and showcases the emission reductions that can be achieved through smart use of data. Further, it underscores the important role played by crews in leading the way to a more sustainable maritime industry.

This summer a group of leading offshore companies came together in an unprecedented campaign to reduce industry emissions from operations. The results achieved are proof that industry-wide collaboration is an imperative part of the path towards meeting the industry emission reduction targets. The campaign was initiated by data- and fuels specialist VPS and garnered participation from some of the offshore industry's foremost vessel owners: Solstad Offshore, Simon Møkster Shipping, Boskalis Offshore Energy, Rem Offshore, Tidewater, Skansi Offshore, North Sea Shipping, and DOF.

All these vessel owners are already actively working on reducing the emissions footprint from their vessel operations and have incorporated ways of collecting and using vessel data to drive effective decision-making. VPS´ data-driven decarb solution Maress was used by all participating companies and vessels to track the emissions and efficiency of the vessels during the campaign.

The underlying idea behind the initiative was to show by example what is possible to achieve by collaborating and sharing of non-competitive data in the spirit of reducing as much emissions as possible. Some participants referred to the campaign as a friendly competition between vessels across the different companies´ fleets. As the heart of change beats within the vessels themselves, all change starts with the highly competent crews. Tom Karlsen, Technical Manager in Simon Møkster Shipping put it clearly:

"If we as a vessel owner are to succeed in reaching our emission goals, we need to ensure that everyone is involved. The most important piece of the puzzle -by far- is the people working onboard the vessels."

Often, emission reductions in the industry are being discussed on almost abstract level, but the truth of the matter is that most operational emission reductions are a direct result of the decisions made by the people out there operating the vessel. When the crews are provided quality data on vessel efficiency and emissions to support their experience-based decisions it directly leads to savings.

A common theme among the vessel owners and crews participating in the campaign is the strong focus on operational efficiency and keeping the emissions at a minimum. With solutions like Maress in place the vessel owners ensure that everyone involved in the operations have access to the right data and analytics that help support this focus. This, in turn, underpins a culture where everyone in the company takes pride in contributing towards emission targets. Campaigns like this are a proof that decarbonisation is a topic that unites - and something that crews, shore personnel, and charterers can rally around.

With more than 50 of the participating vessels seeing emission reductions of more than 10% compared to their own past it is difficult to choose which vessels to highlight as the top performers. Nonetheless, two prime examples of subsea vessels that fully committed to the campaign and saw great results were DOF´s Skandi Hugen and Skandi Vinland. EVP Sustainability in DOF, Marianne Møkster commented:

"The great performance from the crew onboard these vessels demonstrate the excellent work our people do on the vessels every day to help us reach our common decarbonisation goals. We participated in the campaign with 14 vessels, and a key aspect for us is to put focus on emission reductions while maintaining the safety of the operations. Having high quality data and decision support is an enabler to achieve these emission savings".

Malcolm Cooper, VPS CEO continues:

"The amount of savings achieved by the vessels in this campaign is just staggering and inspirational. My congratulations to everyone that participated. For us in VPS it is a key part of our strategy to help the industry decarbonise by leveraging the unique data access that we as a company have on maritime fuels and emissions. All the vessels in this campaign are using our data-driven decarb software Maress, and creating collective action and results for our customers - such as in this campaign - is something that we will aspire to do more of".

This campaign highlights the powerful potential of collective action in the pursuit of the industry emission goals. Solstad Offshore´s Chief Sustainability Officer, Tor Inge Dale concludes: "We strive to stay in the forefront of the industry's change towards more sustainable operations, and we firmly believe in collaboration in combination with powerful digital tools such as Maress to facilitate just the kind of benchmarking to make this happen. We´ll be ready for the next campaign, and hopefully with friendly competition against even more vessels and companies wanting to be part of the change".

About VPS

VPS is a world-leading maritime decarbonisation advisory and services company, dedicated to innovation and sustainability. VPS helps maritime companies to identify pathways towards more sustainable operations - by providing insights, digital tools and advice along the entire marine fuels and emissions value chain. VPS is a pioneer in the marine fuel testing industry with over 40 years of experience and has an established position as the clear market leader. VPS´ data-driven decarbonisation solution Maress combines available data from vessels with other relevant datasets to provide insights on how to reduce fuel and emissions. vpsveritas.com

For inquiries, please contact VP Commercial Decarbonisation, Sindre Stemshaug Bornstein: +47 977 500 023 sibo@vpsveritas.com

VPS experience with alternative fuels

Article by Dr Nick Clague – Head of Sustainable Fuels

Introduction

It is well reported that 3% of global emissions are attributed to world shipping and the entire industry is now on a drive to reduce emissions to net zero close to, or by 2050. At the recent MEPC 80 conference the IMO introduced additional interim checkpoints of 20% global greenhouse gas emissions reductions compared to 2008 but striving for 30% by 2030 with a 70% (striving for 80%) reduction by 2040[1]. On top of this the EU ETS scheme will be expanded in 2024 to include all vessels over 5000GT transporting general cargo or passengers with the share of emissions subject to the ETS being increased from 40% in 2024 to 70% in 2025 and 100% in 2026. In addition, methane and nitrous oxide emissions will be added to the EU ETS from 2026. Offshore vessels will also be added to the scheme from 2027.[2,3]

With all of these new requirements (and additional costs and complexity) for reporting emissions from vessels, operators and owners are now looking very closely at how to reduce their emissions. Some of this has been achieved from what can be done ‘today’ such as slow steaming, improving vessel design, air lubrication and reducing sulphur in fuels.

However, to meet the requirements of net -zero by 2050 and reduce the cost of paying for emissions the shipping industry is also looking at other means of decarbonisation including the use of digitalisation of onboard systems for optimal efficiency and advanced monitoring of stack/exhaust emissions. Although a lot has been done so far there is still a lot more to be done if shipping is to achieve net-zero by 2050.

One of the main ways to reduce emissions is not only to burn less fuel but to also look at alternative fuels that can help further reduce emissions and remove the need to burn fossil fuels. As an interim step some operators are looking at LNG as a fuel and installing dual fuel LNG engines on vessels. Although LNG significantly reduces emissions – up to 23% - compared to VLSFO on a well to wake basis it is still a fossil fuel.[4] LNG vessels also have the issue of methane slip and with methane being 25 times more potent than carbon dioxide[5] at trapping heat in the atmosphere, other vessel operators are looking to other alternative fuels such as methanol, ammonia and bio-fuels, especially with methane emissions becoming part of the EU ETS in 2026. These fuels can provide additional emissions savings compared to conventional fuels and LNG, but also offer their own challenges.

This article provides an insight from the VPS perspective based on our experience of testing the latest alternative fuels that are in use today aboard vessels operating around the world.

VPS Experience with new Alternative Fuels

FAME (fatty acid methyl esters) or more commonly referred to as biodiesel, has been used within the road transportation sector for cars, vans and trucks for many years. The composition of FAME is dependent on the feedstocks used in the manufacturing process and can vary greatly between each batch, between each supplier and where it is purchased around the world. FAME has one big advantage in that it is a ‘drop-in’ replacement for traditional fuels and can be used at varying amounts up to 100%. For example, a B30 fuel will be a blend of 30% FAME and 70% conventional fuel. Due to the changes in chemical structure between each FAME, its performance as a fuel can vary greatly too. Carbon chain length and degree of unsaturation can influence the cold flow properties, with the degree of unsaturation also influencing oxidation stability and oxygen content. The level of oxygen content has an influence on the energy content, which is already lower than for conventional marine fuels. As a result, VPS were able to develop a technique to fingerprint the FAME source which has proven to be a great addition to the testing used to support our customers. With the introduction of the EU ETS and with FAME having a zero CO2 emissions factor, being able to accurately measure FAME content in fuel will be an advantage to vessel owners and operators. Several test methods already exist for determining the level of FAME in biofuels (including ASTM D7371, ASTM D7963, EN14078 and EN14103) but all have their limitations. VPS have developed a new technique which has higher precision, repeatability and reproducibility over the whole range from B0 to B100, enabling vessel owners and operators to obtain the correct emissions allowances.

FAME, due to its partially oxidised nature compared to conventional hydrocarbon-based fuels is also susceptible to bacterial growth which can lead to sludge and increased acidity, which can then lead to other problems such as blocked filters and corrosion. Again, due to it partial oxidation and some of the esters in the fuel being unsaturated, FAME can have significantly reduced oxidation stability which can cause sludge, filter blocking, darkening, acidity increase, microbial growth and rancidity which will be noticed by a rancid odour.

All that said, FAME does provide an environmental benefit from a well to wake perspective and with careful management onboard should cause no issues in its use, especially in blends with conventional fuel. So far, many of the samples tested by VPS have been single samples for single vessels with an estimated in-use total of biofuel used so far in the region of 30-40KT/month (VPS estimation) which is just a small fraction of the monthly market volume for shipping fuels. Based on data from VPS PortStats, so far in in 2023 we have tested over 300 FAME or FAMEcontaining bunker samples, the most of which have been available in Europe (mainly Rotterdam), but also from the US and Asia (mainly Singapore). However, based on this testing so far, we are safe to assume that FAME containing fuels are on trial and there is high scrutiny on its performance in these trials as we would expect.

This is from both crew and technical level, where in extreme cases engine components are being inspected and merited/demerited after the trial, looking for any signs of issues. This is being done at great expense to the vessel operators. Further, the top management of ship owners and operators is involved with decarbonisation high on their agendas too. This naturally results in suppliers being cautious about what is being supplied with only top quality products being offered. Will this level of diligence be maintained if biofuels were to become a main marine fuel?

To support this, of the over 300 “bunker” samples tested in 2023, only 30 vessels (approx. 10%) took biofuel more than twice. Typically, from the stem sizes taken it appears the vessel will only have this fuel onboard for around 1 week before it is consumed, further suggesting FAME biofuels are currently on trial.

Probably the biggest factor holding back the adoption of FAME into marine fuel is the price which can be as much as twice the price of VLSFO[6] but with the introduction of the EU ETS in 2024 this cost will be off-set by the savings obtained by using FAME to increase the zero CO2 emissions allowance.

We have also seen other sources of material being used as options for fuel. HVO or hydrogenated vegetable oils is derived from waste oils from cooking and is highly processed and hydrogenated to remove any unsaturation and oxygen containing molecules like esters[7]. As such HVO is often referred to as renewable diesel and performs in a similar way to diesel. When comparing HVO with FAME we see higher energy content, good oxidation stability, superior cold-flow properties and little or no microbial growth. This is due to the fact the HVO is hydrogenated and any partial oxidation (as found with FAME) has been removed during the hydrogenation progress. Again, as with FAME, HVO has a higher price than tradition marine fuels of similar viscosity which could restrict its usage as a marine fuel.

Cashew nut shell liquid (CNSL) and tyre pyrolysis oil (TPO) have also been suggested as marine fuels either as a ‘B100’ or in blends. CNSL is highly acidic and contains very different molecules compared to FAME which are phenolic in nature. These phenolic molecules have many uses outside the marine industry but as a fuel they could be susceptible to polymerisation under the right conditions of heat and potential prolonged storage. However, in blends with traditional fuels CNSL could be suitable as a fuel but more testing is needed to confirm its suitability. TPO is a relatively new technology and further testing is needed to prove its suitability as a marine fuel.

One fuel that is gaining a lot of attention is methanol. Unlike other fuels, it is almost entirely made up of a single molecule. It is readily available and can be manufactured from environmentally accepted sources. It also contains no sulphur and so significantly improves SOx emissions to very low levels. NOx emissions can also be reduced by up to 80% compared to conventional marine fuels. [8] As with other alternative fuels price is a consideration for methanol especially as it has a round 2/3 the energy density of traditional fuels. Methanol is also classed as dangerous goods and has a low flash point so increased safety measures are needed when handling and shipping methanol.

VPS were recently involved in the very first bunkering of methanol in Singapore both for Bunker Quantity surveys (BQS) and Fuel Quality Testing (FQT)[9] . Following the successful bunkering operation, the fuel samples were tested and were a close match with the fuel quality that was supplied to the ship from the bunker vessel via a shore tank. Currently there are no industry specifications for the use of methanol as a fuel, but these are under development. There is a specification from IMPCA[10] (International Methanol Producers and Consumers Association) which is being used as the benchmark specification for methanol as a marine fuel as the industry gains experience. Subsequently, VPS were involved with the bunker surveying of the same vessel in Port Said and Rotterdam as it sailed to its final destination in Denmark. VPS also undertook the analysis of the methanol fuel on all 3 occasions.

Over the next few years the number of vessels being fuelled by methanol is due to increase significantly and several new plants for producing bio-methanol are planned or under construction in support of the marine industry. Currently the vessel order book as of August 2023 [11] shows 161 vessels on order which is about 7.6% of all vessels on order. This is up from 95 vessels on order in July 2023.

Conclusion

The maritime industry is current working to reduce emissions to meet the IMO target of net-zero on or around 2050. There have been lots of measures adopted over the last few years to improve fuel efficiency and reduce emissions. This has included slow steaming, vessel design, air lubrication etc. However, all of these methods still involve the use of fossil fuels. So, the next step is to start using alternative fuels with significantly reduced or even zero carbon footprints. This has started with many new builds and some retrofits on vessel with dual fuel engines allowing the use of alternative fuels such as methanol.

In the future we will also start to see other fuels being used and there is a lot of current research ongoing around the use of ammonia as a zero-carbon fuel and also some consideration around the use of nuclear energy to power vessels.

VPS are also leading the way with the testing of these new alternatives fuels but are also working with vessel owners and operators to maximise their efficiency via their Maress technology and then also continuous emissions monitoring through their unique Emsys system. This gives an overall picture of energy-in via the fuel, monitoring of energy use and then quantifying the emissions from the vessel. In effect this shows how and where all the energy from the fuel has been used on the vessel.

With the EU ETS expansion in 2024 and the need to reduce emissions in shipping, VPS are leading the way in the analysis of new alternative fuels to support our customers in assisting them in meeting their emission reduction targets whilst making sure these fuels are fit for purpose. Coupled with our new and innovative digital technologies for optimised vessel operations and continuous exhaust emissions monitoring, VPS are perfectly positioned to provide a wide range of maritime decarbonisation services to the global fleet.

Contact

For more information please contact Nick Clague at: marketing@vpsveritas.com

References

1. UK P&I Club – News and Resources – ’MEPC 80 A Summary’

2. DNV Technical and Regulatory News NO.02/2023 – Statutory ‘EU ETS : Preliminary Agreement to include shipping in the EU’s Emissions trading system from 2024’

3. European Commission – Climate Action – ‘Reducing emissions from the shipping sector’

4. Shell Global – Energy and Innovation – ‘LNG – fuel in transition’

5. United States Environmental Protection Agency – ‘Importance of Methanol’

6. Neste – investors market data – ‘biodiesel prices, SME, FAME’

7. Neste Renewable Diesel Handbook

8. Methanex – ‘Methanol as a Marine Fuel’

9. VPS Press Release – ‘VPS Completes the First Methanol Bunker Quantity Survey’

10. IMPCA Methanol Reference Specifications Version 9 10 Jun 2021

11. Clarkson’s World Fleet Register – ‘Environmental & regulatory News: August 2023

Methanol as a marine fuel - VPS exerience to date

By Steve Bee, VPS Group Commercial Director

Introduction

As the shipping industry looks to decarbonise and become net zero by 2050, ship owners and operators are looking at alternative fuels with a lower carbon footprint in order to reduce overall emissions from their fleet. In Europe this is linked to the EU ETS scheme coming in 2024 and also the FuelEU Maritime[1] legislation coming in 2025. As part of the ever-changing marine fuel mix, methanol is now being seriously considered as a low-carbon fuel to assist shipping in achieving its decarbonisation targets.

Methanol (CH3OH) is a liquid chemical used in thousands of everyday products, including plastics, paints, cosmetics and fuels. Liquid methanol is made from synthesis gas, a mix of hydrogen, carbon dioxide and carbon monoxide. These components can be sourced from a wide range of feedstocks, using different technologies.

Renewable methanol is an ultra-low carbon chemical produced from sustainable biomass, often called bio-methanol, or from carbon dioxide and hydrogen produced from renewable electricity.

Renewable methanol can be made from numerous and plentiful sources which are globally available. The carbon molecules required to make synthesis gas for methanol production can be obtained from CO2 via industrial exhaust streams, or even captured from the air. Synthesis gas also can be produced from the gasification of any carbon source, such as municipal solid waste or forestry residues. Biogas, obtained through fermentation, from landfills, wastewater treatment, plants or animal wastes can also be used as a feedstock for methanol production. Additionally, renewable energy can power the electrolysis process to generate clean hydrogen for the production of renewable methanol.

Methanol is the world’s most commonly shipped chemical commodity and more than 95 billion litres are manufactured every year. It has been stored, transported and handled safely for over 100 years. Since it remains liquid at ambient temperature and pressure, the infrastructure required to deploy it as a fuel, is largely in place: combustion engines, fuel cells and power blocks can easily be adapted to use methanol.

Methanol as a Marine Fuel

The attraction of methanol to shipping, is that renewable methanol can significantly reduce greenhouse emissions to atmosphere including, reducing carbon dioxide (CO2) by up to 95% and nitrogen oxide (NOx) by up to 80%, and eliminating sulphur oxide (SOx) and particulate matter (PM) emissions.

However, there are numerous considerations regarding the use of methanol as a marine fuel. Firstly, methanol exhibits good burn characteristics, but will require a pilot fuel for ignition, eg a gas oil, or a biofuel. Further positives are, it is a liquid at atmospheric pressure, its biodegradable and can run well in existing engine technologies.

However, methanol has a Flash Point of only 12ºC, which immediately raises questions relating to the Safety of Life at Sea (SOLAS) requirements. SOLAS states no marine fuel with a flash point less than 60ºC should be onboard a vessel. Methanol has a low energy content, approximately 40%-50% of the more traditional fossil fuels used within the maritime sector. Methanol is highly reactive and therefore materials with which methanol may contact, should be inert, eg stainless steel.

In order to achieve the Tier III NOx requirements, pure water must be added to methanol prior to burning. This allows for approximately 30% less NOx emissions compared to fossil fuels.

VPS Completes the First Methanol Bunker Quantity Survey, Sampling and Testing

In July 2023 VPS were requested by Maersk to undertake the very first methanol bunker quantity survey (BQS). This took place in Singapore for Maersk’s first methanol-powered container ship, the Laura Maersk.

Prior to this first methanol delivery, various levels of pre-delivery work were required including, the delivery barge tank-cleaning operation and a part loading of methanol to the barge, to ensure no cross-contamination could take place, during the actual delivery. VPS, as part of the BQS operation, also undertook the required closed-sampling procedure, to safely harvest representative samples of the methanol delivered to the vessel, which were then transferred to a VPS Laboratory for quality testing.

In the 12 months leading up to this BQS, VPS invested heavily into new laboratory equipment and R&D in order to provide a comprehensive testing and advisory service in relation to methanol as a marine fuel.

In order to safely transport methanol samples to the VPS laboratory, the transfer via aeroplane, had to comply with the International Air Transport Association (IATA), rules for the transportation of dangerous goods. It is worth noting when considering using methanol as a marine fuel, it is the person sending methanol samples for testing, who must be trained and accredited to the IATA standards, ie the vessel crew, or vessel agent.

The testing of the samples from the Laura Maersk bunkering, was conducted to the International Methanol Producers and Consumers Association (IMPCA) test slate. The key test considerations here were, the purity of the methanol, the presence of ethanol, water content, the presence of acetone, chlorides, the acidity of the fuel, sulphur content and numerous other impurities, which could be detected.

Following the Singapore bunkering the Laura Maersk set sail for Port Said, Egypt, where VPS repeated the BQS, Sampling and Testing of the methanol delivered to the vessel. The final bunkering stop took place in Rotterdam, where VPS once again completed the BQS operation, sampling and testing.

The VPS surveying and testing of these three methanol bunker stems, showed the fuel delivered matched the Bunker Delivery Note (BDN) and the Certificate of Quality (CoQ).

VPS and Methanol Bunker Fuel

VPS have proven that safe, accurate and reliable, quantity surveys and sampling of methanol can be undertaken. Plus, following significant investment in state-of-the-art laboratory equipment, plus analyst and advisory training, VPS can also provide accurate analytical testing of methanol samples to determine the quality of the fuel and provide the necessary and valuable marine engineering advice, to support ship owners and operators when they look to use methanol as their low-carbon marine fuel of choice.

VPS are currently working with numerous shipping companies, suppliers and engine manufacturers on testing their methanol samples and sharing our experience, expertise and innovative approach in helping them gain a greater understanding of this low-carbon fuel.

With more than 160 methanol-powered vessels currently on order, it is inevitable that methanol use will significantly increase within the maritime sector and VPS have proven high-level performance to support the industry in this aspect of it’s decarbonisation journey.

For further information on how VPS can assist you regarding your decarbonisation challenges, please contact info@vpsveritas.com

Search

Search

Customer

Customer